Affiliates and operators – a relationship of convenience

Affiliate marketing pays external publishers to generate traffic/leads for them. There are two main revenue models for wagering affiliates: revenue share and cost per acquisition (CPA).

Under a revenue share arrangement, the affiliate receives a long-term trailing commission that is a percentage of the gross losses of the referred customer. The CPA model involves just a one-time payment per customer. Generally, a customer acquired through an affiliate is recognised only once they have made a deposit, effectively aligning incentives between affiliates and operators.

Affiliates are often characterised as a “necessary evil” in many industries, as they can be an effective acquisition channel, but come at the cost of control.

In our experience, they are a critical channel for emerging wagering markets like the US. In mature markets like Europe and Australia, affiliate marketing is not a growing revenue opportunity. Consequently, we are currently focused on affiliates that are well-positioned to grow in the burgeoning US market.

In the US, operators are competing to land grab and acquire as many customers as possible. Operators in the US, big and small, have been spending up to $1,000 to acquire a customer in their pursuit of crucial market share. However, marketing budgets are now coming under serious pressure.

As the cost of capital and the importance of profitability have increased, operators are far less willing to overpay for customers without clarity on their lifetime values.

As discussed in our last column, multiple US-only operators, such as Churchill Downs and Wynn Resorts, have rapidly reduced their marketing activities, with a stronger focus on profitability. Despite this headwind, affiliates are well-positioned to generate significant earnings from their US operations.

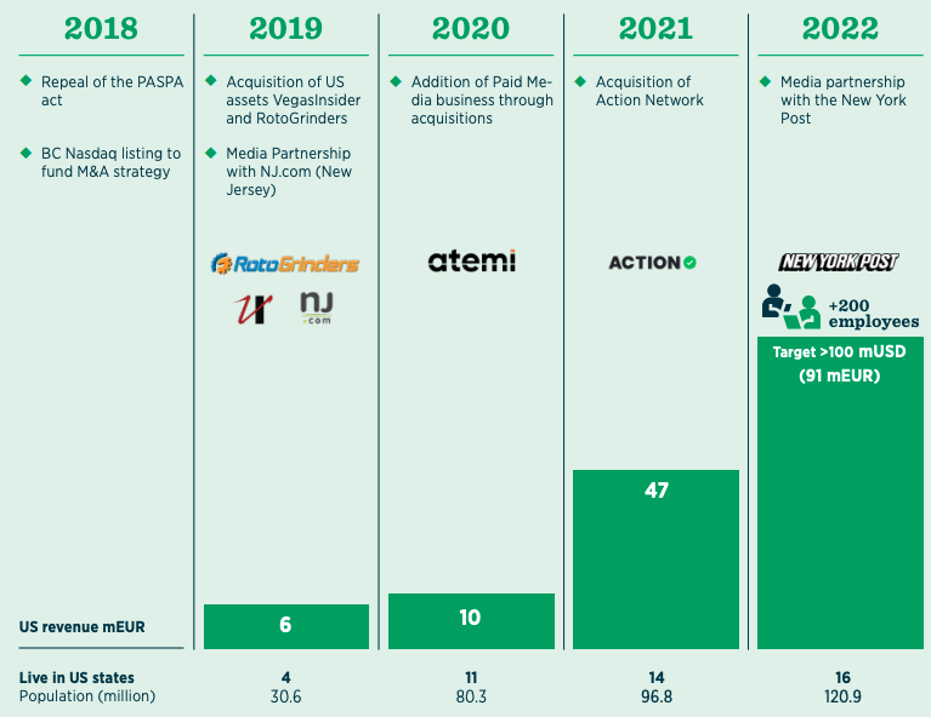

Better Collective

With 2,000+ content sites and applications, Denmark-based Better Collective (BETCO:SS) is an industry-leading affiliate. Over the last 18 years, Better Collective has won over 250 operator clients (including Bet365, FanDuel and Coral), which market their brands through Better Collective’s website portfolio, leveraging the company’s more than 65 million monthly visitors across all sites.

Better Collective is the largest listed affiliate, with a valuation of $760m. It generates circa $280m per year in revenue, with the US already contributing 46% of this total, demonstrating the size of the opportunity stateside.

The company’s US business grew revenue and EBITDA by 435% and 469% respectively in the first quarter of this year. As the US has a slow state-by-state roll out, we believe that US affiliates will be very successful over the next five years, depending on the pace of legalisation.

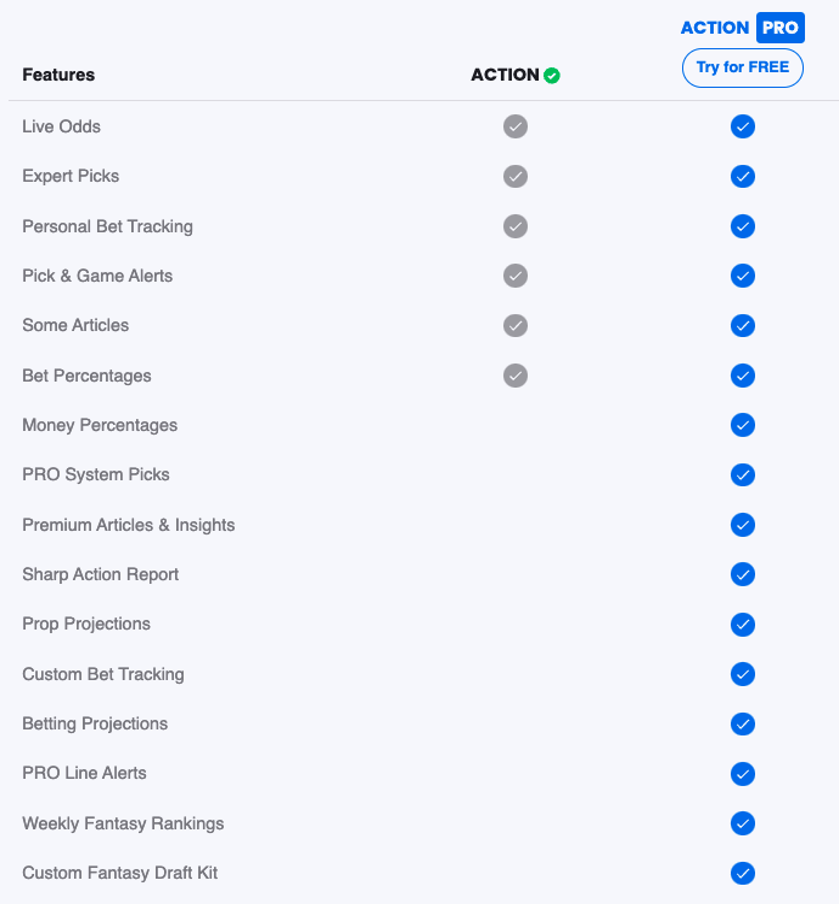

Niche audiences in each US state will be particularly valuable assets in future M&A activity once the US market matures. We are confident that targeted media channels, such as podcasts, newsletters and radio shows will be crucial acquisition tools for operators looking to develop niche audiences. We already see affiliates like Better Collective focusing on such opportunities, exemplified by their May 2021 $240 million acquisition of The Action Network, which has various podcasts and a daily newsletter. Launched in 2018, The Action Network’s media platforms primarily provide sports news, insights, odds and proprietary betting tools and data. The company also has subscription products, such as Action Pro.

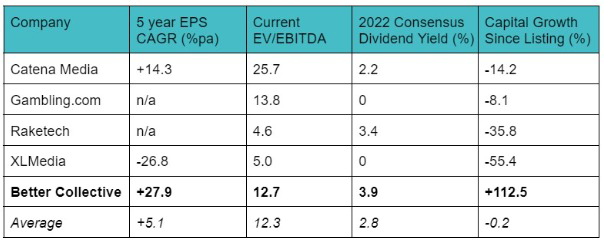

Better Collective is still led by its founders, Jesper Søgaard (CEO) and Christian Kirk Rasmussen (COO), who each own 19.4% of the company. We are impressed by Better Collective’s management, who have completed 27 acquisitions since 2017. Despite the execution risk associated with an M&A-heavy strategy, the company’s adjusted earnings per share (EPS) have grown from $0.28 in 2017 to $0.67 in 2021, an industry-leading compound annual growth rate of 24.5%.

Within its peer group of publicly listed affiliates, Better Collective is the only business which has generated a positive capital return for investors since listing. The company is led by a well-aligned and proven management team, which is focused on growth despite operating in a relatively mature industry.

Since inception in August 2019, Waterhouse VC has achieved a total return of 1,874% as at 30 June 2022, assuming the reinvestment of all distributions. See our long-term performance table below.

Please note the above information in relation to Catena Media, Gambling.com, Raketech, XLMedia, Better Collective, Churchill Downs and Wynn Resorts is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Better Collective. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.