RP iGaming Index: passing on the baton?

In a month which saw the top-order of the Index transformed by the entry of the Flutter-Stars combination and DraftKings, stocks with an explicitly US focus now represent 27% of the index despite a still nascent igaming market. Paul Leyland looks at what’s driving this critical mass of investors to bet big on the US

May saw US markets in particular continue their coronavirus rally. This has been fuelled by hopes for a V-shaped recovery, the digital resilience (and even benefit) of a few key ‘mega stocks’ (e.g. Amazon) and the understanding that when governments turn on the fiscal taps it is typically equity markets that benefit most.

The Nasdaq is now at its most expensive ever on a 2020E earnings basis, but for the moment investors are looking to Q4 and 2021 with confidence while preparing to ignore a Q2 earnings bloodbath.

The benchmark therefore increased by a solid 10%, up 38% from its March lows and 28% since May 2018. Tellingly, however, its March ‘lows’ were only 10% off where the index started.

The RP iGaming Index captures many of these wider trends, and these powered an impressive 31% rally during the period. A welcome but rare outperformance and still lagging the benchmark, though, over time (see below).

Those stocks with a retail component staged strong rallies in the period as a path to reopening became clearer (eg, Boyd +38%, Churchill Downs +52%, Penn National Gaming +133%, Scientific Games +51%, William Hill +44%), reflecting hopes that reopening means rapid recovery of revenue and (crucially) cashflows.

However, the retail nature of these stocks (with only William Hill a real hybrid in terms of revenue mix) meant that they are weighted as small components of the Index. Stocks with a retail element of over 50% of revenue represent just 7% of the Index, demonstrating the ownership gulf between land-based and online businesses on a global basis.

Also similarly to the wider markets, the presence of a few digital ‘mega stocks’ certainly has also helped the rally: DraftKings is now #2 in the index in terms of size (more below) and powered up 105% in the period.

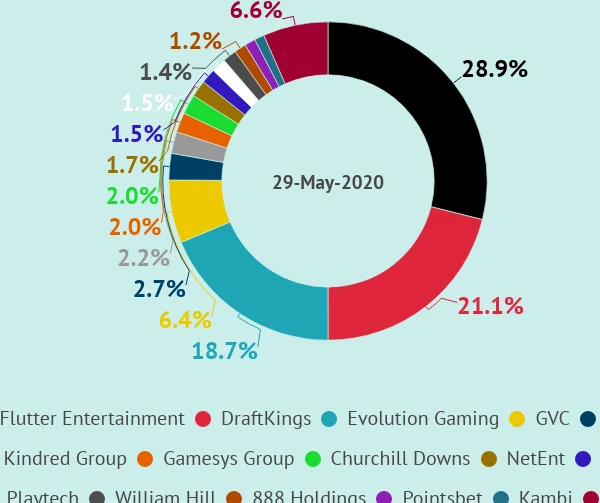

Flutter (plus Stars Group) increased by a more modest 14% but still enough to be the Index’s largest constituent. These two stocks represent 50% of the Index on their own (see below).

From the perspective of policy actions driving the igaming rally, the hope of government largesse benefitting the sector is more nuanced for gambling than for the wider economy. Certainly gambling stocks can benefit from the overall protection of consumers and also higher market valuations. However, on a more sector-specific basis governments can take away (tax, regulation) as much as give.

Here we have an interesting valuation indication of where igaming investors think the action is. In Europe, igaming-led stocks have been reward for their resilience during the Covid-19 crisis, but valuations imply a health scepticism on both long-term growth and regulatory risk.

Regular readers of this column will be aware that we share much of this scepticism for most stocks in the Index. The US is a latecomer to the igaming party, however, and, with historical inevitability thinks it has nailed it on the first pass. Whether this will be analogous to the Golden Bear’s (in)famous passing to beat the Stanford Cardinals in a seminal 1982 college football match, or more similar to the tutorial provided by Rommel at the Kasserine Pass in 1943 remains to be seen.

Nevertheless, stocks with an explicitly US focus (and little else) now represent 27% of the index despite a still nascent igaming market. In other words, less than 1% of total global igaming revenue is producing c. 30% of stock market-exposed igaming value.

There are some good structural reasons for this: most Asian online gambling is not accessible to investors through listed operators. Equally, the US market may be nascent but it is ramping up quickly. For some components of the index, this has been an opportunity worthy of root-and-branch repositioning.

GAN is a clear beneficiary of the post-PASPA world and is now on the Nasdaq, having waved goodbye to an Old World listing. GAN is still small (only 1.1% of the Index), meaning that a small opportunity in macro terms can have transformative benefits in a company-specific context. However, investors aren’t typically interested in small bets – as the numbers above show a critical mass of investors have now made a big bet.

Just 24 months since PASPA was repealed, for 27% of the index to be driven explicitly and primarily by US online gambling opportunities (and this excludes William Hill, which is at least half in that category) is little short of astonishing. For it to pay off for investors, four things need to happen:

1. More US states need to legislate for online gambling, especially one of the (few) big ones

2. They must legislate in a way that allows for profitable growth

3. Growth must be big enough to make current marketing spend look sensible

4. There needs to be enough market share for everybody, DraftKings especially given its current Index position

In our view, any one of these is a big ask. To get all four of them would be almost a miracle. However, back to that Kasserine Pass analogy – it took only 16 months for US forces to learn all the necessary lessons and save the Old World from itself again.

To reflect this shift, and also some wider comings and goings in the sector, the index now (briefly) has 41 constituents (with Eldorado and Caesars still separate).

The additions demonstrate the US focus, albeit most are small: DraftKings (21%), BetMakers (0.5%), Esports Entertainment Group (0.1%), PointsBet (1.1%), Score Media and Gaming (0.3%) and Scout Gaming (0.1%) have been added. Stars is now part of Flutter (29%) while Nektan has gone into administration (tiny to nil).

Disclaimer: the narrative provided represents the opinions of the authors. Any assessment of trends or change is necessarily subjective. The information and opinions provided are not intended to provide legal, accounting, investment or policy advice, nor should they be used as a forecast. Regulus Partners may act, or has acted, for any of the companies and other stakeholders mentioned in this article.