Kalshi again halted from election betting after appeals court stay

A three-judge panel from the US Court of Appeals for the District of Columbia Circuit granted a stay at about 8.30pm on Thursday at the request of the Commodity Futures Trading Commission (CFTC). The CFTC, a federal regulator for derivative markets, argues Kalshi’s political ‘predictive contracts’ are a national security threat.

The stay is the latest ruling in Kalshiex LLC vs CFTC. The case was originally filed last November.

As of Friday afternoon, Kalshi was not taking trades on the contracts, which had a $100m (£76.2m/ €90.2m) limit. The appeals court could rule as soon as Monday (16 September). It could reverse the stay or decide to review the case further. If the contracts are held up in court, that could take until after the 5 November US elections, thereby rendering them void.

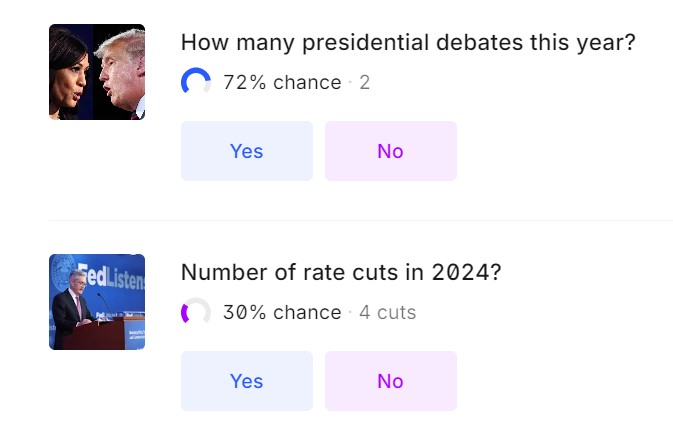

The futures in question relate to which party would win control of either the house or senate. But there are still other politically adjacent contracts offered by the New York-based exchange. As of Friday, the company’s site was offering trading on the number of presidential debates and the number of interest rate cuts from the Fed.

Stay came after district court sided with Kalshi

The appeals court’s ruling came hours after a district court ruling allowed Kalshi to offer the contracts. The CFTC previously blocked the futures, citing its authority to prohibit derivatives involving unlawful activity or gaming.

Judge Jia Cobb from the US District Court for the District of Columbia previously ruled that the regulator “exceeded its statutory authority” in halting the exchange.

“Although the court acknowledges the CFTC’s concern that allowing the public to trade on the outcome of elections threatens the public interest, this court has no occasion to consider that argument,” Cobb wrote. “This case is not about whether the Ccourt likes Kalshi’s product or thinks trading it is a good idea. The court’s only task is to determine what Congress did, not what it could do or should do. And congress did not authorise the CFTC to conduct the public interest review it conducted here.”

It is unclear how much money Kalshi accepted on contracts before halting trading. It is also unclear how those contracts will be adjudicated, especially if they are ruled illegal. When trading was still live, Kalshi co-founder Tarek Mansour told the Associated Press that the company was “only getting started”.

“Now is finally the time to allow these markets to show the world just how powerful they are at providing signal amid the noise and giving us more truth about what the future holds,” Mansour said.