How will the first US interest rate cut in four years affect the gaming industry?

On Wednesday, Fed chair Jerome Powell announced a new rate range of 4.75%-5%, down from 5.25%-5.5%. The committee also announced that it expects to cut an additional 50 basis points through the rest of the year and 100 basis points in 2025. Its next meeting is set for 6-7 November.

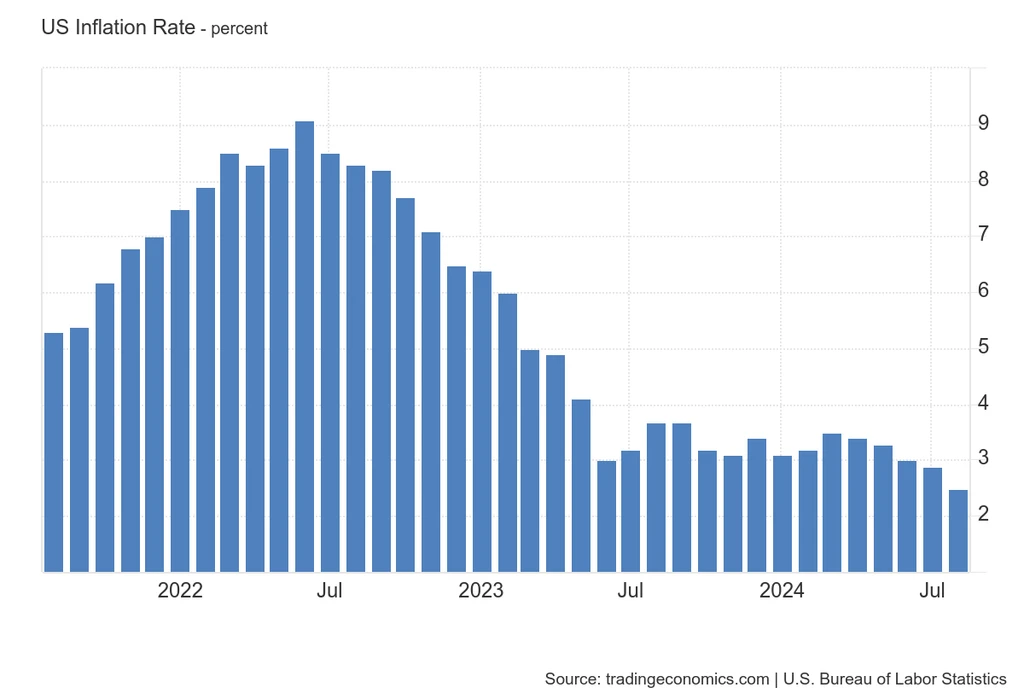

The previous rate, which was the highest in 23 years, had been in place since last August. Wednesday’s cut is the first since March 2020, which was an emergency move in response to the Covid pandemic. Rates were held close to zero from mid-2020 to early 2022. Then the Fed kicked off a flurry of hikes up over 5% through July 2023, where rates had stayed until this week.

As a consumer discretionary industry, gaming could, in theory, benefit greatly from reduced rates. Firstly, consumers could have more recreational funds to bet. But perhaps most notably, suppliers and operators could have more freedom to finance projects or pursue M&A opportunities.

Powell said on the Fed press conference that the US economy has made “significant progress” over the last two years.

“Today, the Federal Open Market Committee decided to reduce the degree of policy restraint by lowering our policy interest rate a half-percentage point,” Powell said. “This decision reflects our growing confidence that within appropriate recalibration of our policy stance, strength in the labour market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%.”

Fed aiming for “soft landing”

The 50-basis-point cut is larger than the typical 25-basis-point move. The decision has drawn both optimism and hesitancy. Some analysts are bullish on easing rates for consumers and businesses, but others fear the cut might have come too late or might fuel further inflation.

In August, the Fed’s preferred inflation gauge was 2.5%, down from 2.9% in July and 3.7% in August 2023. That is within reach of the committee’s goal of 2%. The bullish cut is the Fed’s latest step as it looks to achieve a “soft landing”. Such a scenario would involve reducing inflation while also avoiding a recession, a very difficult tightrope to walk. Pundits often compare a soft landing to carrying a piano down a staircase.

Rate cut could benefit gaming in multiple ways

Rick Arpin, US gaming leader for KPMG, told iGB that the consultancy “will be looking for a series of interest rate reductions” in the near future. That is in line with the Fed’s outlook, as well as most analysts.

“If we see that, the impacts should include some relief for the more leveraged companies, an increased appetite for M&A and some incremental ability for emerging companies to obtain financing,” Arpin said.

Up until recently, the industry had been dominated by publicly traded companies. But a slew of private equity deals this year have caused some to wonder whether more aggressive dealmaking could be coming.

Industry analyst and sports betting investor Chris Grove told iGB that “cheaper capital is typically a tailwind for M&A”. Now that the US online gambling industry is “shifting into a new phase”, Grove says, there are “interesting companies that can help drive better product and margin gains” and the overall sentiment seems in favour of – “or at least not punishing” – growth opportunities.

These factors, he argues, seem to forecast “a meaningful uptick in transactions in the quarters ahead”.

Fantini: Rate cuts will help with debt, borrowing

In his latest column for GGB, Fantini Research founder Frank Fantini posited that casino operators were likely to the biggest winners from the cuts.

This, he said, is because they have historically “relied on a fair amount of debt to fund growth”. But he also qualified this by mentioning that most companies already rejigged their balance sheets in response to Covid shutdowns. Companies with maturing debt, he said, “should be able to refinance at lower rates in a number of cases”.

Fantini cited research on the subject from Deutsche Bank analyst Carlo Santarelli. Santarelli surmised that rate cuts would be most beneficial to five companies. These are, in order: Golden Entertainment, Caesars Entertainment, Light & Wonder, Red Rock Resorts and Penn Entertainment. All five would see increases in discretionary free cash flow of least 5%.

Before the cut was announced, Fantini said that the industry’s real estate investment trusts (REITs), VICI Properties and Gaming and Leisure Properties, were becoming increasingly attractive. Both have hit 52-week highs in recent weeks.

“In addition to the advantages lower rates offer in their efforts to make acquisitions and finance tenant growth, their dividends become more appealing compared to bonds,” Fantini argued. “VICI’s dividend yield is 5.1% and Gaming and Leisure’s is 5.8%. Combine that with stock appreciation and total return is very attractive, especially to institutional investors and income investors.”