Optimove iGaming Pulse – October 2020

October was quite the month for the sports betting vertical, with sports fans worldwide spoilt for choice as both the NBA and MLB finals took place.

It was a great month specifically for the city of Los Angeles as the LA Dodgers won the 2020 World Series and the LA Lakers won the 2020 NBA Championships.

In addition, matches continued in the UEFA Champions league, with many exciting games on the agenda for sports fans and bettors.

We detail below how these affected sports KPIs and also explore whether casino KPIs were impacted in any way.

Sports KPIs

The average deposit amount decreased by 13% month-on-month and by 6% year-on-year, rising to €33 per player.

Monthly deposits

The average number of monthly deposits for sports bettors remained the same month-on-month and increased by 5% year-on-year.

Net gaming revenue per player

There was an increase in the average revenue per active player during October, with revenue up 5% month-on-month and 33% year-on-year to €88 per player.

In Canada, we saw an increase of 35% in monthly revenue per player – this was perhaps due to Canadian players betting on MLB games as there are many baseball fans in the country.

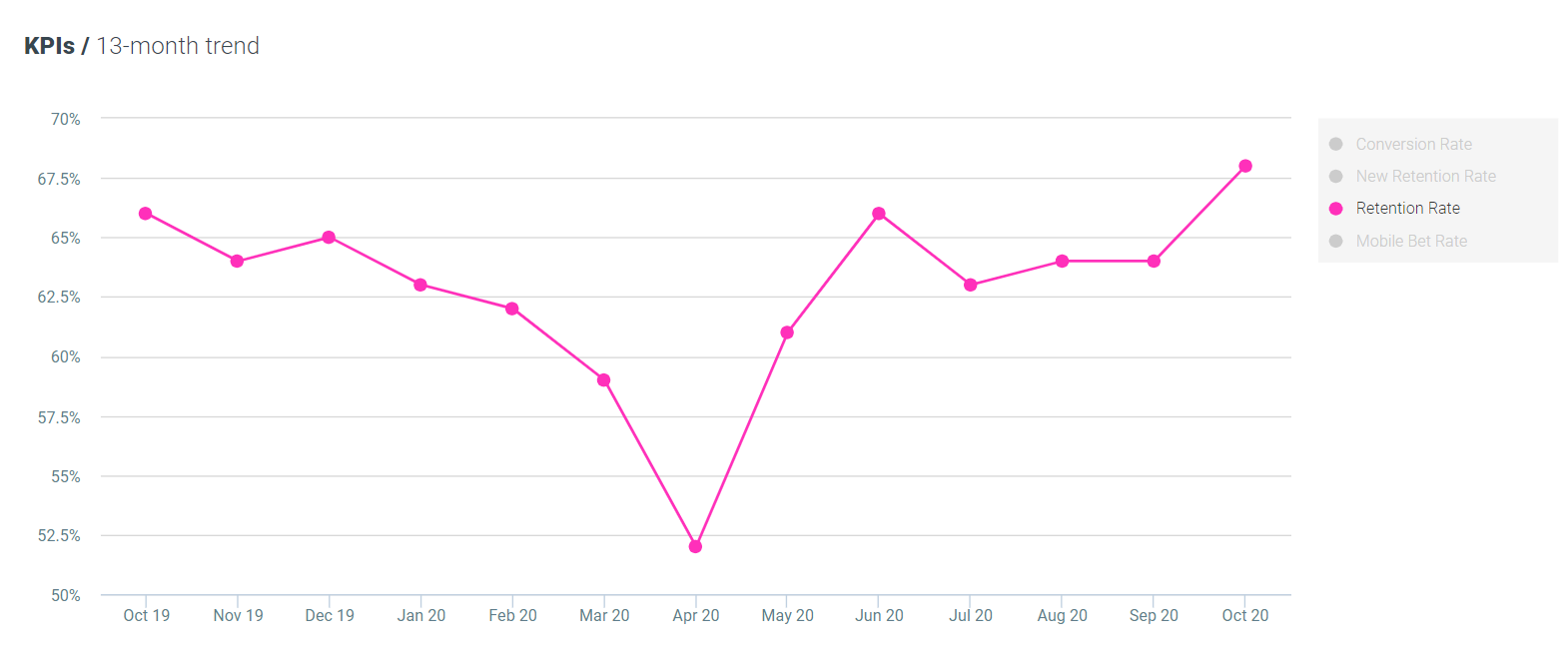

Retention rates

Retention rates for sports bettors increased in October, by 2% month-on-month and by 8% year-on-year.

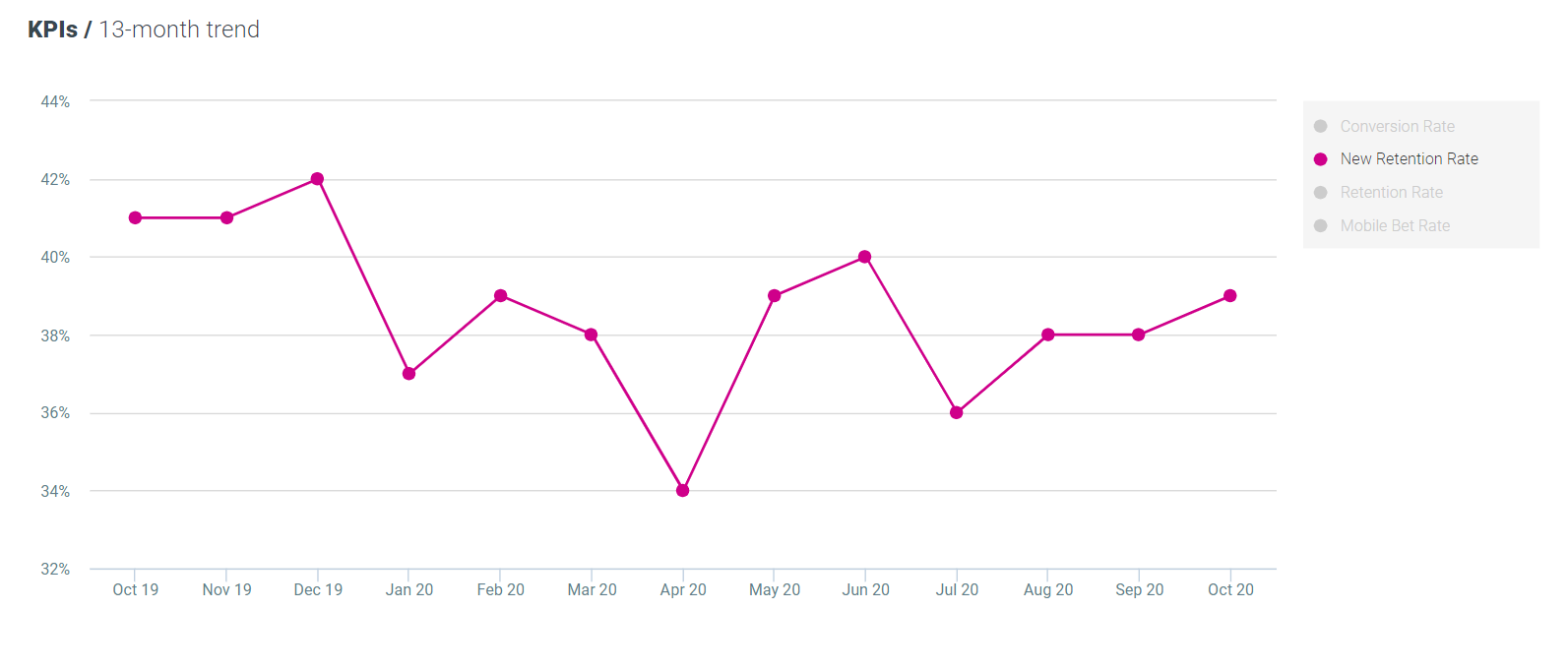

New retention rates

This KPI shows the number of players who made their first deposit in September and remained active in October.

Last month, new retention rates increased by 3% month-on-month. It is likely that the many sporting events that took place in October kept September’s new players active and entertained, with plenty of games to bet on.

However, while up on the previous month, new retention rates were down 5% on a year-on-year basis.

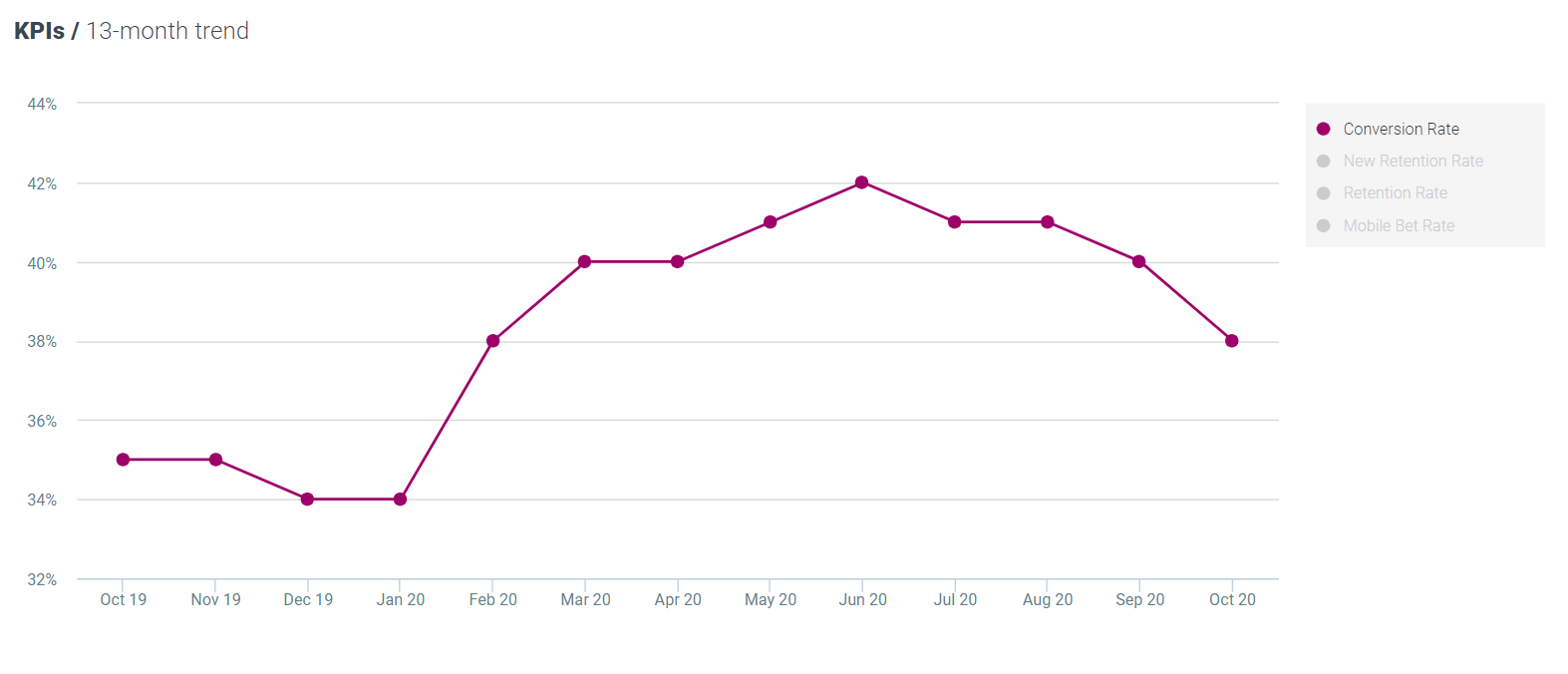

Conversion rates

Conversion rates increased by 2% month-on-month and by 8% year-on-year, rising to 43%.

Casino KPIs

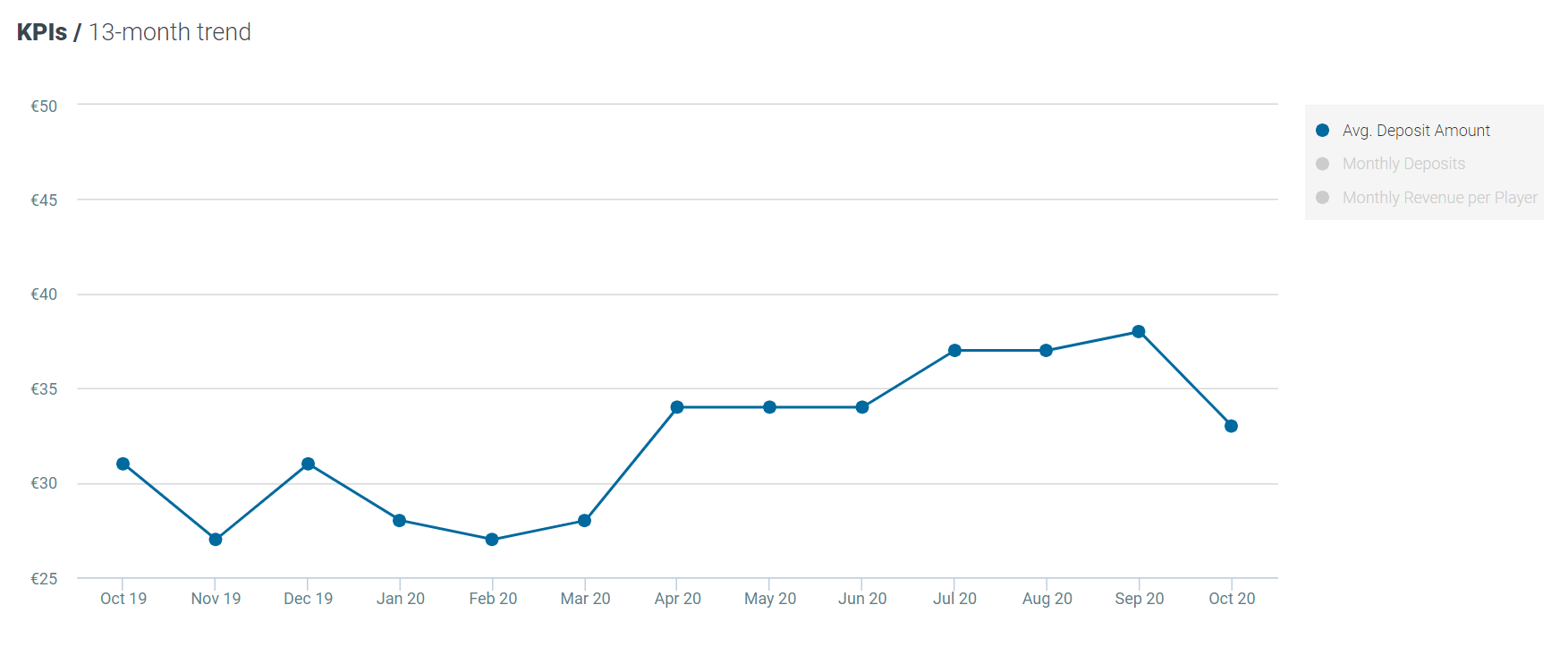

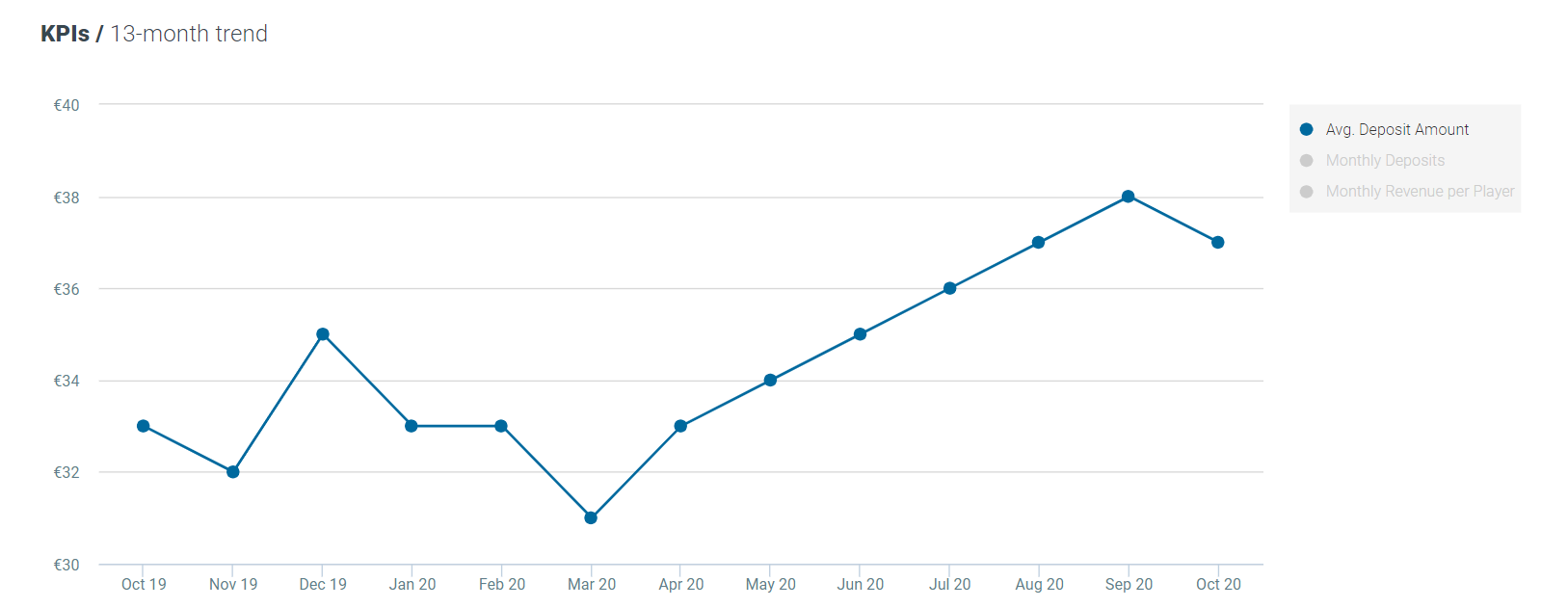

Average deposit amount

The average deposit amount for casino players decreased by 3% month-on-month but increased by 12% year-on-year to €37.

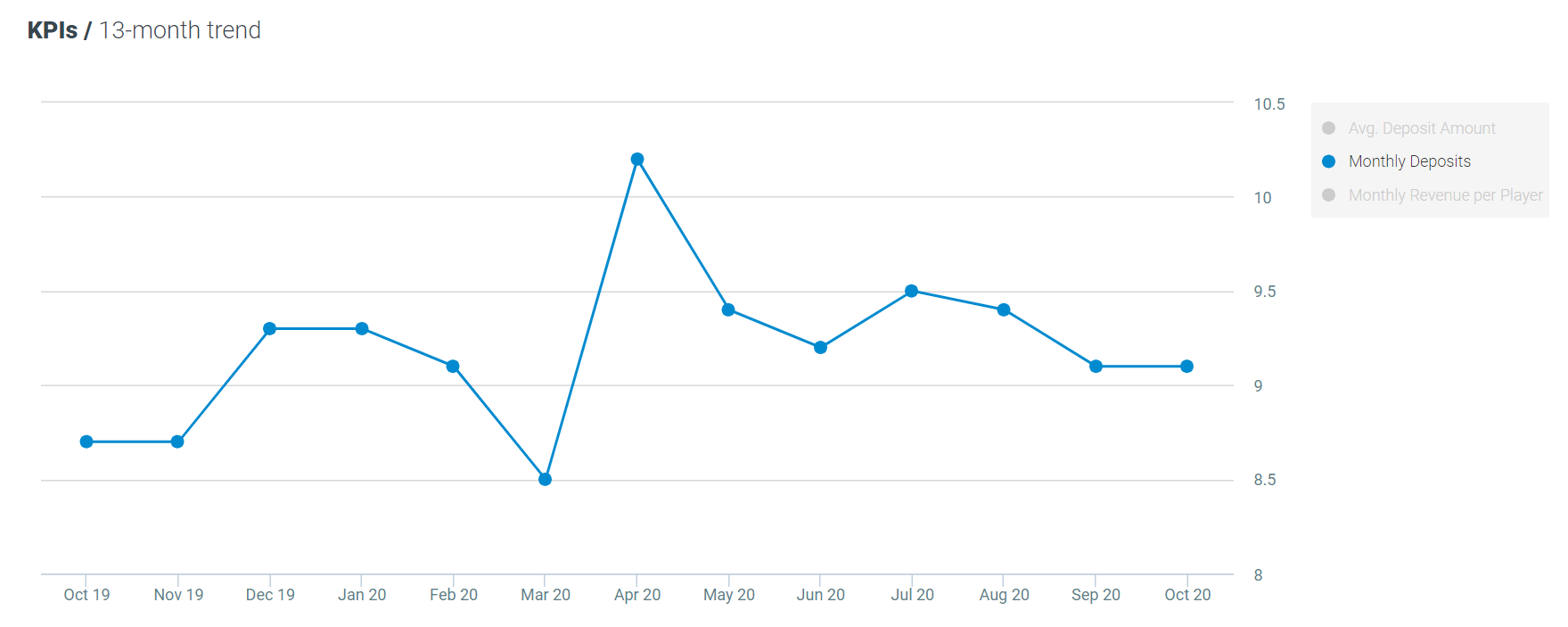

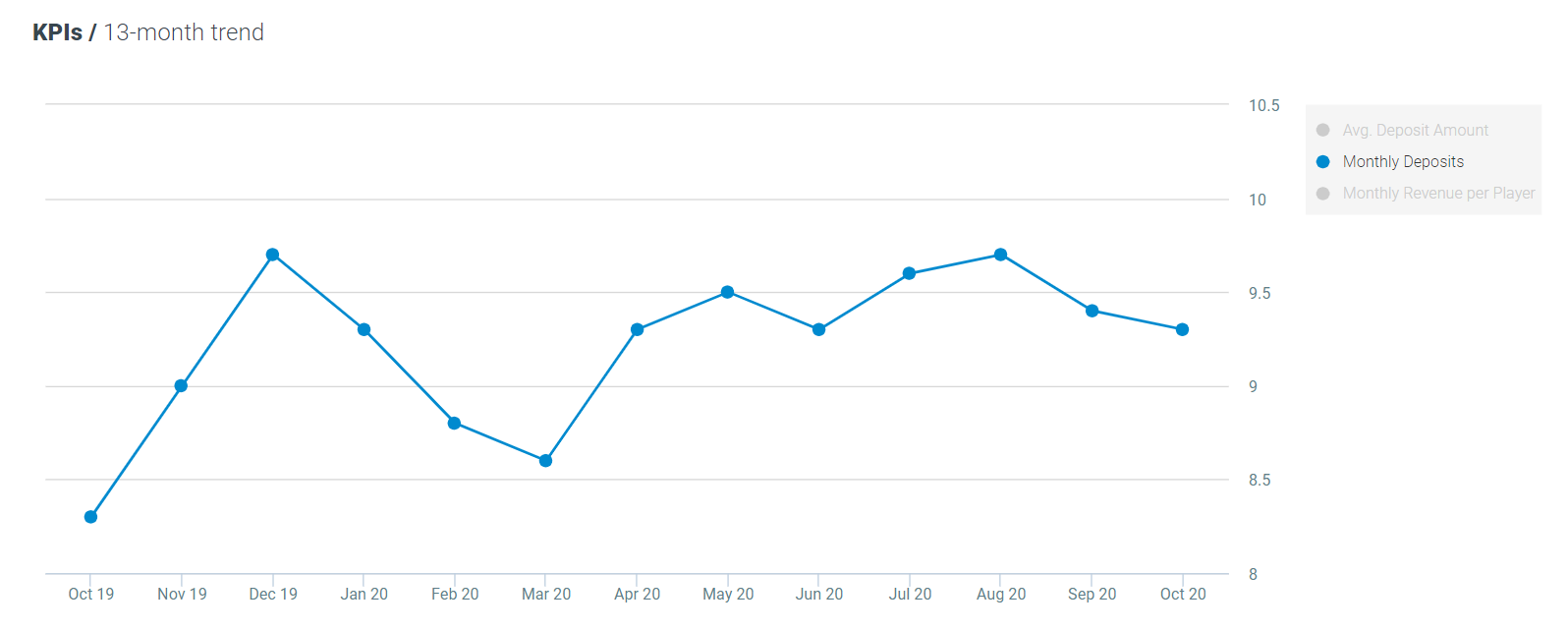

Monthly deposit per player

The average number of monthly deposits per player in October slightly decreased, falling by 1% month-on-month to 9.3 deposits per player. This represented a 12% year-on-year increase.

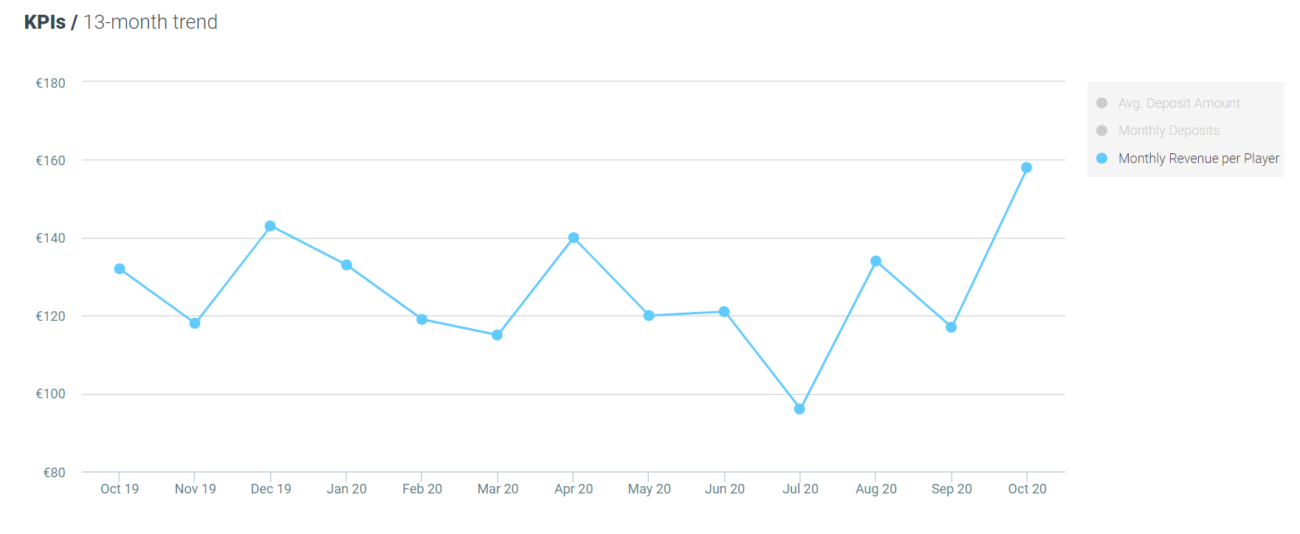

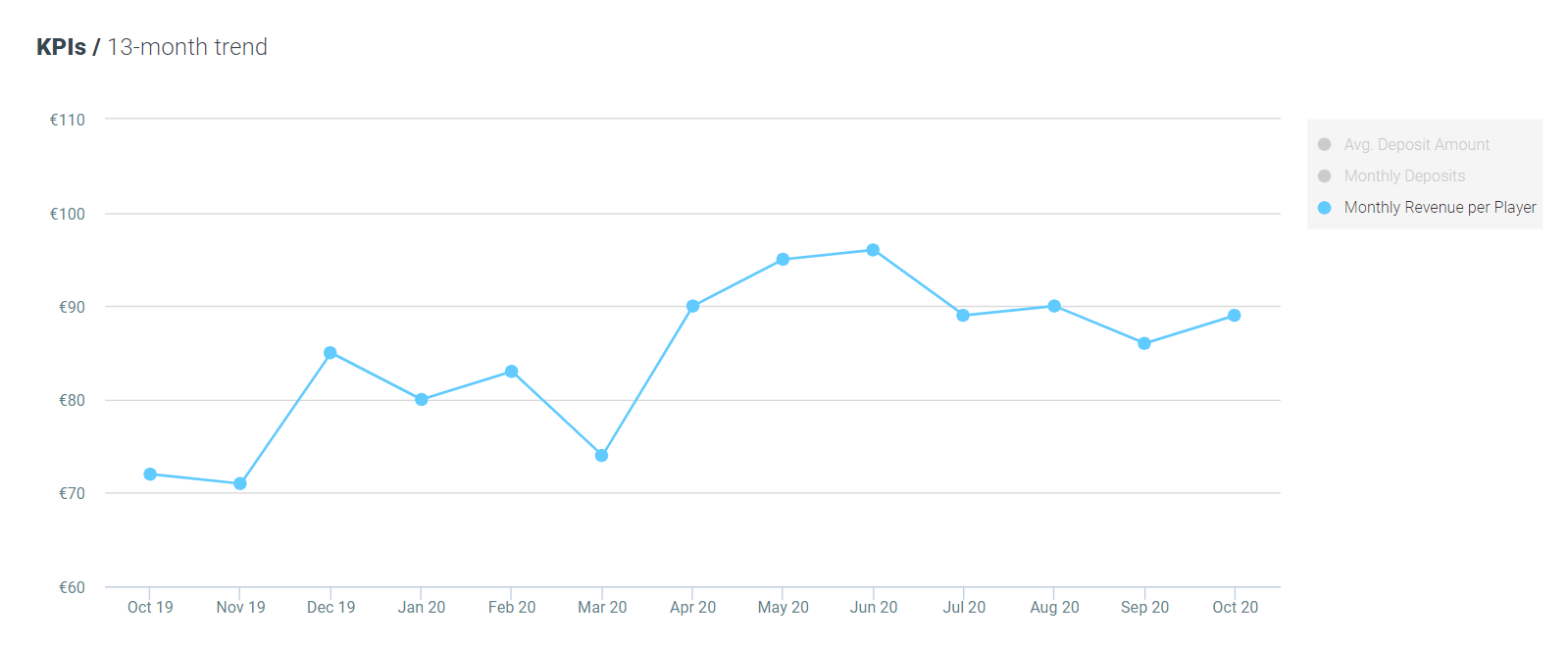

Monthly revenue

The average net gaming revenue per active player increased slightly in October, by 3% month-on-month, but increased dramatically on a year-on-year basis, rising by 24%.

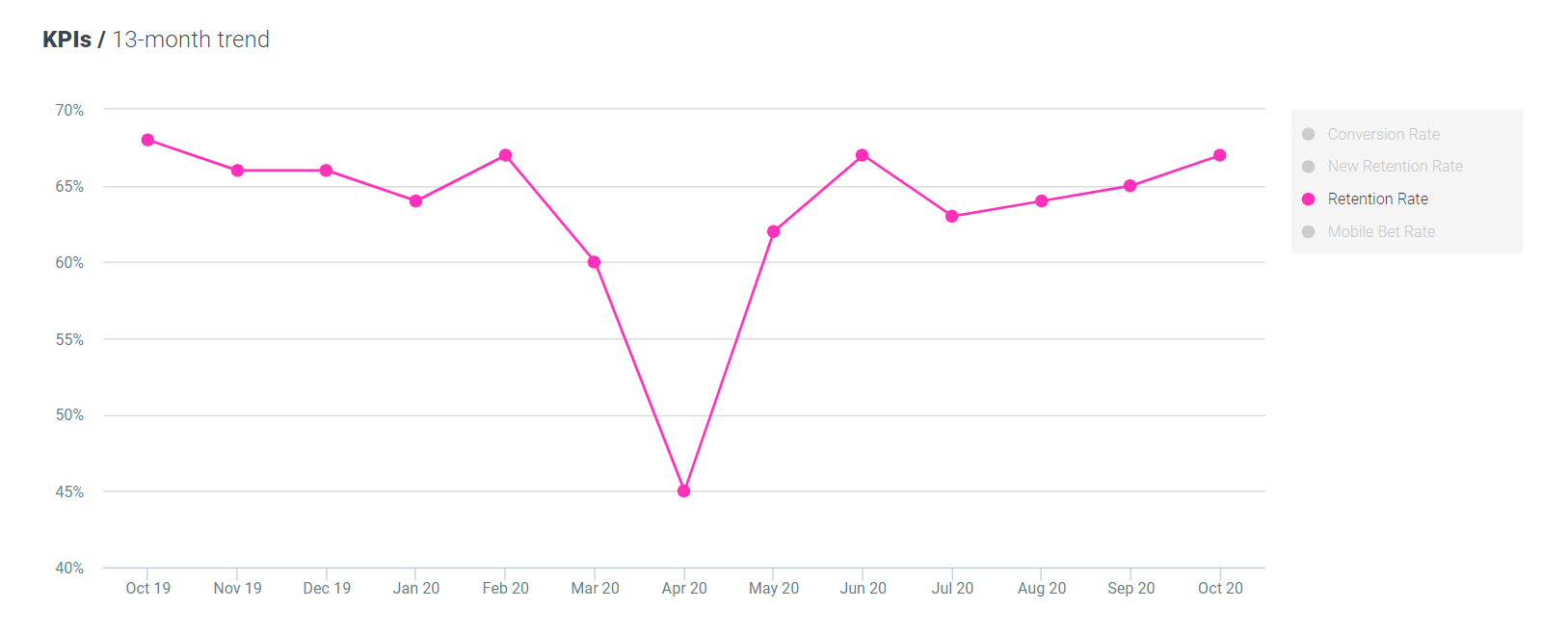

Retention rates

In October, retention rates increased by 6% month-on-month and by 3% year-on-year.

Conversion rates

Last month conversion rates decreased by 5% month-on-month but increased by 9% year-on-year.

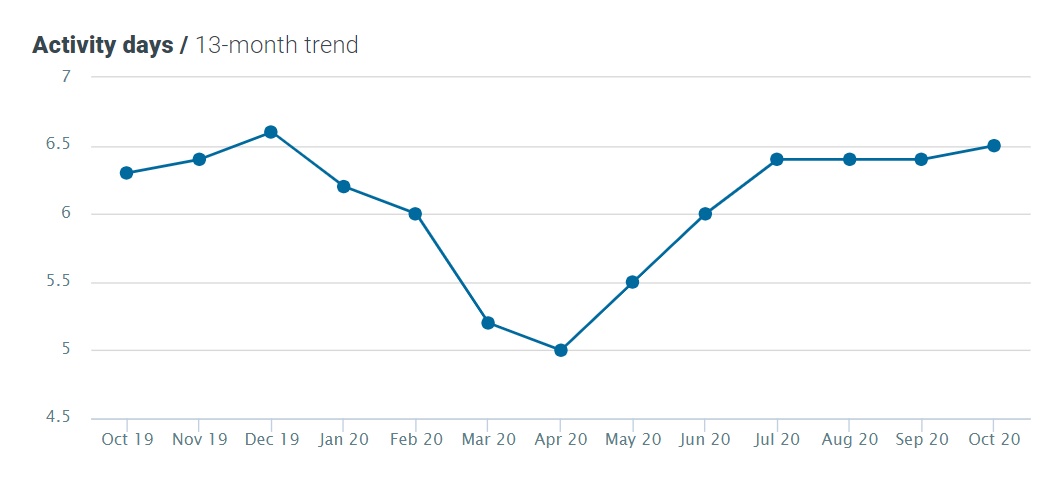

Number of activity days

This KPI shows the number of activity days during the month – days where a player either places a bet or makes a deposit.

During the months of March and April, at the height of the coronavirus outbreak, casino attracted many new players, with some of these having crossed over from sports. However, new players are typically less active and as the chart below shows, as the volume of new players increases, the average number of activity days decreases.

For October specifically, the number of activity days was fairly stable – increasing by 2% month-on-month and by 3% year-on-year, rising to 6.5 days.

About iGaming Pulse: iGaming Pulse is an industry benchmark tool for the gaming sector. iGaming Pulse enables gaming operators to accurately assess their overall performance against industry-wide key performance indicators.

Its figures are updated on a monthly basis. It enables gaming operators to gain a clearer understanding of how their KPIs compare against the rest of the industry, broken down by geography and game type. This type of data, which is made publicly available for the first time, provides operators with the ability to conduct comparative analysis and derive insight into how their performance compares with industry averages.

iGaming Pulse comprises of data collected from over 200 online casinos and sports betting companies, including industry giants and boutique operators, providing an accurate, statistically significant sample of the industry. Access to this information is vital for operators that are limited to only their own data. Optimove’s iGaming Pulse is now fully accessible, ensuring operators will have a clearer overview of how they compare to the industry.