Waterhouse VC: Crunch time in the US

As discussed in our June newsletter, investors in US online wagering operators are growing impatient with the losses recorded for the sake of gaining market share.

One reason we focus primarily on suppliers over operators is because operators rely heavily on their customer acquisition cost (CAC).

In mature, highly taxed, regulated markets, a handful of operators earn the majority of profits because they have the lowest CAC and the best operational efficiencies.

Sportsbet take 2

Flutter’s third quarter results demonstrated FanDuel’s (Flutter’s US brand) clear market leadership. It has a 42% gross gaming revenue (GGR) market share in mobile sports betting and 18% market share in igaming.

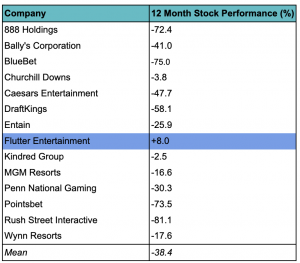

As shown above, Flutter is the only operator from its peer group to generate positive returns for investors over the past 12 months. It’s also our only portfolio holding in the group. We initially invested in Flutter because of their profitability in mature international markets, scale, marketing expertise and team.

FanDuel’s strong position

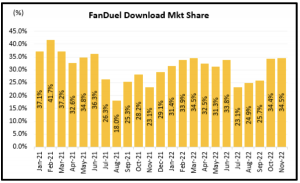

In the US, FanDuel has achieved 19% more app downloads than DraftKings year-to-date (3.3m vs 2.8m). It has achieved this with 9% less marketing spend ($727m vs $803m).

Product innovation and superior user experience have contributed to 77% year-on-year customer retention (Flutter Entertainment). These strong metrics allow Flutter to guide for US profitability in 2023.

FanDuel is consistently achieving 30%+ share of app downloads. It also has 46% market share of sportsbook GGR in its three largest states (New York, New Jersey and Pennsylvania).

Flutter effectively leverages its experience gained outside the US to grow FanDuel with a focus on near-term profitability. In 2021, the US represented just 22.5% of Flutter’s overall revenue.

As discussed in September, Sportsbet (Flutter’s Australian brand) has 50% online market share and has grown revenue at 36% per annum since 2009.

Scale is critical

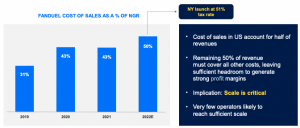

In regulated markets like Australia, wagering taxes typically increase over time. Sportsbet’s cost of sales has grown at 42% per annum since 2009, increasing from 30% of revenue in 2009 to 49% in 2021.

Sportsbet’s increasing cost of sales as a proportion of revenue demonstrates the importance of achieving scale in regulated markets. High CAC and large overheads erode profits when gross margin is just 51%.

Despite the increase in taxation in Australia, Sportsbet’s operating leverage and scale benefits resulted in EBITDA margin expansion. It rose from 14% in 2009 to 34% in 2021.

Smaller competitors under pressure

The profits of Sportsbet’s smaller competitors are pressured by tax increases, contributing to Sportsbet’s market share gains. In Australia, the top three online sportsbook operators have 87% market share. The top three in the UK have 78% market share; in the US, the top three have 81% (Flutter Entertainment).

All three jurisdictions have a cost of sales higher than 30% of revenue. This negatively impacts the competitiveness, and ultimately the market share, of smaller operators.

With regard to taxation, the US is following a similar trajectory to Australia and mature European markets. FanDuel’s cost of sales has expanded from 31% in 2019 to 50% expected in 2022. New York launched in January with a 51% tax rate.

Don’t count FanDuel out of igaming

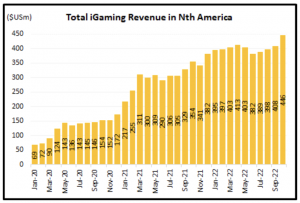

In October, total igaming revenue in North America was a record $446m. That’s an increase of +26% year-on-year and +10% month-on-month.

Igaming is a significant growth opportunity for FanDuel. The company currently has 18% market share in igaming, lagging third behind BetMGM and DraftKings, which have 29.8% and 22.8% respectively.

FanDuel’s sportsbook is its primary customer acquisition channel. Around 41% of sportsbook customers are then cross-sold into igaming within 30 days. The operator will be improving its range of igaming products and developing promotion tools to retain and monetise players.

Taking a large slice of a large pie

There are many views on the potential revenue of US sports betting at maturity. BetMGM and DraftKings estimate it to be $14.1bn and $22bn respectively, while FanDuel estimates it to be $22.6bn (Flutter Entertainment).

At the moment, FanDuel has 42% market share and expects to generate around $2bn of sportsbook revenue this year.

If the potential revenue opportunity is $19.5bn (taking the average of the three operators’ estimates) and FanDuel’s market share falls to 30%, FanDuel’s implied online sports betting revenue at maturity is $5.9bn. That’s about 3x higher than this year.

If FanDuel’s market share remains at 42%, revenue would be around 4x higher.

The upside for FanDuel’s sportsbook business

As discussed above, Sportsbet has an EBITDA margin of 34%. Flutter aims for FanDuel to achieve long-term EBITDA margins comparable to their other divisions (including Sportsbet).

If FanDuel achieves a mature EBITDA margin of 25%, the sportsbook business alone can generate higher EBITDA than Flutter’s entire business generated in 2021. This excludes any contribution from igaming.

Waterhouse VC has been invested in Flutter since September 2019. While our initial investment has appreciated 70% over the past three years, we remain particularly optimistic about the growth profile of the company’s US operations.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to 888 Holdings, Bluebet Holdings Ltd, Pointsbet Holdings Ltd, Churchill Downs, Bally’s Corp, Flutter Entertainment Plc, Caesars Entertainment, Entain, Kindred Group, MGM Resorts, Penn National Gaming, Rush Street Interactive, Wynn Resorts and DraftKings Inc is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter Entertainment Plc. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.