Is the UK still attractive to listed operators?

Taking a look at UK gambling investment, London’s public equity market has shrunk in the last 10 years. Up to 45 companies left the UK market last year and, with live bids ongoing for a further 15 at the end of Q1 2025, this trend looks set to continue.

“There are fewer listed companies, and the companies that remain are of lower value,” says Ivor Jones, equity analyst for Peel Hunt. This rate of departure has accelerated further recently, with the London Stock Exchange (LSE) now estimated to account for just 3% of the global equity market.

According to Statista, in February this year just 1,660 companies were trading on the LSE, a number that saw it fail to make a list of the 10 largest exchanges in a 2025 breakdown published by Visual Capitalist. Twenty years ago, the figure stood at 2,916.

“The UK is a small market and a small share of total equity value, and that has put pressure on valuations,” Jones notes.

“UK investors have been seeing higher interest rates available if they’ve got cash to invest, or higher interest rates making their mortgage more expensive. They’ve been selling UK equity, and they’ve been turning it into something else. So there’s been a constant outflow.”

What’s happening with UK public equity investment?

UK fund managers have been selling off domestic public equity holdings in response to investors redeeming their money and this has contributed to valuations remaining low.

The gaming sector has largely mirrored wider public market shrinkage, with consolidation leading to fewer listed names over time. Notably, Betfair Group was delisted from the LSE in 2016 after merging with Paddy Power, and GVC absorbed Ladbrokes Coral, after the two merged in 2017.

In the same year, 32Red was bought by Kindred Group and subsequently disappeared from the LSE. And then Evoke, known previously as 888, bought William Hill in 2021 resulting in yet another name leaving the London exchange.

Jones believes this wave of consolidation-driven M&A by listed incumbents in the UK is largely behind us. “There’s still M&A happening to some extent along the fringes of the industry,” he says. “[Although] it’s hard to imagine Entain buying Evoke.”

Private equity is another investment option

Jones points to private equity takeovers also driving consolidation. Although the UK has experienced less of this trend, in Europe, Blackstone, CVC and Apollo Global Management have dominated gaming deals and backed leading players like Superbet, Tipico and Lottomatica in Italy, over the last few years.

“Private equity has been the default buyer of lots of businesses. When you look at a business like Evoke, for example, it has about €1.8 billion in debt. That’s not an impossible transaction for a large private equity firm to buy the whole business, refinance the debt and reinvest more aggressively to make the revenue grow faster and deliver the promised profitability more quickly,” says Jones.

The PE trend in gaming has also been more prevalent in the US than the UK, with a handful of deals agreed in 2024, including Apollo acquiring suppliers IGT and Everi Holdings in a $6.3bn deal.

Frank Fantini, founder of Fantini Research, puts the wave of US PE deals down to waning valuations across gaming stocks, as the sector struggles to reach the all-time highs experienced during the Covid-19 pandemic.

Speaking to iGB’s sister publication GGB, he said, “Private equity firms can continue to move into [gaming] as they have the luxury of paying higher prices for acquisitions knowing they are free of impatient investors and can wait for their paydays.”

Easing of regulatory pressures returning UK to growth

The UK government’s decision to reform the 2005 Gambling Act rocked the industry, driving down revenue in 2021 and 2022 as operators grappled with the threat of much tighter regulations and prepared for the worst. The white paper’s release in 2023 caused another wave of panic as operators were faced with incoming affordability checks, deposit limits, online slot stakes and a statutory levy, to name a few.

In H1 2024, 888 Holdings experienced a 25% year-on-year decline in UK revenue, which it put down to proactive player protection measures initiated during the period. The group subsequently said it soon expected to return to growth, but in April of this year it reported a 1% UK revenue decline as it continued to face pressures from incoming regulations.

But player protection measures have been much softer than the white paper suggested, and operators are starting to see a slow return to growth, as the impact of these new regulations have already been absorbed. Entain hailed UK net gaming revenue growth of 22% in Q1.

This followed 13% growth across the UK&I business in Q4 2024 as the operator hailed an “earlier than expected” return to growth in the market.

UK investors are becoming more optimistic

Entain CFO Rob Wood said the turnaround effort was powered by the group addressing frictions and complexity within its UK customers’ journeys. “Those drivers enabled the UK to return to market levels of growth in H2, which in turn helped all of Entain return to market growth,” he told analysts in March. “We’re therefore already on track to deliver our targets of market growth in 2025.”

Entain’s CEO Stella David expects the group to seize UK market share from tier two and three competitors as, unlike Entain, they may struggle to absorb the costs of regulatory changes.

According to Jones, UK investors are once again optimistic about the future of the sector, but today operators with predominantly regulated revenues are not as in demand as they once were. “There was definitely a period when companies thought investors wanted a high proportion of business to be regulated, because regulated was seen to equal low risk. But the UK is a good example of that not being the case,” he says.

“That period of simply thinking regulated is superior to unregulated is gone. I think investors are more likely to make an informed view about where risk is, rather than see it through the lens of regulated or not regulated.”

Evoke and Entain have also appeared more methodical in the way they communicate with shareholders, presenting a much more medium-term investment outlook and reiterating the underlying attractiveness of the business.

Diversifying the revenue mix

Mark Segal, CEO for London-listed games provider Gaming Realms, believes diversifying the company’s geographic portfolio to improve revenue streams has helped mitigate the impact of stagnation in the UK. “We have quite a diversified revenue or revenue exposure now, because it’s multiple operators in multiple markets [using our games] and we can retain a highly efficient focused cost base. So, we’ve been able to grow our revenue year-on-year,” he tells iGB.

Gaming Realms started its life as a listed operator, with the Foxy Bingo brand under its umbrella. But on acquiring social games platform Slingo in 2015, the group pivoted to a pure-play B2B provider. Segal says shareholders responded well to the company’s transition and new investment poured in. “It’s clear investors really like the B2B model. I think they find that very attractive and that’s where we are now.”

Segal admits tightening regulations hit operators harder, while suppliers are somewhat shielded from the impact of heavy-handed player protection measures. Operators are more exposed to risk, he suggests, and that makes satisfying shareholders more difficult.

Allure of US stock exchanges

With UK valuations impacted by the wider economic environment and outflows of public liquidity, some UK and European-listed companies have relocated to US exchanges, on the promise of better access to capital. The New York Stock Exchange (NYSE) is the biggest stock exchange globally with a market cap of $36 trillion, according to Statista, followed closely by Nasdaq, also based in New York.

Shell, one of Europe’s most prominent oil and gas entities, floated the idea of switching its LSE listing to the US in 2024 as its American peers were experiencing much higher valuations. The company reiterated it was still reviewing this option in January, after its 2024 revenue declined 16% to $23.7 billion.

Another recent example is Wise, a UK-listed fintech, which announced in June that it would shift its primary listing to the US. CEO Kristo Käärmann said the US listing would enable better access to the world’s deepest and most liquid capital market.

US macroeconomic trends

US markets are rising, in response to some of the actions taken by President Donald Trump. And the online gaming sector is unlikely to be impacted by incoming tariffs, so it will remain buoyant against other sectors, which may be harder hit.

iGaming giant Flutter moved its primary listing to the NYSE in January, from Euronext Dublin, but the group maintains a secondary listing in London. In Flutter’s case, the move made sense to leverage and further support its burgeoning FanDuel business, which in 2024 accounted for 41% of total group revenue. In making this move, Flutter showed it was all in on the US opportunity, and the operator subsequently absorbed its core UK and Ireland business into the wider international arm.

“If you have a reasonable US exposure, then it makes sense to list on the US market nowadays… particularly if you view yourself as a high growth or tech company, the US market tends to value these a lot higher than the UK market,” says H2 Gaming Capital Managing Director Ed Birkin.

Did Flutter make the right move?

Jones expects Flutter is eyeing an entry onto a prominent US index, like the S&P 500. Despite a broadly positive response to Flutter’s move, equity analysts warned the company in March against its “overreliance” on the US. iGaming and sports betting growth in the market has slowed as fewer states have gone online in the last year. No new iGaming states are expected to launch this year.

In response to Flutter’s 2024 earnings, analysts Regulus Partners said in a note the operator’s increasing focus on the US “as the only recognised growth driver for the group” would likely add to the risk of black-market growth in Europe.

“Organic growth will need to be topped up with good returns on investment of their strong free cash flow – and you’d assume they can get better returns on strategic M&A than they can with share buybacks,” H2 Gambling Capital’s Birkin added.

Elsewhere, reports in May suggested UK-based private gaming group Bet365 was either eyeing a US IPO or a partial sale of its global business to a private equity firm. According to The Guardian, Bet365 conducted talks with US advisers and Wall Street banks earlier in the year.

Reviewing Bet365’s options

Although the UK remains a core market for Bet365, it has lost market share to competitors in recent years as others have advanced their technical capabilities and presented comparable bet builder offerings. A US listing makes sense if it wants to achieve the highest valuation possible and lean into the success of its US business, which continues to grow, while many of its European peers are exiting the market.

“With more trading liquidity, and the US market (and Americas in general) likely being their main growth opportunity going forward, this is a compelling story for US investors,” Birkin muses on the Stateside listing opportunity for Bet365. “A US IPO would give them a higher valuation and access to more capital than a UK listing.”

But in Birkin’s view, private equity is a better option for the betting giant as, he says, “It allows time for a change in management – assuming current management want to step back – and to accelerate growth while still a private company ahead of a US listing at some point in the future.”

The US SPAC attack

In 2022, Betway’s parent company Super Group merged with US special purpose acquisition company (SPAC) Sports Entertainment Acquisition Corp (SEAC), resulting in its listing on NYSE in 2022.

“The US as a listing venue is particularly attractive because of the sheer volume of capital available and the credibility assigned to US-listed businesses by investors, regulators and banks,” explains Super Group’s Investor Relations team.

SPACs gained popularity among sports and betting groups in the early days of legal US sports betting. They provide a vehicle for accessing public equity more quickly than through a traditional IPO. DraftKings merged with a SPAC under the name Diamond Eagle Acquisition Corp in 2019, listing on the NASDAQ in early 2020. Since then, its share price has skyrocketed almost 95%. The operator has come out fighting as part of a duopoly alongside Flutter’s FanDuel, leading the US’ online betting and iGaming sectors.

“The fact that the US market was liberalising at that point… added increased momentum among US investors who were then developing an appetite for iGaming stocks which wasn’t previously as prevalent,” says Super Group.

Although the UK has long been a core market for Super Group, its Betway brand being synonymous with English Premier League football, the opportunity for a US-listing, and its partnership with SEAC, was too good to turn down.

“We have benefitted [from the US listing] in many ways. Our profile has been raised with investors, who now understand our business and strategy better and recognise what makes us stand out. We’re also now more credible with regulators and banks than when we were privately held, and even our customers appreciate the clear message of strength and integrity that being a listed business gives us,” the IR team says of its success on the NYSE.

LSE fights back

Attempting to remedy some of the reputational damage LSE has experienced since companies started flocking to US exchanges, its parent company LSEG reported in March that London had a more geographically diverse investor base than the US. Data suggests US exchanges are supported by an 81% North American investor base, while LSE is propped up by 41% North American and 31% UK-based shareholders. European investors account for 15% of the LSE and 9% of US exchanges.

According to data collected between 2019 and 2024, meanwhile, barriers to entry for the UK are lower than the US, as LSE IPO fees are almost 1% below NYSE fees – and 2.5% lower than Nasdaq.

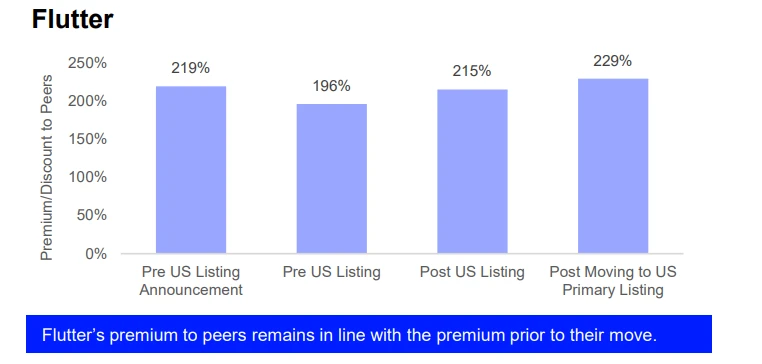

“Flutter, Ferguson, CRH and Abcam are four companies that switched from a UK primary listing to a US primary listing in recent years,” an LSE Group note stated.

“Of these, while they may have seen a small initial increase in EV/EBITDA and P/E ratios following the addition of the US listing, any improvements have largely reverted after switching to a ‘primary’ US listing. When comparing to US-listed peers, any valuation gaps have not significantly changed upon addition of a US listing.

“Movements seen in discounts or premiums to peers have largely been moderate, suggesting any changes in valuation are due to industry trends rather than the change in listing.”

Tax burden for UK listed operators

Although UK incumbents are starting to see green shoots after a difficult period, the market could be facing additional pressures from a government review of the current remote gambling tax model, which sees betting taxed at 15% of operator profits and iGaming at 21%.

Stakeholders are worried the government could increase remote betting tax to come in line with iGaming under a new consolidated structure, and that would likely hit operators quite hard. An update on the process is expected in the Autumn Budget.

The market is increasingly being compared to Germany and the Netherlands, where player restrictions and increased tax rates are stifling the industry. Valuations and share prices in the UK reflect increasing market risks and ultimately, according to Jones, the UK is “feeling flattish”.

“Equity investing is about evaluating risk and, most importantly, paying the right price for it,” he says. “Gaming has been disappointing in terms of the balance of risk, and that’s the best way to put it.”

While the market’s remaining listed companies don’t look set to leave any time soon, methods to appease investors outside of improving UK performance are becoming more common, including diversifying their geographic reach, while reasons to remain listed in the UK are becoming less so.