Crypto wagering: The forces driving growth

The growth of crypto wagering and Web 3.0 are turning traditional wagering on its head.

The entire real-world wagering ecosystem is being rebuilt in virtual worlds like Decentraland, presenting opportunities and risks to established operators.

In Decentraland, players must first purchase or transfer cryptocurrency (MANA or DAI) tokens to their Decentral Games wallet, which they can stake on certain games.

Online crypto operators, which have a similar UX to online fiat operators like FanDuel and DraftKings, are already recording extraordinary turnover.

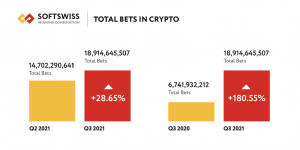

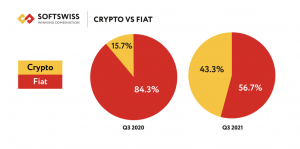

In Q3 2021, the total number of bets placed using cryptocurrency increased by 181% yoy, while the share of bets in crypto (43.3%) is fast approaching par with fiat (source: Softswiss).

For example, crypto-focused Sportsbet.io (not to be confused with the Australian “Sportsbet” business owned by Flutter) records US$2.7bn of turnover per month.

To put that in perspective, in 2021, Australia’s largest operator averaged US$1.2bn of turnover per month and has around 50% market share in the country.

Sportsbet.io has partnered with multiple renowned football clubs, including Arsenal, Southampton and São Paolo.

Monetising the metaverse

The fund has a particular focus on companies providing a critical B2B service to gaming and wagering operators. Examples of this include investments in racing data providers, voice and text to bet solutions and affiliate marketing services.

An interesting business we have seen in the Metaverse is Admix, founded by Sam Huber in 2017.

The core business of Admix is the creation and publication of in-play ads that do not impact the experience of the player. This aligns the interests of the advertiser, the game developer and the player.

Admix already counts many of the largest global brands as clients, with over 1,000 brands buying Admix inventory each month.

A persistent criticism of Web 3.0 is the lack of monetisation in worlds such as Decentraland and The Sandbox. However, Admix demonstrates how critical B2B service providers can generate revenue from Web 3.0.

Admix is incredibly excited about the growth of Web 3.0 but is addressing it in a way more akin to a real estate developer. The company has been purchasing land in Decentraland and The Sandbox since 2020 and is leasing that land out to many of the brands who are existing clients of this core “in-play ad” business.

“The same concepts of proximity, how the price is created, and why you would buy versus rent, all of these are the same questions you would ask of physical real estate.”

Sam huber, CEO, AdmiX

Building experiences on land parcels and leasing it back to their clients has sometimes yielded monthly rents over $60,000, with profit margins per development of over 70% (Fast Company). For example, in Decentraland, Admix developed a display of oversized perfume bottles for L’Oreal, and has built temporary installations for events like New York Fashion Week.

It is no surprise to us that much of the current activity in Decentraland occurs in its Vegas City District, a digital Sin City.

We envision that service providers like Admix will take their experience from prior tangential ventures and apply it to the growth of crypto gaming and wagering, perhaps attracting clients like Sportsbet.io as well as mature land-based brands like Caesars, Wynn and MGM.

It would not surprise us to see many of these businesses on an Admix-owned billboard in Decentraland.

Dominant Web 2.0 companies are generally only 20 years old and took a couple of years to begin generating meaningful revenue. Their extraordinary growth has catapulted many of these businesses to become the world’s largest by market capitalisation.

They all have one simple common characteristic – they deliver a service that their customers either need or love. For example, running an e-commerce business without Google ad spend is practically impossible today.

Burgeoning worlds like Decentraland and The Sandbox are, for the most part, letting land owners direct the path to monetisation and we are excited to see its continued development.

| Company Revenue (US$m) | First Full Year | First Full Year +2 | First Full Year +5 | First Full Year +10 | First Full Year +15 | 2021 |

| Meta (Founded 2004) | 9 | 153 | 777 | 12,466 | 70,697 | 117,929 |

| Google (Founded 1998) | 0.22 | 70 | 3,180 | 2,370 | 65,670 | 257,637 |

| Amazon (Founded 1994) | 0.51 | 147.8 | 2,760 | 8,490 | 34,204 | 469,822 |

| Twitter (Founded 2006) | 0 | 4 | 106 | 2,530 | 5,077 | 5,077 |

| Nvidia (Founded 1993)* | 13.3 | 374.5 | 1,369 | 3,069 | 3,998 | 26,914 |

Since inception in August 2019, Waterhouse VC has achieved a total return of 2,057% as at 30 April 2022, assuming the reinvestment of all distributions.

Please note the above information in relation to Admix, DraftKings, Decentraland, The Sandbox, Sportsbet.io, Meta, Google, Amazon, Twitter, Nvidia, Caesars Entertainment and MGM Resorts is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter, Meta and Google. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.