Waterhouse VC: Spreading to the subcontinent

India’s online wagering market is growing at a rate of over 20% annually (Sportskeeda) and has become an attractive market for global operators and B2B suppliers due to the country’s rapid development – GDP per capita has doubled since 2009 – and the presence of over 370 million bettors (MyBetting India).

The Indian cricket wagering industry alone is estimated to already be worth US$150bn (£122.32bn/€139.30bn), with around 85% of Indian bettors wagering on the sport (GiiResearch). In India, cricket’s major wagering events are the Indian Premier League and ICC Men’s T20.

One example of a dominant fantasy sports business is Dream11, which offers fantasy cricket, football, basketball and hockey, among numerous other sports.

With a staggering 160 million active users, the company’s valuation reached an impressive $8bn in November 2021, earning the title of India’s first fantasy sports unicorn in 2019. Dream11 was founded in 2008 and had just two million active users in 2016. The company’s exponential growth to 160 million users underscores the tremendous potential of the Indian market.

There are only three Indian states that have officially legalised wagering: Daman, Goa and Sikkim.

Since the Information Technology Act (2000) does not cover online wagering activities and India’s original wagering legislation, the Public Gaming Act (1867), predates online wagering by over 100 years, the legal status of wagering in India remains grey.

However, the government has recognised the potential tax revenue that the burgeoning middle class interest in wagering represents, and is considering a new gaming bill to replace the Public Gaming Act.

Junglee Games

Popular casino games in India include traditional games like blackjack, poker, roulette and slots, as well as two local games: Teen Patti and Andar Bahar.

Some of the largest operators have developed businesses in India, including Bet365 and Betway (owned by Super Group). Global operators are keen to cater to popular local games and, in 2021, Flutter invested in Junglee Games, an Indian gaming business focused on rummy, a card game that has been played in India for over 400 years.

Junglee Games, which is 57.3% owned by Flutter, operates market-leading skill games across desktop and mobile in India, with its flagship product, Junglee Rummy, being one of the largest rummy brands in the world.

In 2022, Junglee grew its average monthly players by 78% to over 50 million players and Flutter sees potential in leveraging its global scale and operational expertise to expand the company’s product offering, including its recently launched DFS (daily fantasy sports) product. Flutter has an option to buy all of Junglee Games by 2025.

Junglee exemplifies Flutter’s broader strategy of building international leadership positions both organically and through acquisition. Flutter’s other recent acquisitions include:

- Adjarabet (2019) – the leading operator in Georgia, with a strong presence in Armenia

- Sisal (2022) – the largest operator in Italy

- Tombola (2022) – the premier UK online bingo operator

Back to B2B business

We believe that an operator’s profitability is highly dependent on their customer acquisition cost (CAC), and a handful of scale operators earn the majority of profits in most markets because they have the lowest CAC and the best operational efficiencies.

Flutter is our only publicly listed B2C investment and has strongly outperformed its peer group over the past 12 months (+64% performance compared to -19.5% median performance of peers), as of 3 March 2023.

In spite of the growth potential in the Indian wagering industry, there are also several challenges that operators will need to navigate. One major challenge is the lack of regulatory clarity in the market, which creates uncertainty for operators and investors. The Indian government’s new gaming bill creates a risk that operators could face regulatory crackdowns or changes in the regulatory environment that could impact their business.

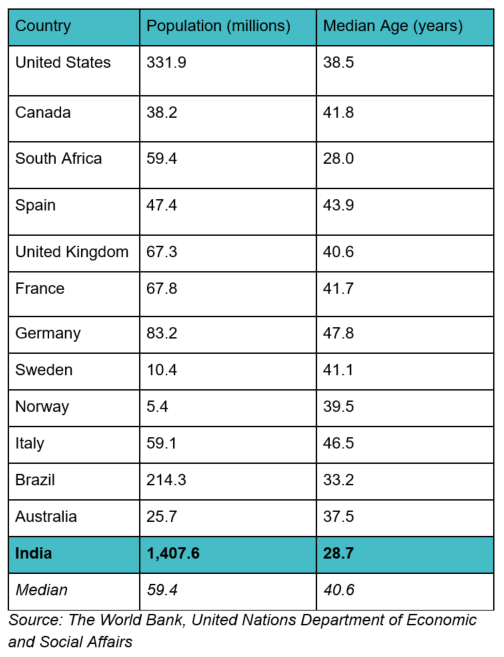

Despite this uncertainty, the Indian wagering industry represents a significant opportunity for operators and B2B suppliers able to navigate the market successfully. With a population of over 1.3 billion people and a rapidly growing middle class, there is significant demand for online wagering and gaming services.

As the Indian government moves towards regulating the industry, there will be even greater opportunities for operators and suppliers to establish themselves in the market and capture a share of the growing revenue opportunity.

Media

In February, I contributed to iGB’s article, “Predictions: The Investment Climate in 2023”, where I discussed how the macroeconomic environment and access to funding has changed for the wagering industry. I also discussed the industry’s potentially overhyped products.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Flutter, Bet365, Betway and Super Group is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.