Super Bowl Sunday: Stats showdown

Many in the industry had high hopes for the 58th edition of the Super Bowl. And they were right too – Sunday’s game was the most-watched American television broadcast since Neil Armstrong walked on the moon.

While loyal American football fans and cheerful once-a-year viewer types undoubtedly tuned in, the hype around the final was no doubt amplified by the presence of Taylor Swift. According to Apex Marketing Group, Swift has generated a hefty $331.5m (£264.0m/€309.5m) for the National Football League (NFL), simply by showing up to watch her boyfriend Travis Kelce, the Chiefs’ tight end, play.

A survey by the American Gaming Association projected that a record 67.8 million American adults would bet $23.1bn on this year’s Super Bowl, marking a 35% rise in bettors from 2023. Regulus Partners, meanwhile, made a more conservative estimate of $1bn being spent on the big game.

Regulus noted that the AGA’s wagering estimate is a bit unbelievable compared to the actualities of the wider US market, where total legal sports betting market handle was $100bn in 2023. For all NFL games, $20bn was wagered throughout the year.

It’s been a long time coming

Also according to the AGA’s survey, 28.7 million adults intended to place online bets with a legal US sportsbook. Regulus says the AGA’s estimates, particularly around the legal sports betting market, bring the sports betting industry’s faults to light.

Despite this, Regulus highlighted one positive side to the projections – namely the success of sports betting channelisation. It stated that illegal bookmakers now make up just 19% of traditional betting engagement. Nonetheless, legal bookmakers are channelling just 45% of Super Bowl betting demand by channel.

Gameday data from GeoComply suggests that the AGA’s estimations were on the low side. In the minutes leading up to kick-off it recorded an enormous spike in traffic, coming to 14,750 transactions per second. This is more than double last year’s peak and the highest transactions per second GeoComply has ever recorded.

GeoComply also reported that 1.77 million new users signed up for legal online betting accounts in the two weeks leading up to the game.

Top of the world

All of this culminates in a huge win for so many groups – the NFL, the US sports betting market and maybe even the occasional Swiftie. But Regulus says the Super Bowl’s great success could spell bad news on the customer acquisition front.

“NFL fans now have a long wait until September before the new season becomes properly engaging again; March to August represents just 2% of NFL bets,” noted Regulus. “Super Bowl is the apex event of a six-month season, worth 2% of all NFL betting or 8-10x more than a typical NFL game, but then the season leaves bettors flat.

“This climax is excellent for sports engagement, but a very poor customer acquisition proposition for betting unless customers can be cross-sold into gaming, basketball or baseball.”

Although there’s a comedown on the horizon, the highest high may have been worth it. In Nevada, which hosted the Super Bowl for the first time this year, $185.6m was wagered on the game across 182 sportsbooks, breaking the state record.

And as expected, the nitty-gritty details of the Super Bowl betting stats back up the hype. FanDuel – which had one of only three total sports betting ads shown during the broadcast – recorded more than 14 million bets during the game, totalling a record $307m in handle for the operator. More than 2.5 million active users wagered with the operator on the big game.

Suspicious transactions surge 206% on Super Bowl Sunday

But the game wasn’t all touchdowns and popstars. According to identification verification service Socure, the Super Bowl endured its fair share of fraud attempts.

Socure reported that, on Sunday, the rate of suspicious transactions on gaming platforms linked to fraud spiked 206%. This was compared to volumes recorded during January’s playoff games. Fraudulent betting attempts saw enormous spikes three hours before kickoff, as well as at the beginning of the game.

A lot of this comes down to email addresses, according to Socure. Transactions were most likely to be reviewed if a person’s email address was not active.

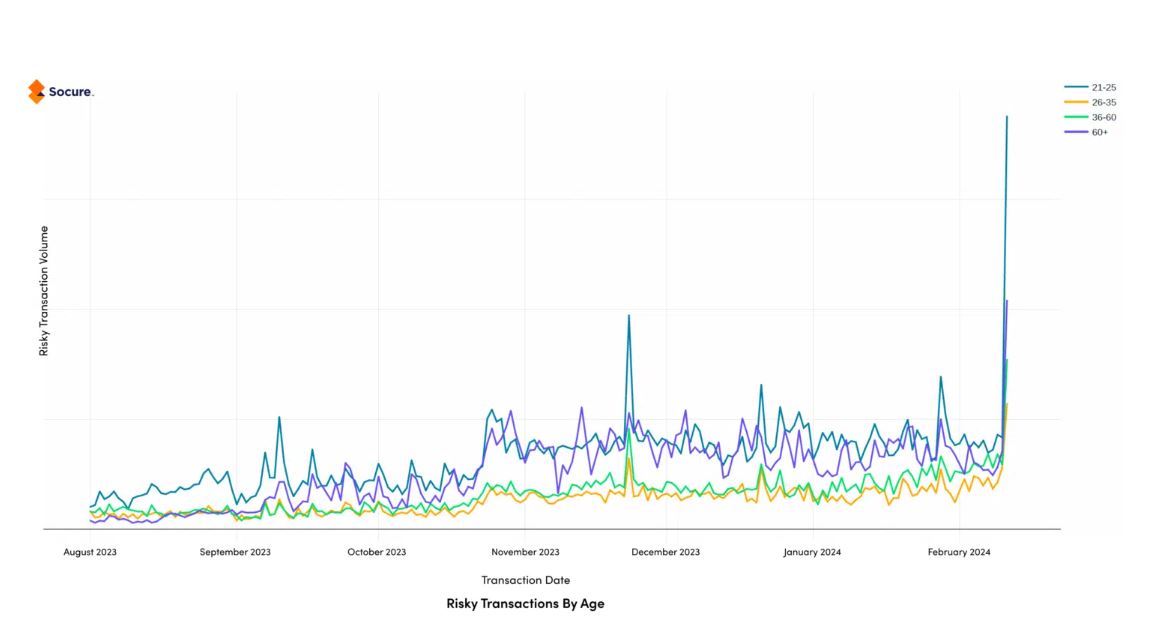

And the most likely group to be targeted? None other than Gen-Z. Socure found that the 21- to 25-year-old age group attempted the most risky transactions by far. However, it noted that this may indicate a slew of stolen identities within the age group, rather than fraud attempts.

All around the globe

This popularity isn’t just limited to the US. Yesterday, Entain released its Super Bowl stats, revealing that there had been a surge in bets placed in the UK and wider Europe. This was particularly true among women, with the number of female bettors growing 51% from 2023’s game and 86% since 2020.

Data from Entain’s Coral, Ladbrokes and Bwin brands found that UK and European bets spiked 12% compared to last year’s Super Bowl.

And according to data from Entain and BetMGM – Entain’s joint venture with MGM Resorts International – Super Bowl bets rose 30% yearly. This was surely enhanced by the 72% year-on-year increase in new customers.

For Ladbrokes and Coral only, the volume of UK Super Bowl bets grew 74% compared to 2020.

When it’s all laid out in black and white, it’s impossible to deny that Super Bowl LVIII more than lived up to the hype. Next year’s edition, set to take place at the Caesars Superdome in New Orleans, Louisiana, will certainly have a lot to live up to.