How are personalisation and technology driving NBA in-play betting?

In June the provider Simplebet, which specialises in micromarket pricing, revealed it had enjoyed a third straight NBA season of growth (up 75% year-on-year), with nearly 13 million in-play bets placed during the 2023-24 season.

Around $325m was wagered with operators using Simplebet’s microbetting products, with the company offering 86 unique in-play markets during the NBA post-season.

Following Simplebet’s third season of consecutive growth, DraftKings announced it had reached an agreement to acquire the microbetting specialist.

The landscape of sports betting in the US since the 1992 Professional and Amateur Sports Protection Act (PASPA) was repealed in 2018 has been one of constant evolution, and in-play has been cemented as a key part of many operator strategies.

This season offers another opportunity for companies to capitalise on that growing demand for in-play betting, tapping into bettors’ psychological desire for instant gratification.

For Leo Gaspar, chief business development officer and co-founder of provider Huddle (and former Simplebet EVP for sportsbook product), the popularity of daily fantasy sports (DFS) prior to the overturning of PASPA is playing a role in the continued prominence of player props.

“When PASPA got repealed, all this stuff became very, very popular because you had to create additional content to engage the audience,” Gaspar tells iGB.

Could in-play exceed pre-event betting?

Such is the rising popularity of in-play betting, some in the industry feel it could one day start to outpace the number of bets made prior to games getting under way.

One such person is Matt Howard, partner at Propus Partners, who agrees the impact of DFS and the link with player statistics has led to a rising betting interest on in-play markets.

“It’s just following the same trend that the rest of the world has, that live betting grows and grows and probably takes over pre-event at some point because that is what every other region on the planet has done eventually,” Howard explains.

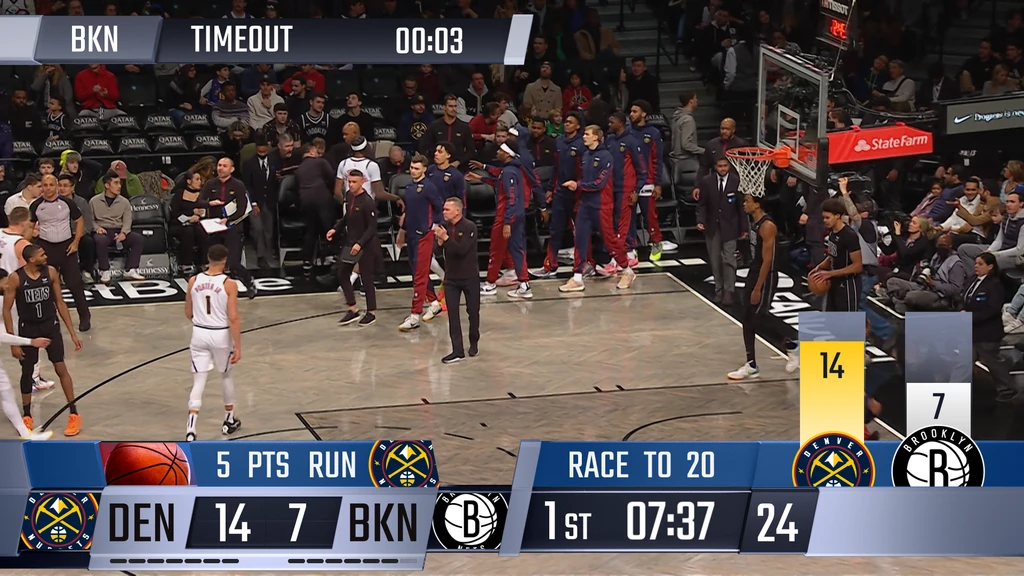

“Basketball generally is a good sport for in-play betting because of that quick bet and return. There are small defined events within the event that you can bet on.”

Despite the increase in popularity, Sportradar notes the US still falls behind other parts of the world for in-play betting, although the company expects that to grow particularly in the NBA, with which it holds an exclusive partnership.

“In the more mature global sports betting market, in-play betting represents 70%-80% of all bets placed, but only approximately 35%-40% of bets placed at the moment in the US,” Sportradar SVP of fan engagement Patrick Mostboeck says. “As the US market evolves and betting habits continue to shift towards those of the rest of the world, in-play betting will continue to grow.

“The NBA represents an especially attractive sports property for in-play betting due to the rapid pace of play and high number of scoring opportunities and lead changes, giving bettors more opportunities to get in on the action and engage with their favorite NBA teams and players.”

What are NBA fans betting on?

One operator placing a real focus on in-play is FanDuel, which has long been battling at the top of the US sports betting market alongside DraftKings, largely down to the rich DFS history of the two companies.

It’s a strategy not exclusive to the NBA, with FanDuel revealing 25% of bets made across the 2023-24 NBA and NFL seasons were on live action.

In 2023, FanDuel unveiled The Pulse, a new product which adds in-play markets relating to the key storylines ongoing in the NBA, aiming to make the betting experience more engaging for fans.

“As the action unfolds, new bets are added to the feed in a narrative-driven format, offering fans a simple and streamlined path to discover what is happening in a game in real-time,” FanDuel sportsbook general manager Karol Corcoran tells iGB.

“Sports fans are increasingly drawn to player narratives and opportunities to engage with their favourite athletes. We’re able to offer fans the betting opportunities they are looking for in real time and have seen the corresponding growth in engagement.”

In terms of what players are betting on in-play, Corcoran says it remains the typical markets providing the most engagement.

“Core markets including moneyline, spread and point total as well as player point totals and three-pointers are popular for in-play betting,” Corcoran adds. “Customer demand will continue to drive our offering.”

As the in-play market matures, Sportradar is expecting to see a change in betting behaviour as betting companies evolve their strategies to meet players’ desires.

“As we continue to innovate the in-play betting category, we expect to see live player markets and micromarkets grow in popularity,” Mostboeck adds. “The fast-paced nature of these bet types add to the excitement of the NBA.”

Personalisation a key factor

To capitalise on the explosive rise in popularity of NBA in-play betting, personalisation will continue to be a core consideration for operators as they look to tailor offerings to individual bettor preferences.

Gaspar describes personalisation as “huge” for in-play, with Howard agreeing on its importance while also outlining his belief that it’s an area operators can make progress in.

“It’s [personalisation] we truly do believe in,” Howard says. “I don’t think the industry has even touched on it, particularly in sports betting where we can get true personalisation. There are the foundations of it in some places, but for true personalisation, customer groups of one, that should be the target.

“The battleground will become front ends, UIs, and personalisation. Generally speaking, the betting content is the same, so it’s how do you show players in a way that attracts them? Housing customers in segments and then showing them the things they’re actually interested in is the future.”

Sportradar innovating to meet demand

Personalisation is at the heart of Sportradar’s NBA plans, which it laid out in a media briefing last week. Its Virtualised Live Match Tracker transforms real-time data into personalised streams for fans, while its 4Sight streaming service will now be available for basketball, having initially launched for tennis.

Additionally, its over-the-top solution emBET, which was integrated into the NBA’s League Pass streaming service at the back end of last season, will continue to show fans sports betting content such as point spreads and over-unders on the platform to elevate the in-play betting experience.

“Hyper-personalisation is key for attracting and engaging the modern sports fan in a digital-first world,” Mostboeck explains. “Fan expectations worldwide have shifted to prioritise personalised, bite-sized content across a variety of platforms.

“Sportradar is leveraging our capabilities across GenAI and machine learning to enable the NBA and our clients to adapt with these shifting expectations and provide basketball fans with an interactive, hyper-personalised viewing experience.”

The impact of tech on personalisation

As Gaspar and Howard mention, the future of in-play betting will largely be driven by personalisation and the tailoring of offerings for bettors, which technology can help with.

However, Gaspar points to this relationship as one of the major “pain points”, with areas such as trading and content management systems (CMS) disjointed by differing technologies.

“I haven’t seen someone who has solved this problem from the ground up, in terms of building a data platform that’s going to have a CMS system that’s going to be powered by AI,” Gaspar says. “So, for example, if you log in, I know what’s your behaviour and, if you’re betting only on NBA player props, that’s the first thing that’s going to pop up on your phone.

“So far, I haven’t seen an operator who has solved this properly. There are some people that are doing it better than others, but no one has solved it yet.”

FanDuel aiming to capitalise

Howard notes that FanDuel is one of the companies “getting it right” in the US by finding ways to appeal to players when the betting content such as odds is largely the same.

With another NBA season inbound, FanDuel is planning to press home its advantage by aligning itself even closer with bettors to drive engagement through its product.

“This NBA season we will have an improved live offering across markets like live rebounds and assists, which continue to grow in popularity,” Corcoran continues.

“Product and market offerings will continue to be primary drivers of in-play betting growth as fans look for ways to continue engaging with games throughout each quarter. At FanDuel, we are focused on offering our customers the best gameday experience and cementing our position as the top choice to bet on the NBA.”

Data is providing a lot of assistance for FanDuel’s aims of achieving that top spot for NBA betting, particularly when considering the fast-paced nature of both the sport and in-play markets.

“Data plays an integral role in our business,” Corcoran explains. “During a game, it takes about 1.5 seconds to receive the data point on something that happened on the court and one additional second for our model to process the data and push out new odds.

“Our algorithms are simulating thousands of outcomes, all in an effort to provide the best live betting experience possible for our customers.”

Getting inside bettors’ minds is the future

The rocketing popularity of NBA in-play betting has no doubt captured the attention of operators looking to capitalise on the trend.

While significant progress has been made, Gaspar and Howard observe personalisation as one area of untapped potential where operators can boost engagement by increasingly tailoring their offerings.

Technology will play a pivotal role too as operators refine their in-play strategies, with data providing the opportunity for operators to cash in on the surge of in-play activity.

Who will win the NBA title come June remains to be seen, but in the in-play betting world, the fight for top spot could be equally compelling, with FanDuel certain to be at the heart of it.