Waterhouse VC: Suddenly we have a convergence of betting and investing

“The market is a racetrack too. But I was not developing elaborate theories in those days. I was just a little kid.” – Warren Buffett (Neckar Substack)

World-renowned investor Warren Buffett (chairman and CEO of Berkshire Hathaway) and numerous other famous investors were initially influenced by betting and bookmaking (particularly horse racing) before transitioning to financial markets.

The new wave of professional bettors is now finding success in financial markets as well, with significant crossover in the statistical analysis and thought processes applied across the two domains. For example, one prominent framework utilised by both investment firms and professional betting syndicates is the Kelly Criterion. Furthermore, in both betting and investing, the impact of decision-making biases and human psychology is critically important.

Warren Buffett

“You could get old racing forms… I would go through them using my handicapping techniques to handicap one day and see the next day how it worked out. I ran tests of my handicapping ability – day after day.” – Warren Buffett (Neckar Substack)

One may expect these to be the words of a professional bettor but they are in fact from Buffett. Few people know that much of Buffett’s formative years were significantly influenced by horse racing. He fervently assessed the Daily Racing Form and, having figured out the probability of each horse winning a race, he even did some of his own bookmaking at the Preakness Stakes in Baltimore. Through betting, Buffett learned several important investing lessons, including:

- “You’re not supposed to bet every race” (Maiden King). When applied to investing, this could be interpreted as there being no need to always actively invest and that it is sometimes best to do nothing.

- “You don’t have to make it back the way you lost it” (Maiden King). When applied to investing, this could be interpreted as the need to pivot investment strategies according to market conditions.

Jeff Yaas

“If you’re the sixth-best poker player in the world and you play with the five best players, you’re going to lose… If your skills are only average, but you play against weak opponents, you’re going to win.” – Jeff Yass (ProPublica)

Jeff Yass (co-founder of trading firm Susquehanna International Group) said the above when asked to describe Susquehanna’s trading strategy. In 1985, Yass and a couple of friends bet at a track outside Chicago using analysis from a Compaq computer. With the assistance of a statistician who had worked for NASA on the moon landing, they bet $160,000 across tens of thousands of wagers to get the exact order of seven horses in three races. This won them $760,000, which was then the largest win in American racing history (ProPublica). The win was never honoured although Yass went on to make $28.5bn through Susquehanna (Forbes).

Similarly to Susquehanna, the world’s largest betting syndicates have turned their attention to financial markets, trading equities, FX and derivatives. For example, one of the world’s largest betting syndicates is now trading $40bn a week on FX.

On the flip side, prominent international investment firms like Susquehanna are also applying their expertise to professional betting. In 2017, Susquehanna launched Nellie Analytics, based in Dublin, with a specific focus on sports betting. In 2022, Susquehanna acquired a 12.8% equity stake in PointsBet, creating an opportunity for Nellie Analytics to explore a partnership in delivering sports analytics and quantitative modelling services to PointsBet.

Mohnish Pabrai

“Investing is just like gambling. It’s all about the odds. Looking out for mispriced betting opportunities and betting heavily when the odds are overwhelmingly in your favour is the ticket to wealth.” – Mohnish Pabrai (The Dhandho Investor)

Mohnish Pabrai (founder of Pabrai Funds) is a fervent follower of Warren Buffett and Charlie Munger. He published a thorough framework for value investing called The Dhandho Investor (Dhandho is a Gujarati word that translates as “endeavours that create wealth”). There are numerous key ideas explained through betting analogies in Pabrai’s book. For example, he believes that the best way to increase returns and reduce risk is by making “Few bets, big bets (and) infrequent bets” (The Dhandho Investor). He often relates betting analogies to the Kelly Criterion (below), which is regularly applied to both professional betting and investing.

The Kelly Criterion

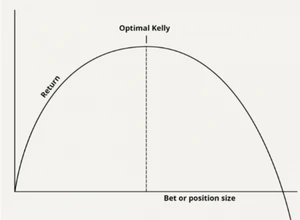

The Kelly Criterion was originally developed by John Kelly in 1956 to assess long-distance telephone signal noise. It now assists investors and bettors in determining the optimal diversification of a portfolio/bankroll by calculating the proportion of money that should be allocated to every individual investment or bet. This proportion is the “K%” in the above formula.

For example, in investing, if the K% is 0.125, then a portfolio should be 12.5% invested in each stock in the portfolio, effectively telling the investor how many positions to take. Of course, if you have a negative winning probability, “W”, there is no optimal Kelly percentage.

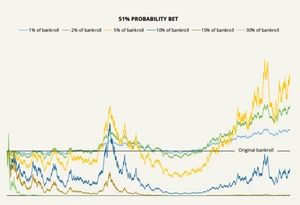

As shown below, position sizing is incredibly important in both betting and investing. If you have a bet with a 51% probability of winning and invest 5% of your money/bankroll each time, you will achieve a very different outcome to if you invest 10%. Minor changes to the percentage invested will ultimately make the difference between success and “gambler’s ruin”.

The Kelly Criterion is the solution to gambler’s ruin, whereby bets/investments are determined as a proportion of bankroll rather than as fixed dollar amounts, such that a person bets/invests less as their bankroll falls and bets/invests more as their bankroll rises.

The Kelly Criterion has been used by some of the world’s most famous investors, including Warren Buffett and Mohnish Pabrai. Bill Miller outperformed the market for 15 years at Legg Mason and has been a vocal proponent of Kelly. Ed Thorp, who returned 20% per annum for 30 years, said of the Kelly Criterion, “Success leaves clues” (ValueWalk).

Thorp also pointed out that Warren Buffett’s investing is consistent with the Kelly Criterion:

“He (Buffett) and his associate Charlie Munger, when managing $200m, put most of it into just five or so positions. Sometimes he was willing to bet 75% of his fortune on a single investment. Investing heavily in extremely favourable situations is characteristic of a Kelly bettor.” – Ed Thorp (A Man for All Markets: From Las Vegas to Wall Street, How I Beat the Dealer and the Market)

Betting on tennis betting

As mentioned in our April newsletter, on 1 July, Waterhouse VC will make an investment in Tom Dry’s professional betting syndicate. With a little help from the Kelly Criterion, Tom’s operational metrics are very impressive. Tom has developed a unique specialisation in tennis, which is much easier to leverage than multiple sports. We believe that his edge in tennis betting would be difficult to replicate due to the quantity of proprietary historical data he possesses and the factors that he applies to his model.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

(main image: wilhei/Pixabay)

DISCLAIMER AND IMPORTANT NOTES

The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD1,000,000 or USD/EUR/GBP/JPY /CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.

.