Penn Entertainment elects two board members as battle lines are drawn in contentious proxy fight

For a gambling-industry event as hyped as any shareholders gathering since the historic PASPA decision, Penn Entertainment’s annual shareholder meeting on Tuesday largely failed to bring the sizzle.

As expected, Penn shareholders elected Johnny Hartnett and Carlos Ruisanchez to the gaming company’s board of directors as part of a continued reshuffling of the board. Their additions were sought by HG Vora Capital Management, a top Penn shareholder.

But Penn did not consider the nomination of William Clifford, a third independent director sought by HG Vora. Clifford’s nomination represents a key sticking point in contentious discussions regarding the future composition of the board.

At the conclusion of the 10-minute, 30-second meeting, Penn CEO Jay Snowden announced the election of Hartnett and Ruisanchez, based on the preliminary results of the vote. But without a resolution to Clifford’s nomination, the brief meeting ended on an anti-climactic note. As a court hearing in HG Vora’s lawsuit against Penn over board seats approaches next month, the meeting arguably produced more questions than answers.

Penn: Nomination of Clifford ‘out of order’

Speaking on behalf of HG Vora, a New York-headquartered hedge fund, Mandy Lamb put forth Clifford’s nomination at Tuesday’s meeting. Clifford has deep experience with Penn, where he formerly served as the company’s chief financial officer for nearly 13 years. He left the company in November 2013, seven years before Snowden’s appointment as CEO, to join Gaming Leisure and Properties.

Snowden abruptly dismissed Lamb’s proposal, immediately quashing any possibility for the election of a third director. Pursuant to Penn company bylaws, the board set the number of Class II directors at two, Snowden stated. He deemed a proposal to nominate a third director as “out of order” and not permissible.

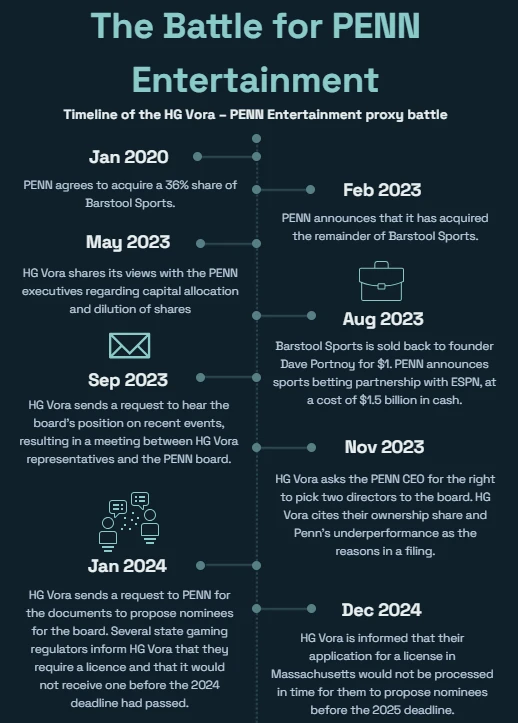

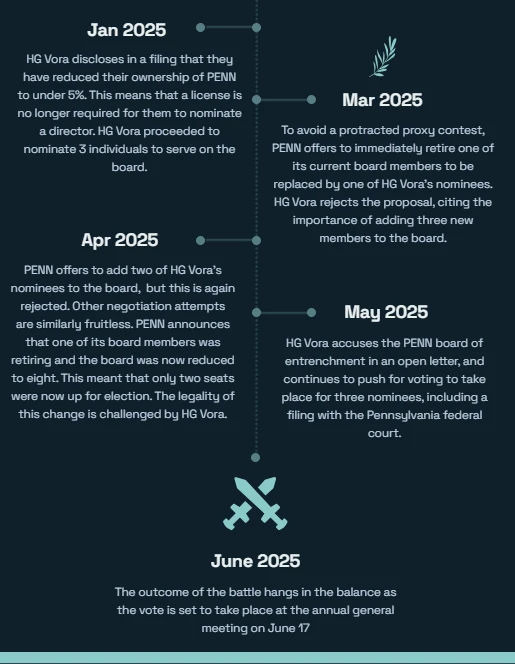

The proxy battle on board composition has been the subject of an intense months-long dispute between Penn and the hedge fund. Since his departure, Clifford subsequently interviewed with Penn for a position on the board in 2020.

Penn indicated that it still has some of the same concerns on Clifford’s expertise in digital gambling that it raised five years ago. In a May letter to shareholders, Penn asserted that Clifford lacked digital gaming and online sports betting experience, areas that are “essential to the future” of its business.

Federal lawsuit

In May, HG Vora filed a lawsuit against Penn accusing the company of violating Pennsylvania Business Corporation law. The suit also accuses Penn of breaching its fiduciary duty by reducing the number of seats available on the board. In response, Penn filed a motion to stay, urging a Pennsylvania court to temporarily halt legal proceedings. According to Penn, the merits of HG Vora’s claim do not “constitute good cause”.

In addition, Penn argued that the plaintiffs have not established likelihood of “imminent and irreparable harm”. There, Penn addressed HG Vora’s arguments on board composition. Speculation about a future board action cannot constitute “good cause”, Penn contends. A speculative matter is not even a dispute ripe for adjudication, Penn added, because it rests upon contingent future events that may not occur as anticipated, or may not occur at all.

Penn also criticised HG Vora for its failure to abide by disclosure standards in other instances. The Securities and Exchange Commission announced a $950,000 settlement with the fund in March 2024 for its failure to make timely ownership disclosures in the lead-up to a May 2022 acquisition bid for trucking fleet company Ryder System Inc.

According to the SEC, HG Vora disclosed that it owned 5.6% of Ryder’s common stock as of 31 December 2021 and certified that it did not have a control purpose. The fund subsequently built its position to a 9.9% stake in the first half of 2022 and formed a control purpose in May of that year. However, HG Vora did not make the proper disclosures until 13 May 2022, the same day it made a proposal to buy all of Ryder’s shares for $86 a share, a sizeable premium over the trading price.

HG Vora trots out the Gold card

Ahead of Tuesday’s meeting, HG Vora urged shareholders to vote using its “gold card,” which featured the nominations of all three directors. By noon on Tuesday, more than 55% of all votes cast in the election were submitted on the gold cards, HG Vora wrote in a statement.

At the same time, HG Vora claimed that approximately five of Penn’s top 30 institutional investors voted on the company’s white proxy card, based on preliminary tabulations from the fund’s proxy solicitor, Okapi Partners.

“Penn’s shareholders have voted overwhelmingly for genuine change, including for the election of William Clifford to the board,” said Parag Vora, founder of HG Vora. “There can be no mistake about the mandate from Penn’s shareholders that the status quo is simply unacceptable.”

Institutional ownership

The nasty proxy battle may serve as an example for major sportsbook operators on how to handle disputes from activist investors. In a memo issued by Penn Entertainment last month, the company claimed that HG Vora violated several institutional investor waivers in which they agreed to remain passive in their activities. Furthermore, Penn asserted that the fund pushed for governance changes despite express prohibitions on doing so by state gaming regulators.

For its part, the hedge fund retorted that it does not consider itself to be an activist investor. To buttress its point, attorneys for HG Vora wrote in the suit that the Penn nominations marked the first time in the 16-year history of the fund that it nominated director candidates for a company in its portfolio. Over that span, HG Vora has invested in hundreds of firms.

In a Schedule 13D filing with the SEC issued on 28 December 2023, HG Vora disclosed an ownership stake of approximately 9.6% of Penn’s outstanding common stock. By the following December, representatives for the fund appeared in Massachusetts for a licensing hearing. According to the lawsuit, HG Vora contends that it sought an emergency hearing with the Massachusetts Gaming Commission (MGC) in order to obtain a gaming licence or limited relief in Massachusetts to be in a position to nominate candidates to the Penn board.

Reduced holdings

After the MGC denied HG Vora’s request for relief, the fund decided to shave its holdings in Penn for licensing purposes. Weeks later, HG Vora disclosed in a 13D filing that the fund reduced its ownership in the company’s common stock by approximately half to 7.25 million shares, representing an equity stake at the time of 4.8%.

According to TipRanks.com, a leading market research website, there is considerable institutional ownership in Penn, with 86.7% of shares held by institutional investors.

Beyond HG Vora, three others maintain a stake of at least 4%, led by iShares which tops the list at 11.4%.

Speaking on the sidelines of Wednesday’s Canadian Gaming Summit, Canadian Gaming Association CEO Paul Burns told iGB that the gaming industry is “in a fascinating spot” at the moment. He was responding to a question on how the Penn matter can become a template for other proxy battles throughout the industry.

One avenue to explore surrounds the mix of private equity investment. As Burns points out, the shift could be interesting since the private equity community maintained a relatively low appetite for sportsbook operators before PASPA.

Investment into digital gaming

Before Penn’s foray into online sports betting, HG Vora lauded the company for its execution on the retail gaming side. The fund pointed to Penn’s financial results in the second quarter of 2015, a period where Penn delivered a strong balance sheet favourable by industry standards in terms of net debt leverage and interest coverage.

Its criticism, however, centres on Penn’s spending habits in growing its digital gaming business. Penn is in the middle of a 10-year, $1.5 billion deal with the Walt Disney Co that led to the launch of ESPN BET.

The August 2023 partnership was announced on the same day that Penn sold Barstool Sports back to Dave Portnoy for $1. In total, Penn had spent in excess of $400 million to purchase Barstool.

A major purchase, eh?

With the Disney deal, Penn essentially swapped Barstool Sportsbook for ESPN BET as its front-facing sportsbook brand. At the time, Snowden had ambitions to hit 20% online sports betting market share by the end of 2027. But as the two-year anniversary of the deal nears, ESPN BET’s nationwide market share still hovers in the low single digits. The deal also came on the heels of Penn’s acquisition of Score Media and Gaming Inc for approximately $2.1 billion.

TheScore, a digital media, sports betting and technology company, is one of the most popular sports apps in Canada. At Wednesday’s conference, Burns gave theScore high marks for its tech platform.

Others, though, have questioned the cost of the Score acquisition, considering other subsequent deals such as Fanatics purchasing PointsBet’s US assets for $150 million. An industry tech consultant speaking to iGB on condition of anonymity this week believes Penn could have waited for valuations to moderate, noting that “timing is half of everything”.

An inflection point?

In attempts to grow its online business, Penn may spend at least $4 billion, HG Vora estimates. Both Penn and ESPN have an opt-out at the end of the third year, which Snowden noted could be exercised by either company if they believe ESPN BET has underperformed. HG Vora has advised Penn to abandon its online division. Based on comments from Snowden on a recent earnings call, such a move appears to be a longshot at best.

“Our digital business continues to evolve, supported by our well-known brand-differentiated IP, a fully owned technology stack and newly recruited, industry-leading talent,” said Snowden on Penn’s first-quarter earnings call. “We are nearing an inflection point.”

Penn is also bullish on a new initiative that enables customers to link their accounts between ESPN BET and the main ESPN app. The features combined with the rollout of ESPN’s new streaming service have Penn Chief Technology Officer Aaron Laberge intrigued by the “bespoke integrations” he said will be unique to the market. ESPN BET will look to the football season to provide customers with new personalised offerings that integrate their sports betting and fantasy sports selections with a quick thumbprint.

Despite Penn’s financial challenges, it is important to remember that top gambling names are valued in many cases as Software-as-a-Service (SaaS) stocks. Stocks in the class are long-dated, high-growth companies in the tech sector. Amazon, for instance, took years to first turn a profit. Nevertheless, questions remain if investors such as HG Vora will exercise enough patience before attempting to execute major change.

Executive compensation

For HG Vora, executive compensation is a major point of contention. In April 2021, Penn’s board awarded Snowden supplemental equity grants worth nearly $200 million keyed to certain price targets, according to HG Vora. Those grants have incentivised Penn’s attempts to grow Penn’s digital business without exercising enough financial restraint, the fund contends.

Snowden’s compensation of $26.7 million in 2024 ranked second-highest for CEOs among a group of approximately a dozen peer companies, according to HG Vora. Penn, however, disputed some of the findings.

Snowden’s realisable pay represents only 45% of his reported compensation and is in the bottom quartile relative to the company’s proxy peer group, the company wrote in the memo. Snowden has only exercised expiring options and has not sold any stock since 2021. Moreover, the transactions were only conducted to cover the strike price and taxes, according to Penn.

Next steps

Since 2020, Penn executives and directors have purchased over $5.7 million worth of stock in the open market using their personal funds, including $2.8 million by Snowden. Of the amount, Snowden made $1.5 million in purchases over the last 10 months, according to Penn.

The insider activity may not assuage the fund. In 2024, the Institutional Shareholder Services gave Penn a score of -100 on its “Pay-For-Performance” evaluation, a comparatively low rating that reflects high pay for low performance, according to HG Vora.

Meanwhile, share advisory service Glass, Lewis & Co gave Penn low marks for compensation levels relative to performance against its peers. More than 60% of the votes cast in the election were against Penn’s Say-On-Pay proposal, according to HG Vora.

Penn did not respond to a request from iGB for comment.

On 10 July at the federal courthouse in Easton, Pennsylvania, Penn and HG Vora have a case management conference scheduled in the fund’s lawsuit.

On Nasdaq on Wednesday, Penn closed at $17.28 a share, up nearly 5% on the session. Shares in Penn are down sharply since hitting an all-time high of $142 in March 2021