Hints of diversification in Q1 esports betting as new season reignites the vertical

The new year serves as the starting gun for much of the esports sector. Counter-Strike players return from the Christmas break, League of Legends (LoL) fires up the engines, Dota 2 readies itself for a new playing field and Valorant starts its Kickoff tournaments with a bang.

With the first three months of 2024 now under everyone’s belts, we can reflect on the performance data outlining the shifts in betting behaviours and predict what’s to come for the year ahead in esports betting.

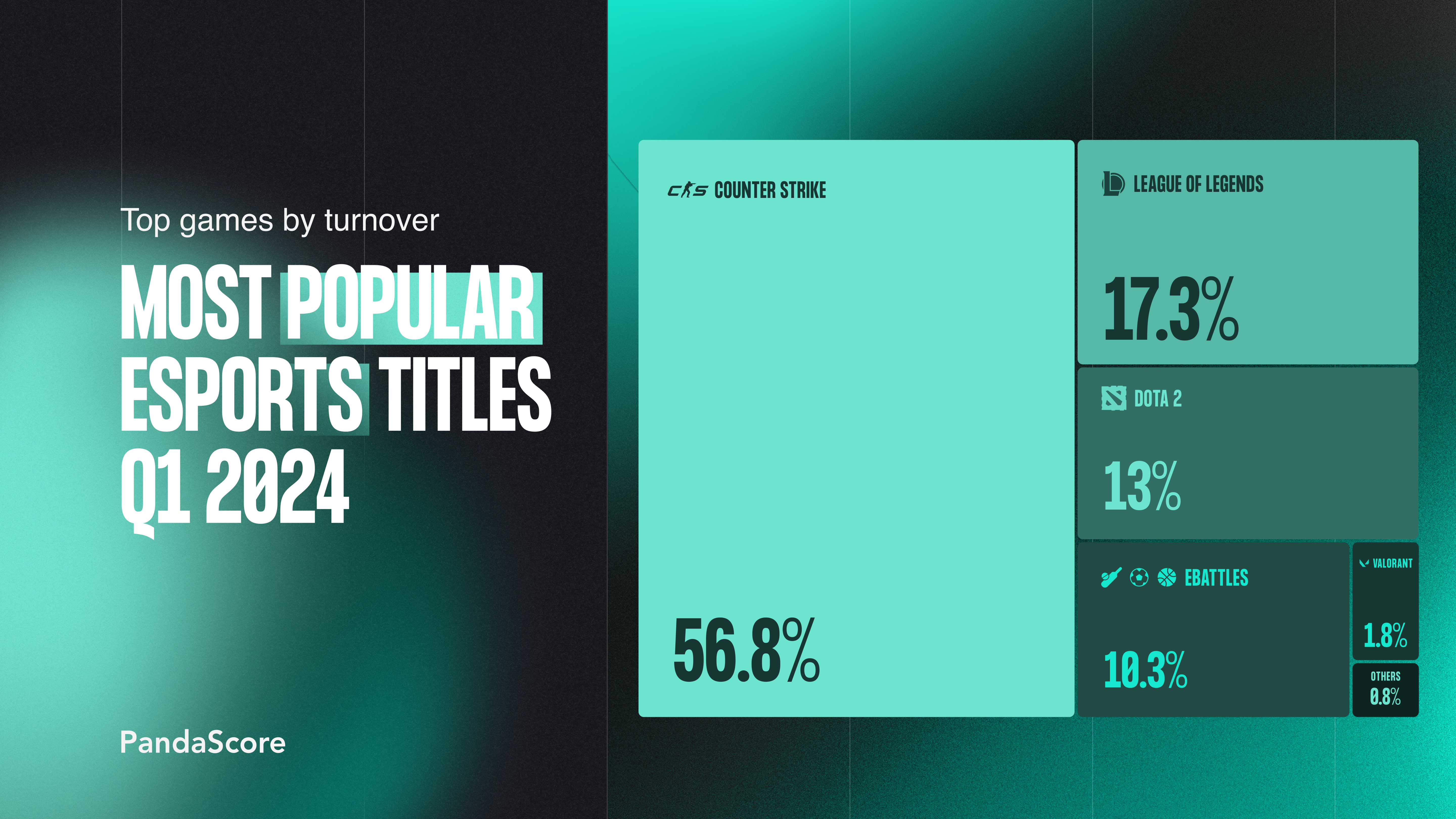

Most popular esports titles Q1 2024

Reviewing the performance of all esports titles during 2023, we found that Dota 2 had overtaken LoL as the second most popular esports title by turnover for odds and data platform PandaScore’s clients.

But in 2024 LoL jumped back into second place as the new season commenced and keen interest in domestic competitions in China and Korea returned and the North American scene experienced a resurgence.

Conversely, we’re now seeing the impacts of the scuppering of the Dota Pro Circuit format as Dota 2 returned to a more decentralised tournament model last year, much like Counter-Strike. In September 2023 Dota developer Valve discontinued its Dota Pro Circuit tournament citing it had become “less exciting, less varied and ultimately much less fun”.

Elsewhere, the performance and popularity of ebattles (esoccer and ebasketball) in Q1 also highlighted the vertical’s strong correlation to the regular sports calendar. Ebasketball accounted for a third of total ebattles turnover as the NBA regular season fast approached its pointy end.

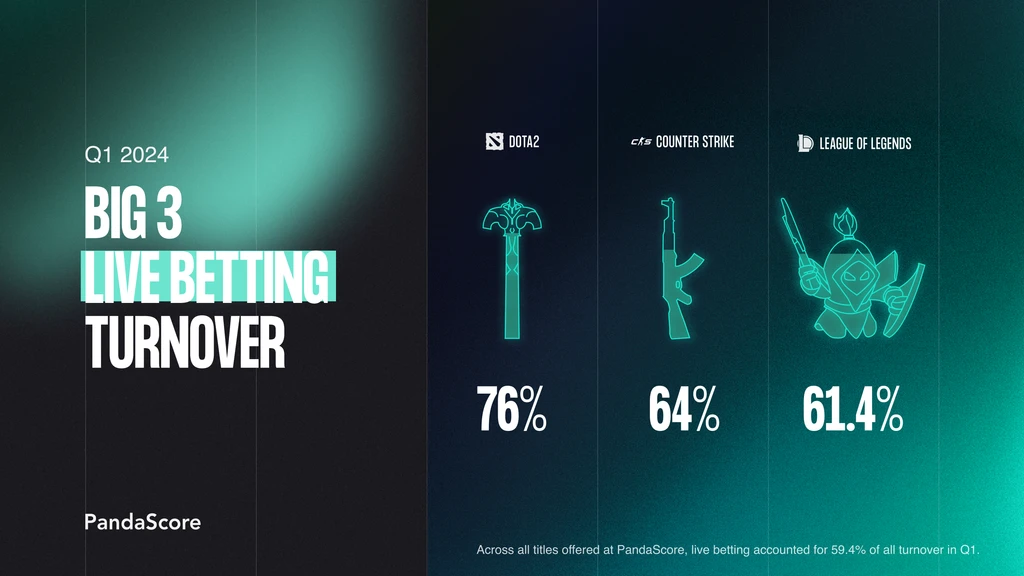

Live betting on the big 3

Considering the average across all titles, Q1 results showed that the big three titles (Dota 2, Counter Strike, LoL) solidified their positions at the top thanks to the strong live betting options available. The 60-40 split between live and pre-match betting in esports remained for Counter-Strike and League of Legends, but Dota 2 is more heavily indexed to live betting.

Multiple factors contributed to the higher presence of live betting in Dota 2. The complexity of the game lends itself to bettors that are familiar with the gameplay and confident in their decision-making during matches. The length of matches – generally between 40-60 minutes – means there’s simply more time for live markets to be open.

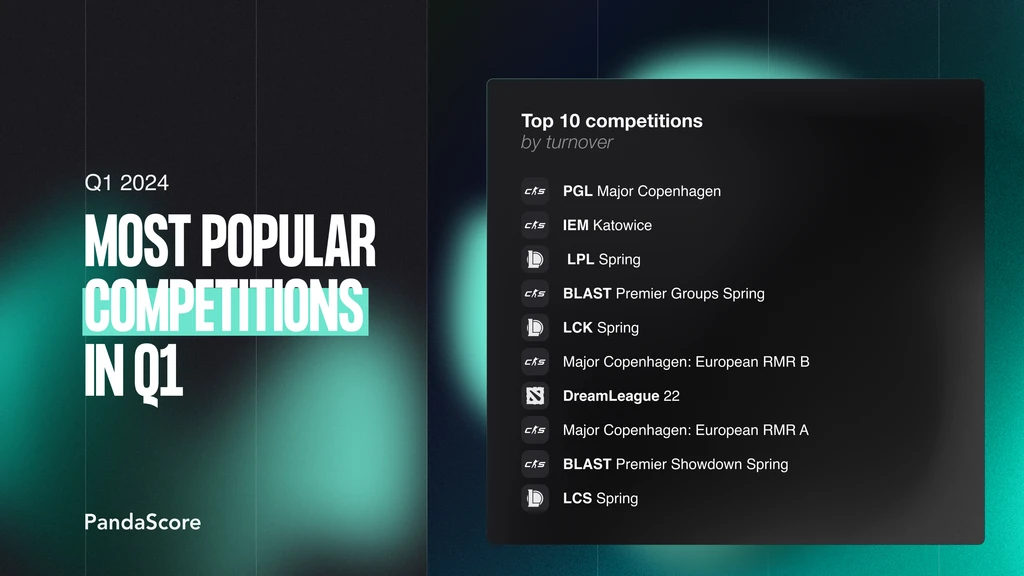

Most popular tournaments in Q1

Counterstrike’s PGL Major was undoubtedly the highlight of the quarter in terms of overall turnover with both its main event and European qualifiers ranking in the top 10 competitions for overall turnover.

The tournament was the first major to be played on Counter-Strike 2 rather than the old game CS:GO. A thriller for fans and bettors it stood head and shoulders above number two IEM Katowice, one of the strongest turnover generators every year.

On the Dota 2 front, the Dream League has always been popular for bettors, but the shift away from the structured Dota Pro Circuit has seen this competition step up to the plate to offer fans and bettors more of what they want.

LoL’s strong overall performance in the quarter is buoyed by its top performing tournaments: China’s LPL is a consistent top performer and Korea’s LCK usually makes the cut too.

The surprise this quarter is seeing the return of the North American LCS to the top 10. Viewership and turnover suffered last year when the league shifted to a mid-week slot, but having returned to weekends, the competition has mostly bounced back to its former self.

With major competitions in Q2 like LoL’s Mid-Season Invitational or Valorant’s regional leagues and Shanghai Masters, operators could see a more diversified performance across their esports portfolio through to the end of June.