State of the Union: Penn elects two directors; dozens of AGs file amicus brief vs Kalshi; more

Yost leads coalition for reversal on prediction markets

A large swath of state attorneys general have joined Ohio AG Dave Yost in pushing an appellate court to overturn a ruling on the legality of prediction markets in New Jersey.

Yost and nearly three dozen state attorneys filed an amicus brief on Tuesday urging the US Court of Appeals for the Third Circuit to side with New Jersey in a legal battle with Kalshi. Amid the contentious battle, questions remain on whether a provision in the Commodity Exchange Act allows the federal government to preempt state regulations on sports wagering when the betting propositions are offered through event contracts.

While Kalshi is partnering with third-party providers to establish anti-money laundering safeguards for its platform, event contracts are not currently taxed on the state level.

“States rightfully have the ability to protect their citizens through the negative consequences of online gaming no matter how it’s packaged,” said Yost in a statement. “We’re protecting the unprotected.”

Yost has been joined by a number of prominent states on the East Coast, including New York, Pennsylvania, Connecticut and Massachusetts. The brief also gained support from a number of states throughout the Midwest such as Illinois, Indiana, Iowa, Michigan and Minnesota.

Kalshi CEO Tarek Mansour has levied criticism toward state attorneys general for attempts to restrict event contracts on sports. Mansour supports regulation of prediction markets on the federal level through the US Commodity Futures Trading Commission. Earlier this week, the Third Circuit granted Kalshi a 14-day extension until 24 July to file a brief in response to New Jersey’s opening brief.

Penn meeting largely uneventful amid HG Vora lawsuit

For a gambling-industry event as hyped as any shareholders’ gathering since the historic PASPA decision, Penn Entertainment’s annual shareholder meeting on Tuesday largely failed to bring the sizzle.

As expected, Penn shareholders elected Johnny Hartnett and Carlos Ruisanchez to the gaming company’s board of directors as part of a continued reshuffling of the board. Their additions were sought by HG Vora Capital Management, a top Penn shareholder.

But Penn did not consider the nomination of William Clifford, a third independent director sought by HG Vora. Clifford’s nomination represents a key sticking point in contentious discussions regarding the future composition of the board.

At the conclusion of the 10-minute, 30-second meeting, Penn CEO Jay Snowden announced the election of Hartnett and Ruisanchez, based on the preliminary results of the vote. But without a resolution to Clifford’s nomination, the brief meeting ended on an anti-climactic note. As a court hearing in HG Vora’s lawsuit against Penn over board seats approaches next month, the meeting arguably produced more questions than answers.

Resolution to come from court system

In May, HG Vora filed a lawsuit against Penn accusing the company of violating Pennsylvania Business Corporation law. The suit also accuses Penn of breaching its fiduciary duty by reducing the number of seats available on the board. In response, Penn filed a motion to stay, urging a Pennsylvania court to temporarily halt legal proceedings. According to Penn, the merits of HG Vora’s claim do not “constitute good cause”.

In addition, Penn argued that the plaintiffs have not established likelihood of “imminent and irreparable harm”. There, Penn addressed HG Vora’s arguments on board composition. Speculation about a future board action cannot constitute “good cause”, Penn contends. A speculative matter is not even a dispute ripe for adjudication, Penn added, because it rests upon contingent future events that may not occur as anticipated, or may not occur at all.

Penn also criticised HG Vora for its failure to abide by disclosure standards in other instances. The Securities and Exchange Commission announced a $950,000 settlement with the fund in March 2024 for its failure to make timely ownership disclosures in the lead-up to a May 2022 acquisition bid for trucking fleet company Ryder System Inc.

According to the SEC, HG Vora disclosed that it owned 5.6% of Ryder’s common stock as of 31 December 2021 and certified that it did not have a control purpose. The fund subsequently built its position to a 9.9% stake in the first half of 2022 and formed a control purpose in May of that year. However, HG Vora did not make the proper disclosures until 13 May 2022, the same day it made a proposal to buy all of Ryder’s shares for $86 a share, a sizeable premium over the trading price.

DraftKings, Underdog submit licensing applications in Mizzou

As Missouri nears a fourth-quarter launch of legal sports betting, a pair of operators have secured a jump on the competition in meeting their licensing obligations.

Two sportsbooks, DraftKings and Underdog, have submitted licensing applications with the state, the Missouri Gaming Commission confirmed. As of Friday, the companies are the only two operators that have turned in the requisite filings, according to the MGC. The story was first reported this week by Legal Sports Report.

FanDuel, DraftKings’ archrival, will almost certainly submit an application before the deadline imposed by the MGC. In total, FanDuel and DraftKings spent more than $40 million in support of a ballot measure advocating for the legalisation of sports wagering.

There are several pathways to attaining licensure in the Show-Me-State. The most immediate deadline falls on 15 July when applications for so-called untethered licences are due. The MGC will award those licences by 15 August. In addition, another classification of licence applications will face a submission deadline of 12 September.

Operators have the option of gaining market access through partnerships with professional sports teams. Already, Bet365 has inked a partnership with the St Louis Cardinals of MLB. Century Casinos has also named BetMGM as its sports betting partner.

Missouri is on track to go live with sports betting by 1 December. Days later, the Kansas City Chiefs will appear in primetime on Sunday Night Football. The Chiefs are seeking their fourth straight AFC Championship.

AML modernisation dominates Canadian Gaming Summit

A who’s who of regulators, legislators and C-suite executives converged upon Toronto this week for the annual Canadian Gaming Summit. Luminaries such as Ontario Lottery and Gaming Corporation CEO Duncan Hannay, Ontario Attorney General Doug Downey and Ontario Alcohol and Gaming Commission Chair Dave Forestell all made appearances at the event.

Since the launch of the Ontario iGaming market about three years ago, provincial regulators have received high marks for facilitating the transition of grey market operators. By some estimates, about 80% of such operators have moved over to the legal market. Nevertheless, Downey appears to be losing patience with some of the stragglers.

“The market’s matured enough now that people have had an opportunity and, if they’re not going to go through the door, it’s time that they stop playing in our market,” said Downey in a fireside chat.

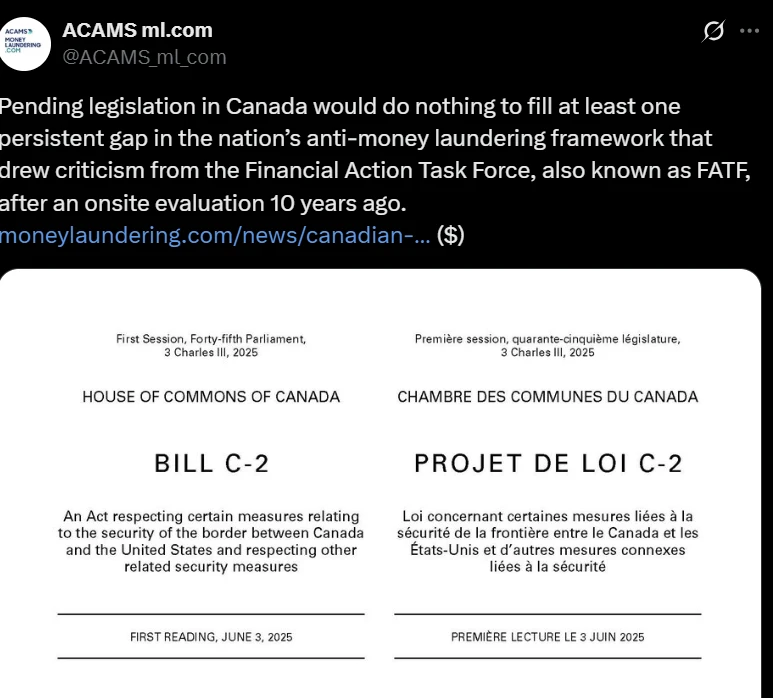

Another hot topic at the event centred on the nation’s anti-money laundering framework, one the gaming industry views as largely outdated. Last year, a comprehensive cyber breach identified in March forced the Financial Transactions and Report Analysis Centre of Canada (FINTRAC) to shut down an AML portal for months.

The hack created exposure for thousands of files in the gaming industry, multiple sources told iGB at the summit. For its part, FINTRAC claimed the centre took every precaution to maintain the integrity and security of its system in an effort to assuage the industry.

Now as the industry pushes for modernisation in AML processes, experts are clamouring for a push toward automised reporting. The breach leaves some queasy on if the security guardrails are robust enough. At a panel on Thursday, several speakers expressed concern that Canada will receive a negative rating when the Financial Action Task Force reviews the national AML infrastructure this November.

ICYMI on iGB

VGW, other sweeps confront tough week as US regulators crack down

NJ sets online gambling revenue record for the month of May

Michigan online gambling revenue tops $300 mil in May

NY board finalises licence fee, capital minimum for downstate casino bids

Louisiana governor vetoes anti-sweeps bill

Pennsylvania gambling revenue clears $600 million in May

Tribes wade into prediction market debate with amicus brief

Ippei Mizuhara, Ohtani’s ex-interpreter, finally reports to prison