Tax Foundation research bears out diverse US wagering tax rates, barriers to entry

Operators must deal with separate sets of laws, regulations and tax structures in each jurisdiction in which they are licensed.

The map does not include the fees that operators must pay in each state. But according to the press release, high licensing fees are among the “common barriers” to entry. It uses as examples Massachusetts, which has a $5m (£3.8m/€4.5m) initial fee and $5m renewal every five years and Pennsylvania, which has $10m initial fee and $250,000 annual renewal.

New York, which is capped at nine operators, has the highest initial fee at $25m. In part because of that, only major US or global platforms are available in the state.

Cost of business related to survival in a market

The Tax Foundation also pointed to the requirement to be tethered to a physical casino or sports team as a barrier to entry. In some states, including Arizona, Kansas, Nevada and Pennsylvania, platforms are required to have a partnership with a physical location. Nevada consumers must register their online accounts in person.

In states like Massachusetts, the high cost of doing business and evolving regulatory landscape have caused some operators to exit. Notably, micro-betting platform Betr and WynnBet left the state in 2024. WynnBet, however, also shuttered its platforms across the country.

Other examples of smaller operators leaving states this year that they found unprofitable are SuperBook and BlueBet. In July SuperBook shut down eight platforms, keeping only its Nevada site live. In August, Australian-based BlueBet announced that it is exiting the three US jurisdictions in which it is live – Colorado, Iowa and Louisiana. Interestingly, all three of those states have tax rates of 15% or less.

Ranking jurisdictions from priciest to cheapest

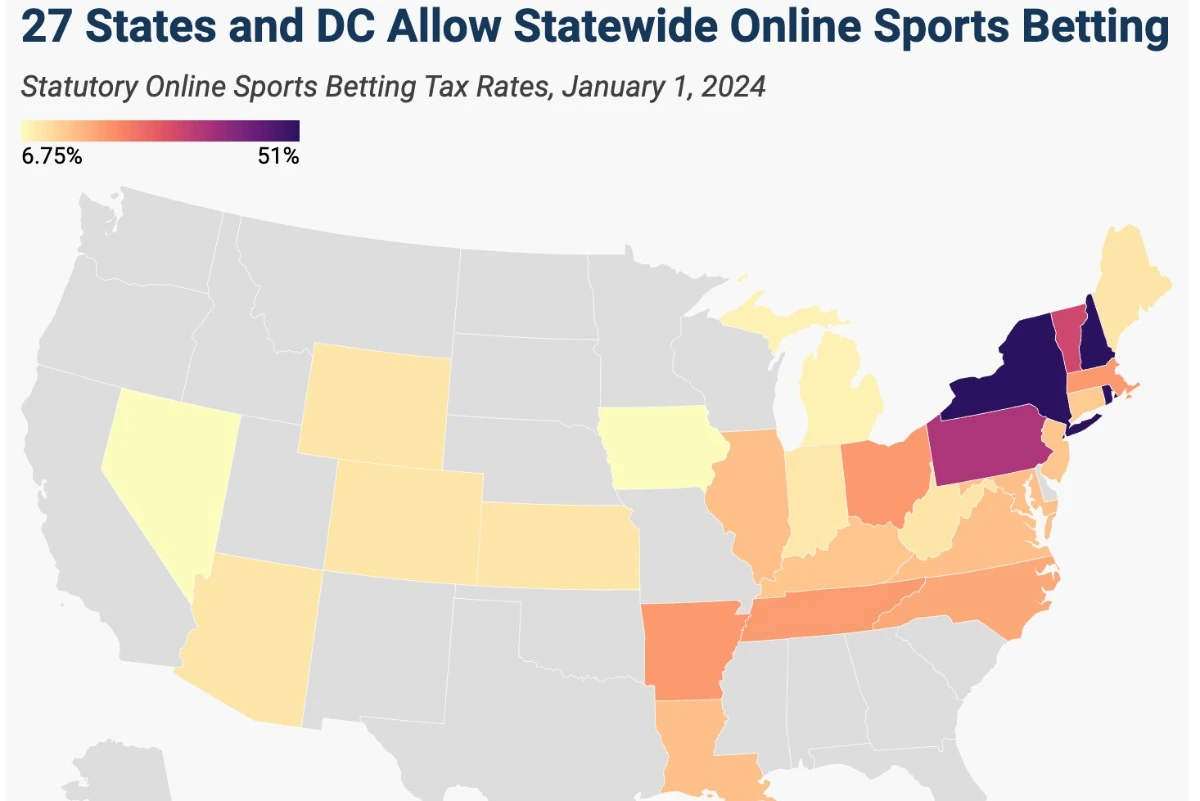

The Tax Foundation ranked tax rates from high to low. New York, New Hampshire and Rhode Island tied for first at 51%. Iowa and Nevada tied for last at 6.75%. From a tax perspective, the map shows that the most business-friendly states besides Iowa and Nevada are Michigan (8.4%) and Indiana (9.5%). The Tax Foundation also points out that Kentucky, Louisiana, Massachusetts, New Jersey and New York have higher tax rates for online wagers than in-person bets.

Of the 28 legal digital jurisdictions, six have a 10% tax rate. That number is the one operators pointed to beginning in 2018 as the sweet spot for wagering.

But since then, it has become clear that the biggest operators can tolerate a higher tax rate and still generate revenue. The current trends are toward higher tax rates. Governors in Illinois and Ohio have pushed through increases in the last 18 months and, of the 28 legal digital wagering jurisdictions, 16 have tax rates above 10%.