Unwinding the sports betting disaster in DC and what comes next

The industry is literally begging for a shot at competitive market. Taken together, the events that have unfolded over the last five years are truly shocking. And they are coming to a head.

Just over two weeks ago, iGB broke the news that the Office of Lottery and Gaming (OLG) had approved vendor Intralot’s proposal to hand over the lottery’s sports betting platform to FanDuel. There is no question that having access to FanDuel across the District will be an upgrade from a platform that has underperformed and been consistently criticised.

But wouldn’t the District be better served by an open, competitive market? Why does the lottery continue to be loyal to Intralot? Could the DC Council solve the sports betting disaster in DC?

The value of a competitive market

There is proof across the country that competitive markets not only serve consumers better than single-source markets, but that revenue to the state or, in this case city, is higher. There are four legal online betting states that use the single-operator model: Delaware, New Hampshire, Oregon and Rhode Island.

In all four cases, like in DC, the regulator is the state lottery. Of the four, only New Hampshire had a competitive bid process. All four have revenue-share models with their respective state lotteries, which get a cut of at least 49% of adjusted gross revenue.

DraftKings operates the platforms in New Hampshire and Oregon while Caesars Sportsbook handles risk management and odds in Delaware and Rhode Island.

“Broadly speaking, more competition ensures that consumers get access to better pricing, more generous promotions and stronger products,” Chris Grove, co-founder of Acies Investments and partner emeritus of Eilers & Krejcik Gaming LLC, tells iGB. “All of that should result in a market that is also more productive from a tax perspective.”

How does DC compare to other single-operator jurisdictions?

GambetDC consistently performs so poorly that in February it was not the top performer in the District. Even though it is the only online sportsbook available throughout the city, Caesars topped the rankings. It also compares unfavourably to the four other single-operator markets in the US.

Here’s a look at tax revenue for three of the single-operator markets. Oregon, which is much larger by population, does not publicly post sports betting financials:

Delaware

Population: 1m

Total tax revenue: $1.4m (January 2024-February 2024)

Average tax revenue per month: $679,806

New Hampshire

Population: 1.4m

Total tax revenue: $104.6m (December 2019-February 2024)

Average tax revenue per month: $2.1m

Rhode Island

Population: 1.1m

Total tax revenue: $85.5m (November 2018-January 2024)

Average tax revenue per month: $1.6m

Washington, DC

Population: 678,972

Total tax revenue: $4.3m (May 2020-December 2023)

Average tax revenue per month: $97,727

Even adjusting those numbers given DC’s smaller population, the platform lags far behind platforms in other single-operator states in terms of tax revenue and then, by definition, handle and gross gaming revenue.

No platform truly has all of DC

GambetDC’s problems are well-documented. Consumers say it is difficult to navigate, the odds aren’t as competitive as in other jurisdictions and there was an outage during the Super Bowl in 2022.

But no platform is or will be truly available throughout Washington, DC. The city provided a massive challenge to GeoComply, which provides geolocation services to the lottery and operators.

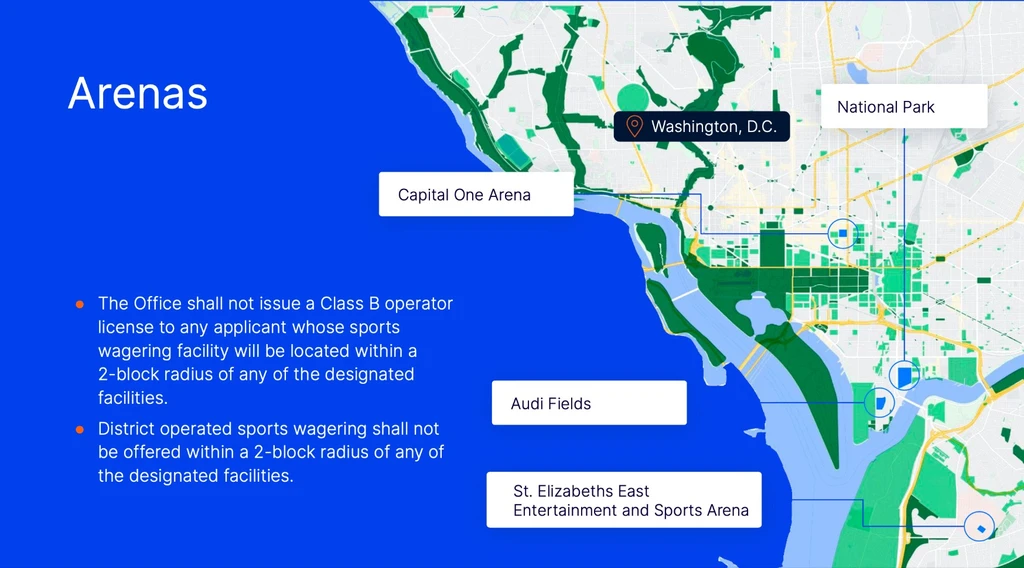

Wagering is prohibited on federal lands, from the National Mall and the Smithsonians to national parks within the District and some individual buildings. Beyond that, there is a two-block exclusion zone around each of the city’s professional sports facilities. GambetDC cannot operate in those zones, which are the domain of the operators partnered with each facility.

BetMGM and Caesars operate online sports betting at Nationals Park and Capital One Arena respectively and within a two-block radius of those stadiums. FanDuel, partnered with Audi Field, could do the same, but has not launched a platform.

The market share argument

When the DC Council in 2019 approved the scenario that gave the lottery the option to expand Intralot’s contract and create a single-operator market, only New Jersey had launched mobile betting.

By the time GambetDC debuted in May 2020, nine other markets had gone live with digital sports betting. Of this number, six launched competitive markets and three single-operator models.

While the DC Council was considering the model, the lottery argued that expanding the Intralot contract to include wagering would allow it to get to market quickly. A 2019 study by Spectrum Gaming projected an open-bid process would delay any sports betting launch until 2022.

Looking back, the decision to go with single operator was the start of the sports betting disaster in DC. And while considering whether or not to legalise at all, one of the critical arguments was that being first to market would allow the District to “capture market share in its region”. This was based in part on the Spectrum study, in which the authors wrote the lottery would “gain a head start over its closest geographical competitors”.

Waiting to bring GambetDC to market would allow Maryland and Virginia to “establish customer relationships with portions of DC’s potential base depriving the DC potential revenue that may never be recovered”, Spectrum’s authors wrote.

It appears that happened anyway.

Maryland and Virginia get in the mix

Between 2019 and now, both DC border states – Maryland and Virginia – have launched competitive markets, with at least 10 choices for consumers. Both states tax operators 15% of their adjusted gross revenue.

In February Maryland ranked fifth nationally in total handle despite being the 14th biggest legal online sports betting state. According to the Visual Capitalist, both states in 2022 ranked in the top 15 in total handle for retail and digital wagering.

On the same list, DC was ranked 22nd. Virginia launched mobile in January 2021 while Maryland launched mobile in November 2022.

The speed-to-market argument doesn’t resonate with DC Councilman Kenyan McDuffie.

“First to market?” he said during a Business and Economic Development meeting on 18 January. “That didn’t play out.”

Why did it take so long for a change?

During that meeting, McDuffie pointedly questioned lottery chief Frank Suarez, who repeatedly said that approving Intralot’s proposal to subcontract with FanDuel was the “fastest solution”.

The proposal, McDuffie said, is rife with problems. Not the least of which is that nearly five years after the lottery made the deal and four years after GambetDC went live, the DC Council was made aware of the subcontracting idea just six months before Intralot’s sports betting contract with the District expires.

“I’m taken aback that it has taken five years for you to make a change,” McDuffie said. “And here we are in January and the contract ends at the end of July.”

McDuffie isn’t the only one who finds the timing questionable.

“I don’t think that the lottery has handled this correctly by avoiding a competitive process,” the vice-president of government affairs for Fanatics Betting & Gaming told iGB. “They’ve had four years of mismanaging sports betting in the District.

“They are now just months before the contract expires and they have a better option? Why they have waited this long is perplexing to me. I am glad to see that Chairman McDuffie is taking the lead on providing consumers options.”

McDuffie’s bill one potential solution

Two months after that meeting, McDuffie dropped a bill that would essentially nullify the Intralot-FanDuel deal. That is where the DC Council’s power lies. While it cannot stop the lottery from making a deal with a subcontractor, what it can do is nullify a contract by creating a whole new set of rules.

McDuffie’s bill would create a competitive market and interested operators would have to go through a bid process. The industry wholeheartedly supports the ideas of a competitive bid process and the resulting competitive market.

“They need to tear down the rule and start again,” gambling consultant Brendan Bussmann of Las Vegas-based B Global Advisors says.

The Sports Betting Alliance, a lobbying entity that represents BetMGM, DraftKings, Fanatics Sportsbook and FanDuel, also supports a competitive market.

“The SBA is excited about the momentum around opening the marketplace,” an SBA spokesperson says. “They’ve long called for it and are looking forward to working with legislators.”

FanDuel declined to comment for this story.

DC wagering timeline for change could be tight

McDuffie’s bill was filed on 20 March. Should the bill pass, the lottery would have to open a Request for Proposal (RFP) and then review all the proposals to see if they meet set parameters. From there, the lottery would then have to have vet the bids that meet the criteria before issuing licenses.

Traditionally, RFPs are open for 60-90 days and, while it’s not clear how long the lottery would need to review bids, let’s assume 60 days. In DC, bills are also required to be sent to Congress for a 30-day review period.

That means that even if the DC Council were to pass McDuffie’s bill today, it would go info effect right at, or likely past the date that Intralot’s sports betting contract expires. Suarez couldn’t say exactly when that was, other than “in July”.

In that scenario, District consumers could potentially be left without a mobile wagering platform that covers the city for some period of time. One source suggests McDuffie’s bill could be tagged with “emergency” status to speed up the process.

When bills are granted “emergency” status, they can move more quickly through the Council, but the result is a law that lasts only 90 days.

BetMGM and Caesars to benefit?

Operators say they would be amenable to a shortened timetable. Such a situation would likely benefit BetMGM and Caesars Sportsbook, both of which are already operating online platforms in the District.

Should McDuffie’s bill become law, BetMGM and Caesars would essentially just be able to make a call to GeoComply. After instructing the supplier to lift the fences around their exclusion zone, their platforms would be available throughout DC. The process would be more time-consuming for companies not currently live anywhere in the District.

There’s value in competition

In the current scenario, it is universally accepted that many DC residents who bet leave the District to do so. And the promised wagering traffic commuters has not materialised.

In his round table testimony, Fanatics Betting & Gaming’s Iden said that it “is no secret DC residents cross the border to Virginia and Maryland to gain access to their favourite mobile sportsbooks to place their bets”.

He went on to testify that 66% of Fanatics Sportsbook’s Maryland customer base and 7% of its Virginia customer base have tried to log into the platforms from DC. He also said that market penetration in DC hovers around 1%-2% of eligible adults. On average, DC adults spent $2.32 per capita on wagering, compared to $21.27 in Maryland, and $10.85 in Virginia.

“The discrepancy between DC and its surrounding markets is an unfortunate byproduct of the difference in market structures,” he said.

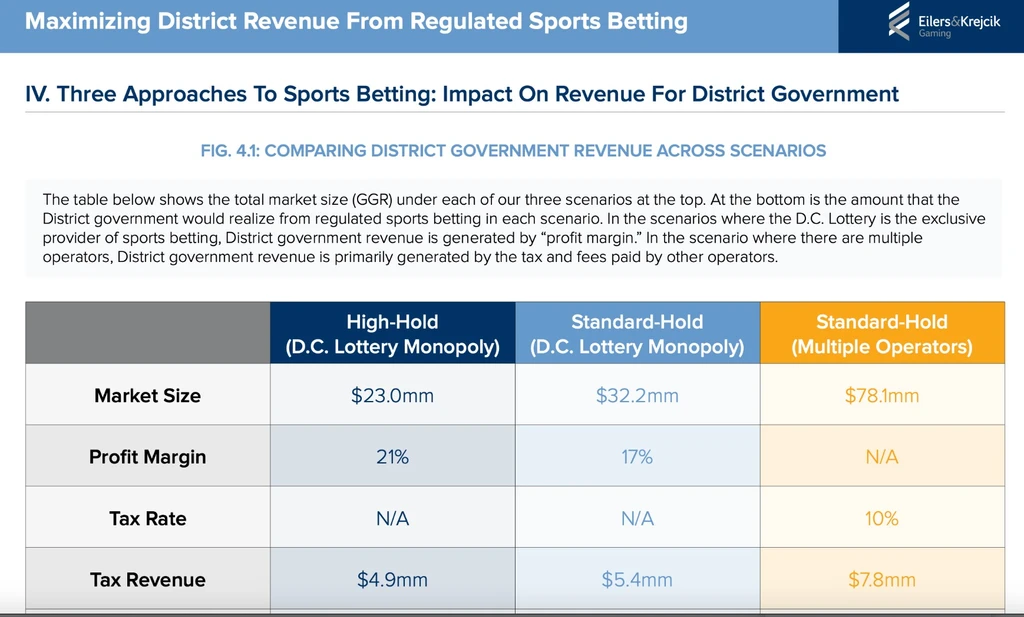

Some of Iden’s statistics came from an Eilers & Krejcik study – Comparative Analysis: Maximizing District Revenue from Regulated Sports Betting. The authors of the paper project a 143% increase in total revenue in a mutiple-operator market versus a single-operator market with the lottery as the only operator.

“A number of factors impact the projected difference in total revenue generated by a DC Lottery-exclusive sports betting and a market where multiple operators are allowed to compete,” the authors wrote.

“We believe the most salient are: increased market spend; pricing and promotional competition; increased out-of-District demand capture; and increased illegal market demand capture.”

Of the single-operator model, Bussmann says: “I think you limit the market and you’re leaving money on the table and allowing the black market to get in. There’s limited choice – limited pricing, limited across the board. They don’t have to provide competition.”

Loyalty to Intralot a mystery

Dating back to 2008, when the lottery first awarded its contract to Intralot there were concerns about how above board the process was. According to the City Paper, at least two council members were accused of “steering” at that time.

When the DC Council legalised sports betting in DC, there was pushback from some members of the council as soon as the lottery announced that it would bypass the competitive bid process and expand Intralot’s deal with the city.

The City Paper then revealed nearly every member of the DC Council had some sort of personal or business connection to wagering lobbyists, including those lobbying for Intralot.

Soon after legalisation the then-DC Council chairman, Jack Evans, became the focus of an ethics investigation. He was forced to resign after it came to light that his partner in his consulting business was also a lobbyist for Intralot.

Other questions arose, including why Spectrum Gaming, which has a business relationship with Intralot, was hired to do the study.

The study ultimately grossly overestimated gross gaming revenue (GGR) in the District from legal sports betting. The entire DC market has accumulated $86m in GGR since launch while Spectrum project $84m for 2023 alone for GambetDC.

Another question arose when an Intralot subcontractor with close ties to Mayor Muriel Bowser was selected for and then paid for a contract it did not fulfill, according to the City Paper. Five years later, the lottery remains loyal to Intralot.

“The definition of insanity continues to remain true in DC”

By agreeing to install FanDuel as a subcontractor, the lottery is also agreeing to extend the Intralot sports betting contract.

In his letter to the DC Council outlining the deal, the lottery’s Suarez explains that the lottery gets a $5m “platform conversion fee” from FanDuel. If the contract is extended, Intralot will pay the lottery $10m in “guaranteed revenue per contract year for the four years following 2025”.

It’s not clear why the lottery has such an allegiance to Intralot. Suarez – the third lottery director since sports betting was approved – fell back on the “fastest to market” argument when pressed about why Intralot should be able to continue the sports betting contract.

“The definition of insanity continues to remain true in DC,” Bussmann says. “You had a no-bid process that started a market wrongly and now you have a no-bid process that adds an extension to the term. This should be a competitive process that does what is best for the people of DC.”