RP iGaming Index: coping with Covid

While the initial market reaction to the pandemic disruption was indiscriminate, the 29% fall in the Index in the period to 3 April also reflects the return of more nuanced considerations on the part of investors, writes Paul Leyland

The Covid-19 outbreak and government responses to it has dominated lives, businesses and stock markets since it became clear that the virus was a global pandemic.

We are therefore going to consider the index through the period 21 February to 3 April – ie from before any major global reaction to the crisis rather than taking a more arbitrary (in the circumstances) calendar month view.

Given the indiscriminate nature of the virus and the global reaction to it we will also not be providing a stock in focus, but instead looking at the responses of key constituents.

Before we look at the numbers, we would like to give our thanks to all of those gambling companies and individuals who have done the right thing by their staff and stepped up to help their communities in this unprecedented period of dislocation and uncertainty.

Whether it is by donating money or by providing food and essential equipment, large parts of the global industry have demonstrated levels of compassion and community spirit that go above and beyond what anyone could have expected or predicted. It is with this spirit that the industry will rebuild its role in society when we meet again.

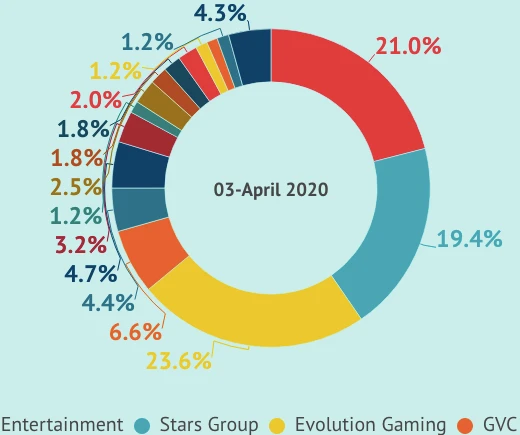

The Index, with each constituent company's performance weighted according to its share of revenue derived from igaming, fell by 29% during the period, underperforming the NASDAQ benchmark by five percentage points.

This underperformance is unsurprising given that 18 companies have retail operations and 24 companies have exposure to global sports through betting (B2B or B2C).

The biggest fallers combine these characteristics, typically with debt also, and include William Hill (-64%), IGT (-65%), Scientific Games (-75%) and Playtech (-49%).

Interestingly, these falls are similar to those suffered by businesses largely reliant on retail operations that are now closed, such as Boyd (-67%), Caesars (-57%) and Rank (-61%).

Initially the market reaction was fairly indiscriminate, as is typical of any sell-off. However, once markets regained their composure a combination of common sense and corporate reporting allowed investors to start thinking about more nuanced considerations.

For example, online gaming could be highly resilient to the crisis if it is sufficiently short-term so as to not significantly impact customer spending, and it is also likely benefiting from substitution.

However, the situation needs online gaming to be legally available for it to be a substitution benefit for regulated and/or listed companies; for the vast majority of the US, as well as Australia, this is cold comfort.

Nevertheless, a recovery of sorts has reflected this. Relative to its lows, the NASDAQ is up over 7% and this is also reflected in online gaming exposed stocks: 888 may be down 14% in the period but it is up 37% from its March lows; this is also true of Aspire Global, Bet-at-Home, Kindred, GiG and NetEnt.

The fast-moving nature of the crisis has made it very difficult for companies to keep the markets informed – indeed, some markets have advised that companies avoid non-essential announcements where possible.

The timing of the impact is also tricky in that it largely impacts the tail of Q1 (making overall Q1 performance relatively meaningless) and will have an uncertain but certainly very big impact on Q2 (where we would not normally get guidance until July-August).

So far, from an online perspective, guidance has largely been provided on the costs of the loss of sports, which is the most obvious negative.

Here there is a fairly simple calculus of the number of weeks that mainstream sports remain disrupted for (likely far longer than specific lockdown measures: Wimbledon and Euro 2020 have already been cancelled or postponed, for example) and the implied lost revenue.

The longer the crisis lasts for, the more costs can be mitigated (duty and content can be pretty immediate, marketing can be avoided and staff can be furloughed where possible).

We have not yet had much guidance on the relative benefit seen by online gaming, which largely needs to deal with social distancing issues with staff rather than more profound supply-side shocks, such as loss of product or venue closures.

Kindred is a gaming-led betting operator and its report of an impact of ‘only’ 10% from the fixture cancellations suggests that substitution into more exotic sports betting, virtuals and gaming has been very strong.

The power of self-help and mitigation vs. initial impact can also been seen from GVC (albeit including a large proportion of retail issues), where monthly EBITDA impact guidance has been halved from £100m to £50m.

It is worth mentioning at this point that the fear of bored citizens stuck at home turning to online gambling in a harmful way has already caused emergency policies in Latvia (ban), Spain (marketing ban) and Belgium (mandatory spend limits).

If the crisis continues with lockdowns as a major component of policy responses, we can expect these interventions to broaden and deepen – especially if elements of the industry fail to ‘self-regulate’ in this moment of unprecedented change and global crisis (always a high risk, unfortunately).

So far, the market has priced in a shock and a few companies have also been priced for potential structural issues (e.g. William Hill, Scientific Games, Intralot, IGT, Playtech, US casinos).

Whether this crisis does cause structural damage is largely dependent upon the time of disruption (unless there are other issues at play also, e.g. Intralot) and the levels of government support and/or business ingenuity provided as ‘normality’ returns.

However, it is almost certain that the ‘normal’ we return to will be a new one.

Ways of working are going to change, tax and regulation are very likely to change and customer behaviour will change most of all – if a ‘transaction-led’ gambler has discovered online (whether domestically regulated or not), they are unlikely to go back to those retail venues that offer little in the way of customer service or entertainment, especially if sports start up before high streets do.

Channel shift has been given a massive structural boost, then, but so has public scrutiny.

Disclaimer: the narrative provided represents the opinions of the authors. Any assessment of trends or change is necessarily subjective. The information and opinions provided are not intended to provide legal, accounting, investment or policy advice, nor should they be used as a forecast. Regulus Partners may act, or has acted, for any of the companies and other stakeholders mentioned in this article.