Optimove iGaming Pulse – August 2020

| By iGB Editorial Team

August saw the final rounds of the Uefa Europa League and Champions League take place, bringing the European football season to an end following long delays. Find out below how this affected sports betting metrics, in the latest edition of Optimove's iGaming Pulse.

August saw the final rounds of the Uefa Europa League and Champions League take place, bringing the European football season to an end following long delays. Find out below how this affected sports betting metrics, in the latest edition of Optimove’s iGaming Pulse.

In addition, the report covers casino players’ gaming activity, at a period when the vertical has traditionally seen a lull in play.

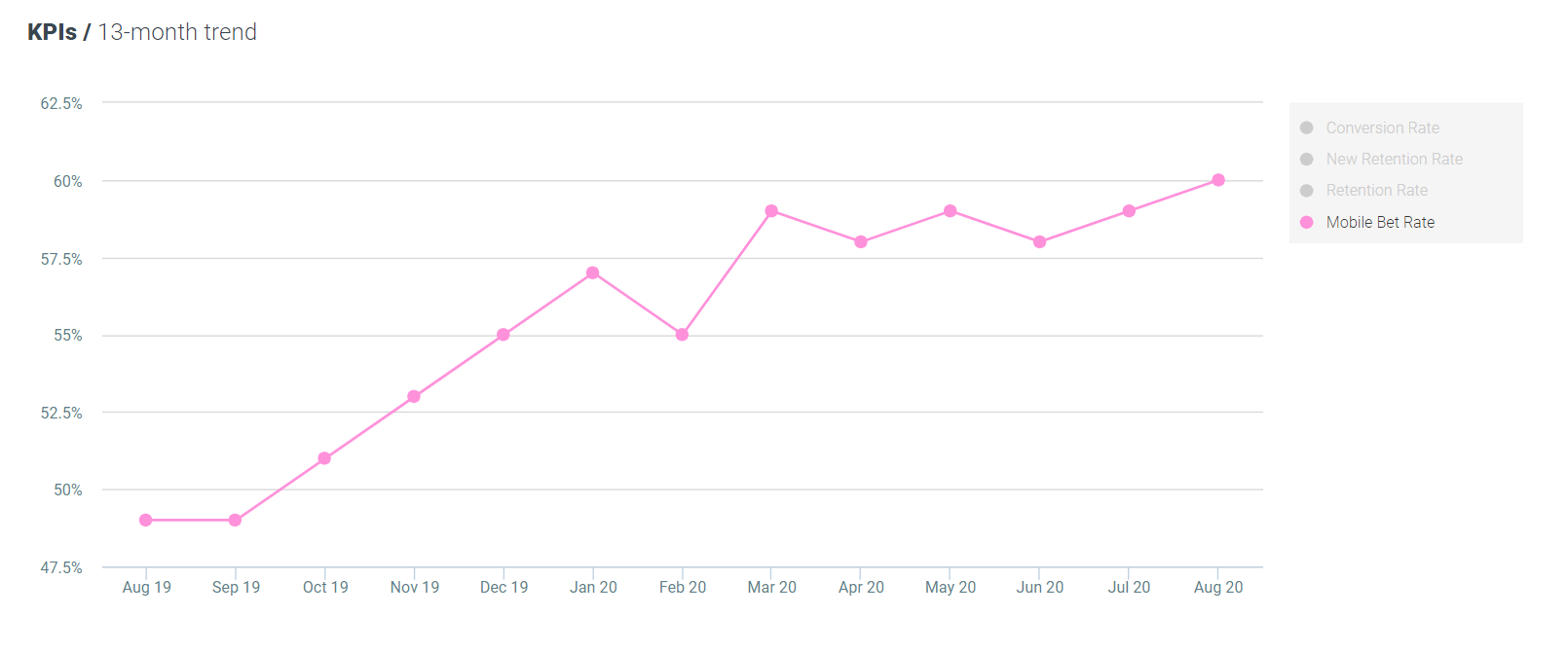

Sports KPIs

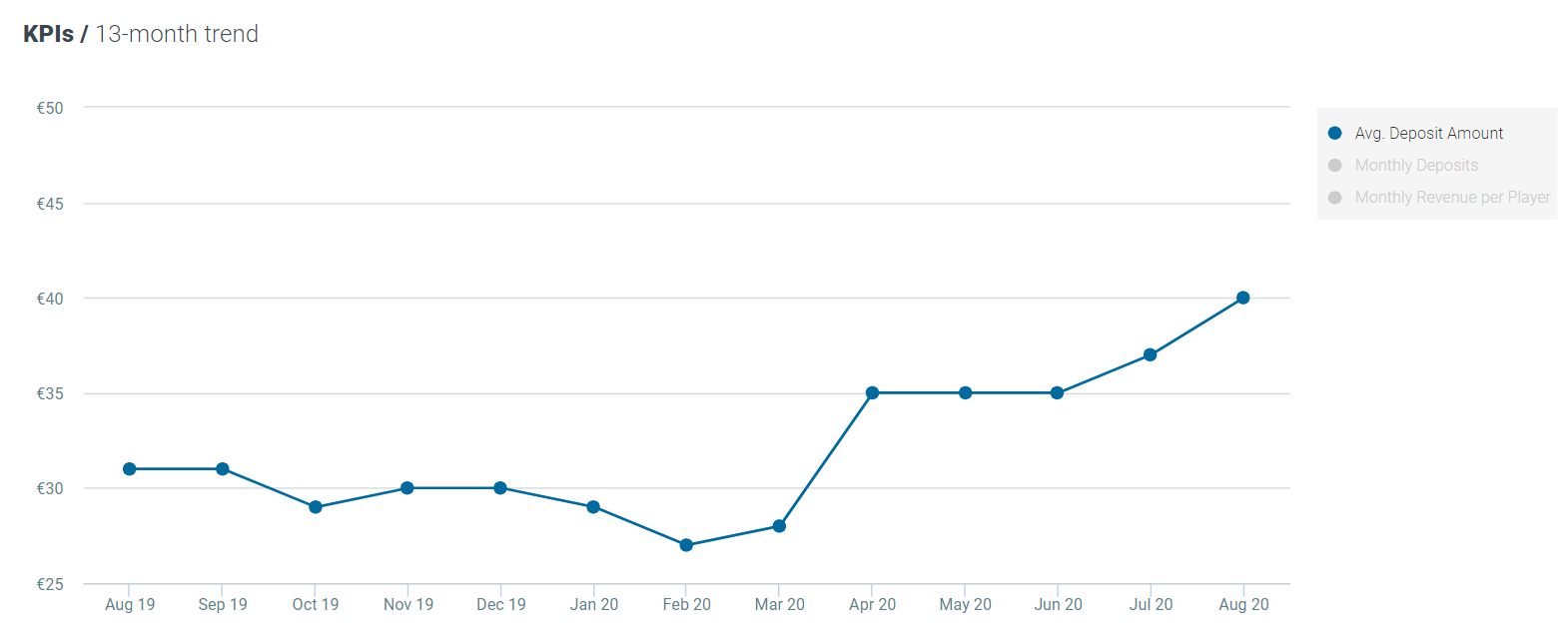

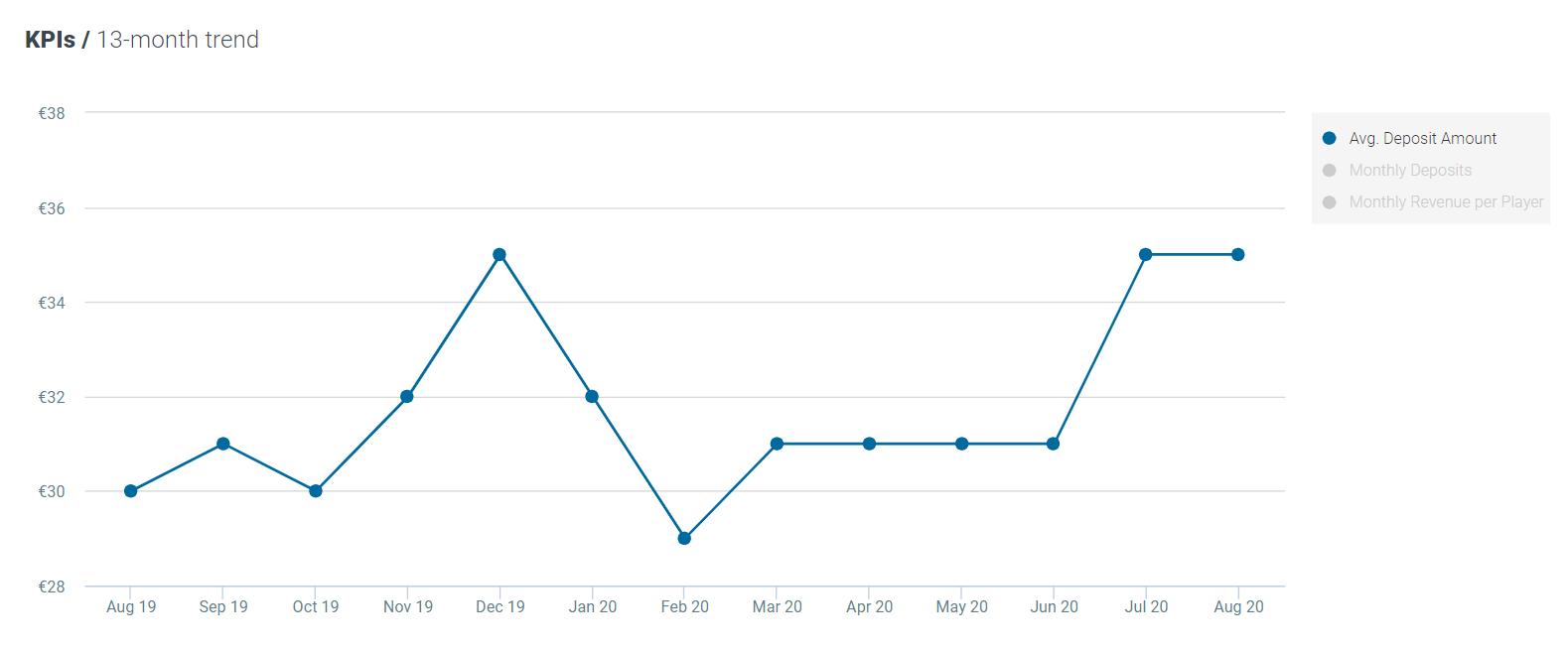

Average deposit amount

The average deposit amount increased by 8% month-on-month and by 28% year-on-year, rising to €40 per player. At this time last year, the major leagues were in their off-season, hence the significant year-on-year growth.