‘Existential threat’: Tribal law experts decry rise of prediction markets

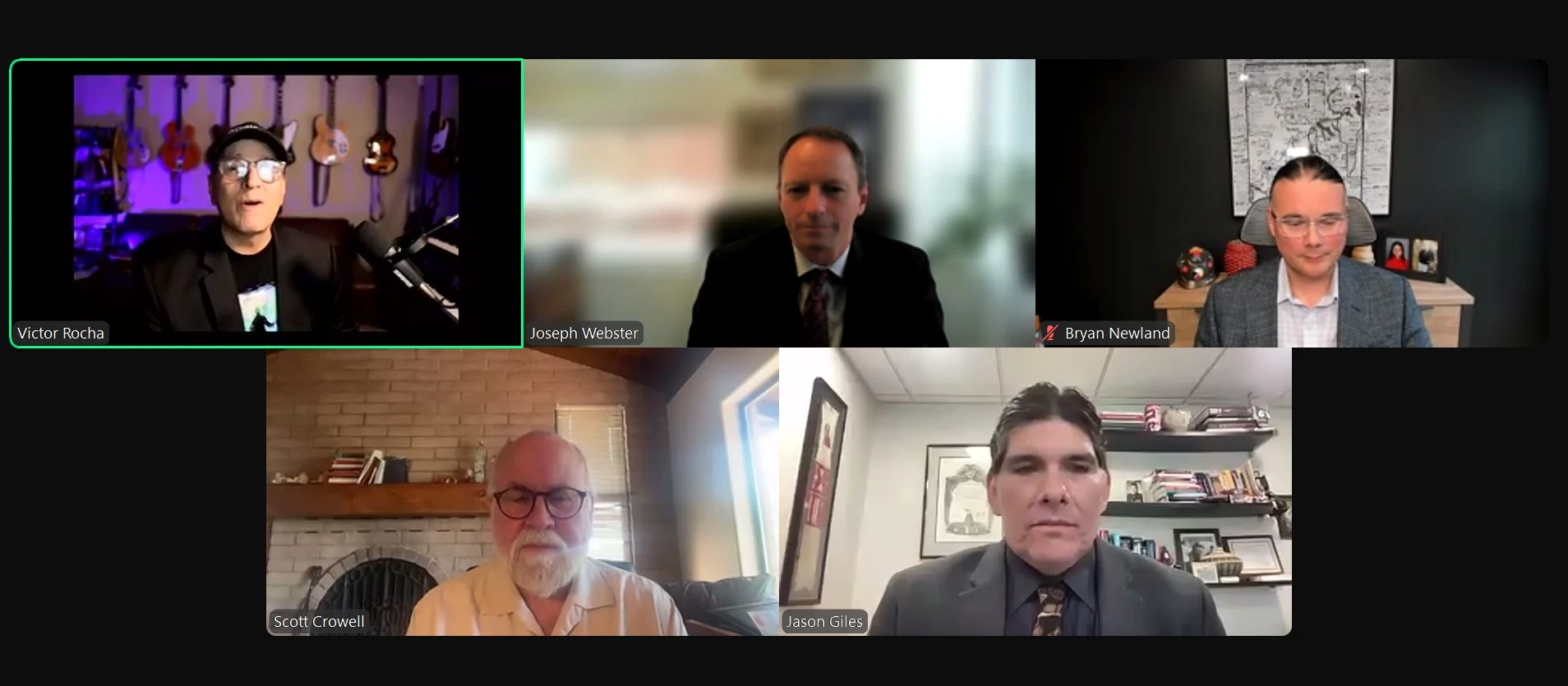

Victor Rocha and Jason Giles of the Indian Gaming Association hosted three well-known tribal gaming attorneys on the IGA’s New Normal webinar series Wednesday, assessing how prediction markets impact tribal sovereignty and gaming rights. In recent months the series has explored the rising challenge from sweepstakes sites. It is now highlighting prediction markets as they continue to expand.

All three guests – Joseph Webster, Bryan Newland and Scott Crowell – called prediction markets, specifically with regard to sports contracts, an “existential threat” to Indian gaming. The issue now, they said, is deciphering the best legal pathways to pursue.

Giles, who serves as executive director of the IGA in Washington, talked about his discussions with policymakers in recent days and how unaware of the subject most seemed to be. He mentioned conversations with Nevada officials, who told him they haven’t been approached by the state’s commercial operators about the issue.

Tribes have so far been among the biggest detractors of prediction markets. The federally legal exchanges operate in all 50 states, including those that have compacted with tribes for gaming exclusivity. Since the Commodity Futures Trading Commission, which currently oversees prediction markets, opened a portal for public comment on the exchanges earlier this year, the majority of input has come from tribal interests.

Indian Country has not been directly involved in any legal action concerning prediction markets to this point. That water is currently being carried by state regulators, with three states involved in ongoing lawsuits against Kalshi, specifically. But tribes have some cards to play in this battle as well, panelists said.

A question of authority

Jurisdiction is a key component of this issue for all parties. Prediction markets such as Kalshi have argued that they are federally legal under the CFTC and therefore are preempted from state gaming laws. This has been successful so far – Kalshi has secured preliminary injunctions to operate in Nevada and New Jersey after countersuing both.

“If you’re keeping score from a litigator point of view, they’re on a roll,” Crowell lamented.

For states, it would appear that they are now in a position of having to fight against the federal government. Election betting and prediction markets overall were heavily contested at the federal level under previous administrations, but that has changed early in President Donald Trump’s new term.

The president’s son, Donald Trump Jr, is an adviser to Kalshi, and the president’s nomination for the next CFTC chair is Brian Quintenz, a Kalshi board member and outspoken supporter of prediction markets. The CFTC’s appeal of election betting, which began under the Biden administration, was formally dropped last month.

In this way, Crowell said, states and tribes have become “strange bedfellows in fighting these issues”. States now feel a sense of having their jurisdiction eroded by unwanted gaming expansion, he said. Tribes could have better luck in their fight, however, thanks to the Indian Gaming Regulatory Act, the federal legal framework for tribal gaming.

The role of IGRA

If the Commodities Exchange Act (CEA) supersedes state gaming law, then so too does IGRA, Newland opined. It is unclear how a direct CEA-IGRA tête-à-tête would play out, but so far, other arguments have fallen flat.

Webster said IGRA was mentioned in a Kalshi brief in its case against Nevada. The company argued that sports event contracts are not defined under IGRA and, even if they were, the CFTC would still have exclusive jurisdiction.

“Think about that – they’re essentially saying that Congress, in passing the CEA, has displaced any role for tribes and tribal regulators in what I think is clear to everybody is a gaming activity,” Webster said. “So the fact that these arguments really haven’t been made, at least not in detail, I think is a concern.”

Introducing IGRA into the fight, even in a losing scenario, could still result in clarity for tribes, Newland argued.

“If it’s gaming, they’re violating tribal laws and, if it’s not gaming, then why are we following IGRA at all?” he commented. “That’s what’s at the core of this whole thing.”

The power of words

Technically, existing CFTC regulations already prohibit contracts involving gaming. Kalshi has managed, however, to successfully argue that prediction markets are not actually gaming. But all panelists cautioned that this is still “in the early innings” and future rulings could reverse current ones. The non-gaming argument was used in connection with election betting, but not sports contracts.

As Newland said, expansion into sports “goes far beyond what was intended” for these markets, which were supposed to provide real economic hedging opportunities. Crowell added that for litigators, “it’s useful to use their own words against them”, referring to Kalshi’s bet-centric marketing materials in recent months.

This twisting of words is akin to a Jedi mind trick, Newland joked: “This is not the gaming you’re looking for.”

“You have to admire their chutzpah,” Rocha said. “They’re almost tribal in their chutzpah.”

The National Indian Gaming Commission was also mentioned, as it is one of the few federal agencies connected to Indian gaming. Newland said the commission ruled years ago that sports betting is considered Class III gaming, which would run counter to Kalshi’s assertion in Nevada.

However, the NIGC has been hamstrung without a confirmed chair for more than a year and it is currently awaiting a new nomination from the Trump administration. And as with other Trump appointment, there’s no telling who the nominee might be or how it might affect these efforts.

Choosing sides

As the issue unfolds, stakeholders must prepare for multiple outcomes. For many tribes, gaming is their primary economic driver, meaning asset protection is of the utmost importance. But commercial operators don’t face that same urgency. They don’t have to fight in court so long as the states are doing so. And even if prediction markets are ultimately legalised, they could simply pivot their business to that sector and likely pay much less in taxes and RG obligations along the way.

DraftKings earlier this year applied to register “DraftKings Predict” with the National Futures Association, although that application has been withdrawn. FanDuel owner Flutter Entertainment said on its first-quarter earnings call that it has moved some of its staff from Betfair, a similar bet exchange business it owns, to FanDuel to help analyse potential opportunities.

Tribes, meanwhile, must prepare to defend their turf, which is not an unfamiliar position. The difference here, though, is the speed with which things are changing. Crowell, who has “been involved in tribal gaming since before IGRA”, has “never seen such an existential threat progress so quickly”, he said.

“Its not something that’s coming,” Webster added. “It’s here.”