Slot Trumps Nigeria: Unlock a market with huge potential

As pioneers in delivering compliant igaming technology solutions, EveryMatrix is among the first aggregators to bring an expansive content portfolio to Nigeria.

As the online casino games segment there remains largely uncharted territory for many, our seventh Slot Trumps report serves as an essential primer, shining a light on key trends and player behaviours.

Internet penetration in Nigeria

The Nigerian market is generally characterised by lower internet penetration (42%), compared to the previous markets in our Slot Trumps reports, with an average of 89% in Europe and 68% in LatAm markets.

Nigeria also showcases lower bandwidth both compared to African markets, ranking towards the lower end among the 15 leading markets on the continent, and when compared to previous igaming markets we have analysed in Europe and LatAm.

This trend, however, is rapidly reversing with Nigerian mobile internet users increasing 20% in 2024 compared to 2023, according to Statista.

This creates a particular setting for the igaming industry in Nigeria. First, operators need to look towards lightweight online casino games. These need to be optimised for low data consumption, and work with limited network speeds. It’s also essential to cater for lower-end devices and browsers, ensuring audiences are kept entertained without latency.

Our internal data confirms that game providers choose different approaches to tackle this particularity. Some, for example, offer games with and without sound to decrease the size of the game. Others choose to focus on creating games for African markets that are smaller in size from the very start.

Slot Trumps Nigeria: Early-stage player behaviour

So, does this impact player behaviours in Nigeria? We take a detailed look in our Slot Trumps Nigeria report.

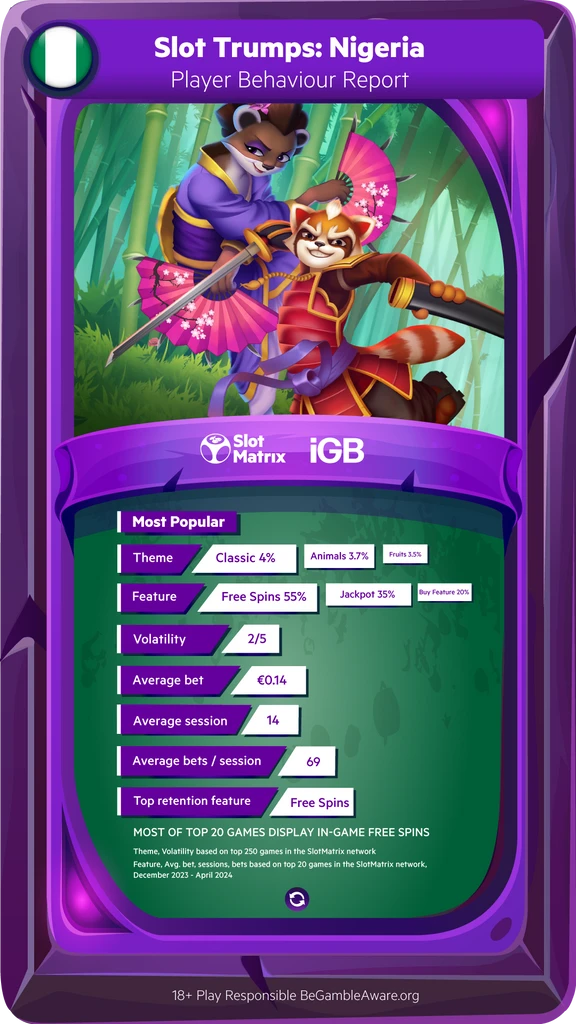

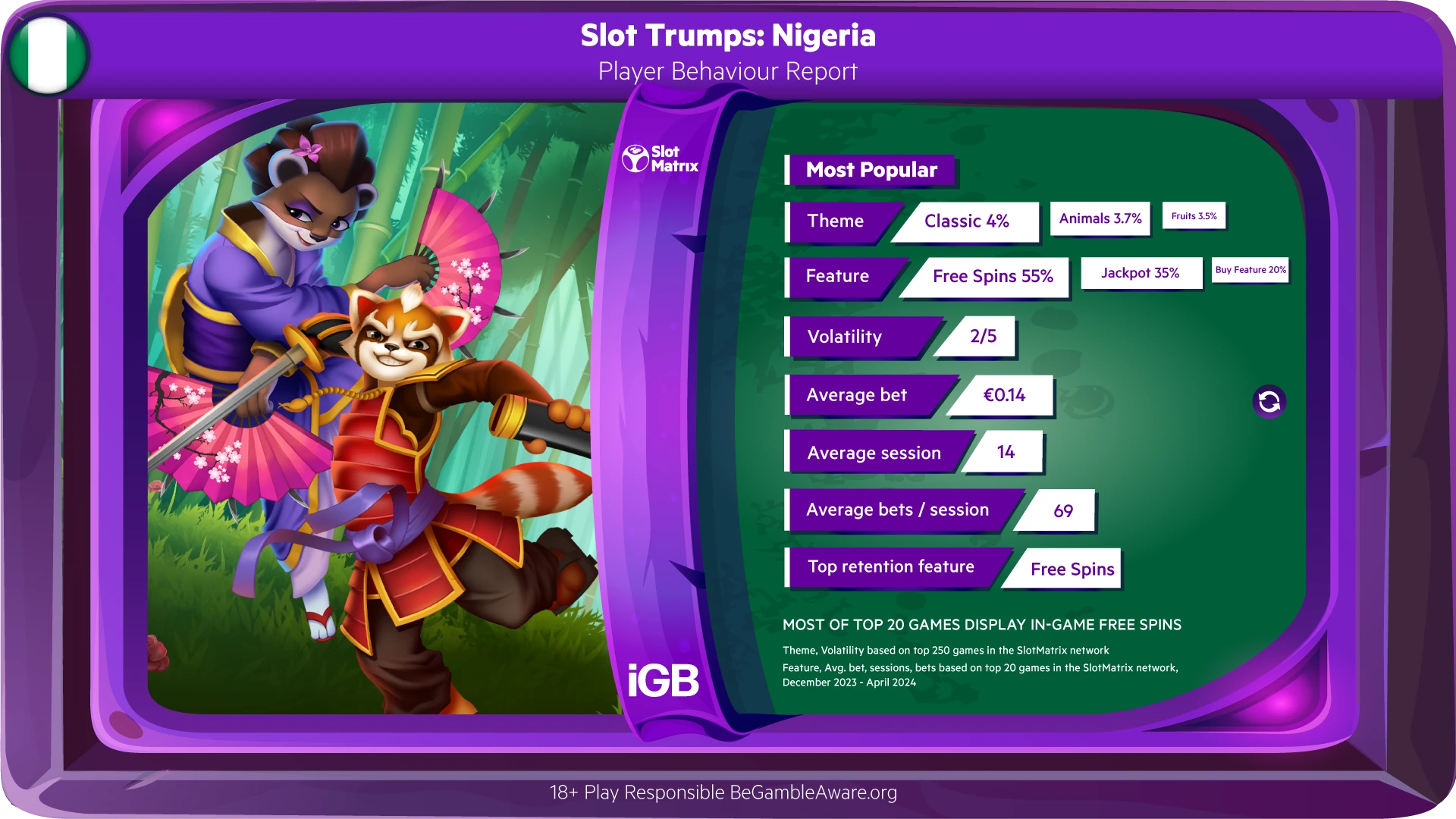

Within our early-stage data in Nigeria, we observed some unique player behaviours and wagering trends. One that stands out is that players generate the lowest average bet of our series so far across the top 20 games within our SlotMatrix network.

According to our Slot Trumps Nigeria report, players spend an average of €0.24 per spin across the top 40 games. This is markedly less than the global average bet of €1.

Correlated with their preference for low volatility games, Nigerian players have yet to transition their real-money habits from sports betting to online casino.

This can be correlated with the market’s current levels of internet penetration and bandwidth. It may well be that when these areas improve for the general population, the appetite for online casino games will gain increasing traction.

Despite the lower than average spend per spin, bonus features hold plenty of interest. This can easily convert players across verticals. In-game free spins (55% of top 20 games) are a great example. The same for jackpots (35% of top 20 games). We also recommend looking at more enticing options such as buy features.

As the most common bonus feature, in-game free spins offer Nigerian players more in-game time, which can be correlated with the large number of sessions within our 90-day dataset timeframe.

As the market develops, we anticipate that lower average bet sizes will also be boosted considerably. This will be driven by more online casino brands, more vendors and a far greater range of content.

Slot Trumps strategies to gain instant Nigeria market share

Tailoring content to local tastes and behaviours is paramount for success in Nigeria. Get this right, and the market will hold great potential. As things stand now, however, operators also need to consider content localisation in terms of game mechanics and size.

They also need to opt for a mobile-first strategy to ensure audiences enjoy the best possible online casino experiences. Of course, the constraint there is the market’s technologically limited framework. However, if you focus on that now, you will also be preparing for the market of tomorrow.

Want to know more? Our SlotMatrix experts can help operators aiming to launch in Nigeria or expand operations. We will help develop the optimal content mix to drive early revenues and capture instant market share.

Understanding the Nigerian online casino player

As the industry’s largest igaming aggregator, EveryMatrix holds the data and access to early-stage player behaviour trends. This helps our partners understand player preferences and cultural nuances before entering new markets. Nigeria, of course, is a key example of this.

Access to this data is as vital as it can be surprising. For example, among the top five most popular game themes in Nigeria is Asian themes, alongside Classic, Animals, Fruits and Action.

In markets such as Nigeria, flexibility is crucial as player behaviour and trends rapidly evolve. Remaining agile to capitalise on the market’s opportunities should involve adapting your content offering. You should also think about how to add more layers of excitement and fun for local audiences. Gamification is a great example. Player engagement with gamification tools such as tournaments and tiered challenges are easy wins for acquiring more local players.