Waterhouse VC: Not too hot, not too cold, just right

As with Goldilocks and porridge, so it is with gambling regulation/taxation. If it is too severe or too lax then Goldilocks will not participate in the regulated gambling industry.

Balancing gambling regulation/taxation is crucial to ensure a harmony between safeguarding consumers, thwarting criminal activities and cultivating a market that is both fair and competitive. A well-crafted regulatory framework effectively considers the interests of betting operators, consumers and the broader community.

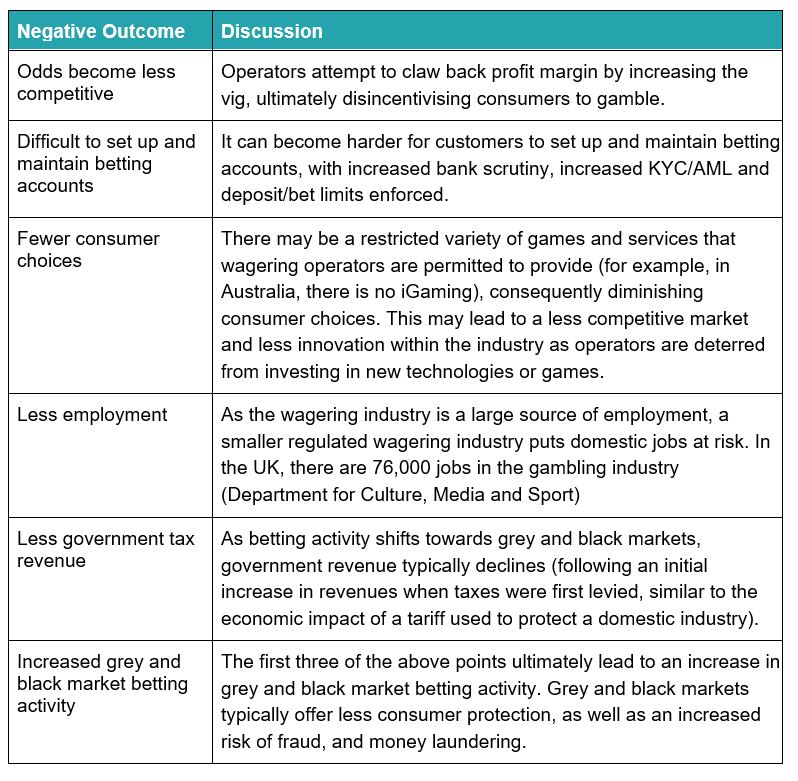

If regulation/taxation is too severe then the following negative outcomes can occur:

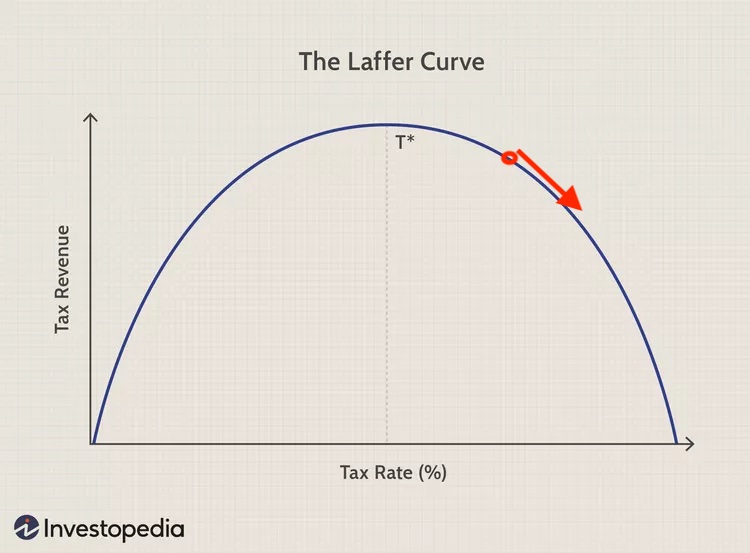

Laffer Curve

Focusing particularly on government tax revenues from wagering, the Laffer Curve illustrates the relationship between tax rates and government revenue. This suggests that there is an optimal tax rate at which government revenue is maximised. In the 1980s, the Reagan administration used the Laffer Curve as a rationale for implementing tax cuts.

Beyond the optimal tax rate, increasing tax rates may decrease tax revenue due to economic activity being disincentivised. When applied to the wagering industry, the Laffer Curve demonstrates that there is a point of maximum taxation at which it becomes no longer worthwhile to operate a regulated wagering business.

On the other hand, if tax rates on wagering are too low, the government may not collect as much revenue. This revenue is required to cover the regulatory and social costs associated with wagering.

Unlike other industries, if taxes are too high in the gambling industry, consumers are driven towards unregulated or illegal wagering operators, where consumer protection is not as stringent.

A blow for legal gambling

Demand for betting has not dropped as taxation has increased. Consumers have simply sought other ways to bet, such as through offshore bookmakers, often licensed in jurisdictions such as Curaçao.

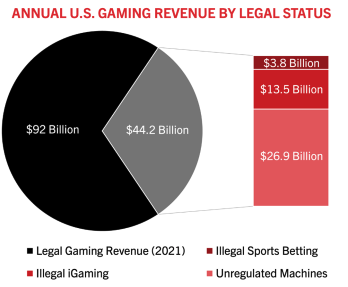

According to the American Gaming Association’s 2022 study “Sizing the Illegal and Unregulated Gaming Markets in the United States”, it is estimated that Americans bet $510.9bn annually with illegal and unregulated operators.

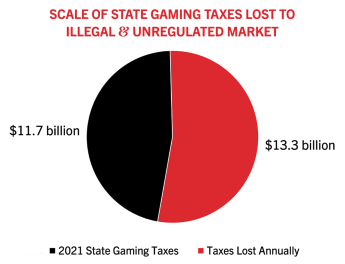

This results in a $44.2bn loss in gaming revenue for the legal betting industry. It also brings a $13.3bn decrease in tax revenue for state governments.

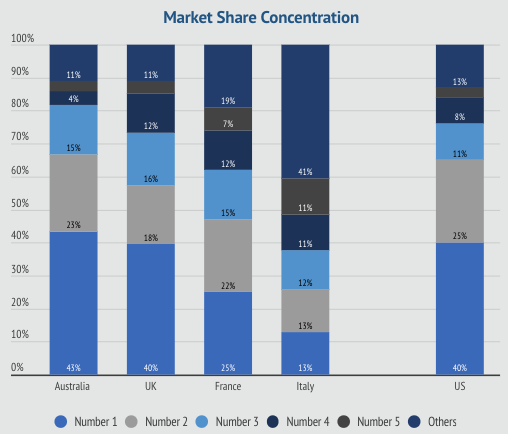

Market sharing among few

Increased taxes create barriers to entry for new and smaller operators, while progressively squeezing out less competitive operators. Larger operators benefit from economies of scale, with operational costs, marketing and overheads spread across a large customer base.

In most regulated wagering markets, the majority of market share is split among a handful of operators.

This negatively impacts consumer choice and, ultimately, the consumer’s betting experience. This is because there is less pressure on operators to innovate and compete to retain customers.

In Australia, just one operator (Sportsbet, which is owned by Flutter Entertainment) has 41% market share. And in Australia, the UK and France, the largest three operators collectively have over 60% market share. In the US, the largest three operators have 76% market share. These are FanDuel (owned by Flutter Entertainment), DraftKings and BetMGM.

Trickling down

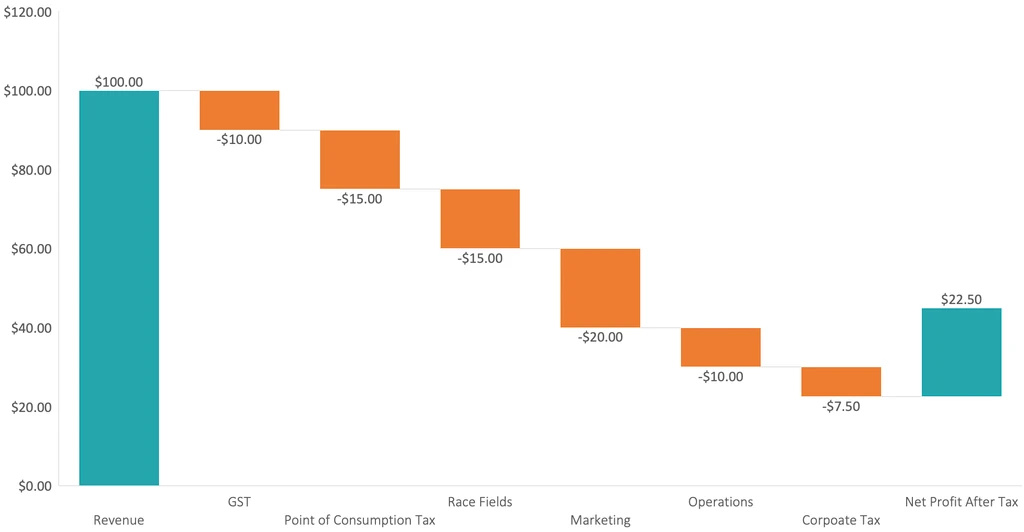

When looking at the Australian market, a general waterfall from revenue down to net profit for a large-scale operator would include:

- GST – 10% of revenue

- Point of Consumption Tax – 15% of revenue (this varies by state – in New South Wales, it is 15%)

- Race Fields Fee – 15% of revenue (estimate extrapolated from 1.5%-2% fees on turnover)

A scale operator could feasibly spend 20% of revenue on marketing and 10% of revenue on operations. After corporate tax, this leaves a net profit after tax margin of 22.5%. In total, in this theoretical scenario, $47.50 in every $100 of betting revenue goes towards some form of tax.

Scale and operational leverage are achieved when marketing and operational costs form a smaller part of revenue, with cost efficiency and increased profit margins as fixed costs are spread over more customers.

For operators that spend a large amount of money as a percentage of revenue on marketing and operations, it is not viable to operate in Australia.

In Sportsbet’s most recent quarterly results, Flutter said: “The market is also experiencing increased regulatory oversight, including a ban on credit card deposits.” The proposed credit card deposit ban in Australia exemplifies the other regulatory measures outside of taxation that are available to regulators.

Losing greys

Betting markets are typically split into three buckets: “white” (regulatory framework is well-defined, such as the United Kingdom), “grey” (regulatory framework is unclear, ambiguous or varies between states, such as India) and “black” (regulatory framework consists of strict laws against betting, such as Saudi Arabia).

We believe that the number of grey markets will shrink over time. We also think there will be a clear split between white and black markets.

When investing in the wagering industry, our focus is on businesses that are well-equipped to navigate regulatory challenges. One of those survival tools is scale. Another is investing in the infrastructure of wagering rather than the operators themselves – Waterhouse VC directs its efforts towards this B2B infrastructure.

When evaluating opportunities for the fund, we seek businesses that not only survive but also thrive under the pressures of taxation and regulation.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 2,439% as at 31 October 2023, assuming the reinvestment of all distributions. For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.