The UK in 2024: Can the sports betting industry be saved?

Despite arguably being the world’s most famous market for sports betting, the UK is now in its most difficult position in recent history.

David Brown, a UK bookmaking industry veteran since 1976, and ex-trading director for William Hill, Coral and LadbrokesCoral, is certainly worried.

“I’ve been in the industry for 47 years and this is the most pessimistic I have ever been over the health of the UK sports betting market,” he states.

2023’s earnings: A sign of things to come

Earnings reports throughout 2023 have arguably precipitated this decline.

What should have been a record-breaking period – first the 2022 World Cup and then a packed holiday season of horse racing – instead became grim reading.

Bet365, the UK’s largest online operator by market share, raised the first warning flag. In a trading update issued at the beginning of 2023, the company announced operating profit was down by 88% over the last financial year.

The second major warning came from 888/William Hill. In publishing its Christmas and World Cup earnings at the start of 2023, it went to great lengths to omit like-for-like gross win performance compared to Russia 2018.

Throughout the year UK-listed Entain, once one of the industry’s brightest prospects, has also seen its outlook worsen.

With its growth slowing in each quarterly earnings report throughout 2023, its outlook is not bright. In November, investment bank and financial services giant Goldman Sachs downgraded Entain to “sell” from “buy”.

Amid concerns over business growth, it now also forecasts Entain’s pro-forma online growth to be negative in Q4 of 2023 and H1 of 2024.

The UK white paper: Creating a cloud of uncertainty

Dismal operator earnings, however, only form part of the picture. The fallout from the white paper, published in April 2023, presents the bigger issue. In particular, affordability checks being introduced in 2024.

In their present form, these checks greatly risk sending punters to the black market due to their intrusive nature.

The issue, as many see it, is the increasing polarisation of views between the GC and the industry.

For example, it has been previously claimed by the GC that only 3% of accounts will be subject to affordability checks. Much of the crux of the current debate has been centred around whether this figure is actually correct.

The GC’s own measure of how many betting accounts would be subject to affordability checks has been roundly criticised as inaccurate by many commentators.

“Rhodes now introduces another measure, ‘gambling at the time’, to support his own data but without definition of what that exactly means,” comments David Brown.

The issue, in short, is that many of the accounts included in the other 97% belong to “occasional” punters.

These include those who only bet on major events, such as the Grand National and thus are unlikely to place another bet for 12 months.

Inevitably intrusive checks, if they continue as planned in 2024, will see many regular punters, who form much of the backbone of the industry, stop using regulated online bookmakers.

The rise of the black market

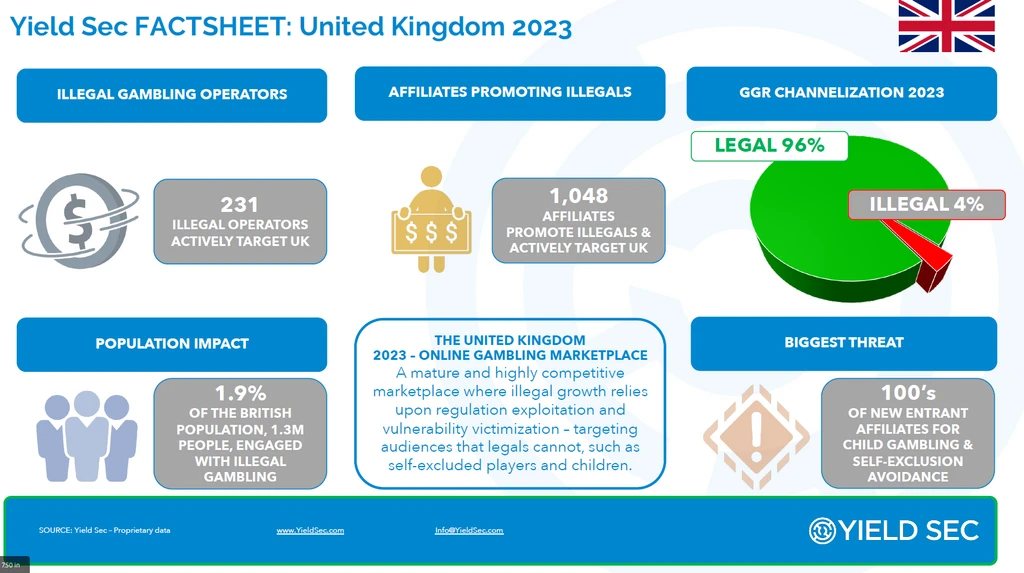

With this, comes the rising spectre of the black market. UK black market gambling operators are increasingly targeting vulnerable players, according to new data published by Yield Sec.

The intelligence platform, led by CEO, Ismail Vali, recently published findings that the number of illegal operators in the UK have increased “fourfold” between 2021 and 2022.

That number doubled again to 231 during 2023. In total, more than 1,000 affiliates helped to publicise illegal operators.

According to Yield Sec, this means that illegal gambling now makes up 4% of the UK’s online gambling market share and gross gaming revenue (GGR).

This results in a significant drop in tax revenue, as well as funding for responsible gambling initiatives such as GAMSTOP.

Via its latest research, Yield Sec has recorded Google searches bidding to aid the avoidance of self-exclusion.

By January 2024, Yield Sec detected millions of “not on GAMSTOP” and other similar Google search results. This allows vulnerable gamblers to bypass self-exclusion strategies with legal operators.

As a result, at-risk players are falling through the “trap door” of looking to bet with illegal and potentially dangerous operators, who are not monitored by tools such as Yield Sec and GAMSTOP.

The Yield Sec platform also reveals a far more extensive, largely unmonitored landscape where illegal operators are strategically exploiting vulnerable audiences as a basic tenet of their go-to-market strategy.

At the heart of this disconcerting trend are two pivotal metrics: Cost per Acquisition (CPA) and Revenue per Player (RPP). Illegal operators navigate the acquisition landscape by targeting audiences shunned by the legal industry, effectively minimising their costs.

Commenting, Ismail Vali, founder and chief executive of Yield Sec, stated: “Our surveillance highlights the disturbing and cynical growth of a certain type of illegal operator present in the UK over the past three years.

“The evidence of illicit gambling options that seek to cynically work around and enable vulnerable problem gamblers to avoid GAMSTOP self-exclusion is distressing and demands immediate and meaningful intervention.”

Navigating 2024: Focusing on the positives

The UK, however, has proven itself extraordinarily resilient in the past and can do so again.

The first bright prospect for growth in the regulated sector is the re-emergence of UK retail. Playtech Sports is fast making it a rival to online sportsbooks.

At the forefront of this digital revolution are the company’s Self Service Betting Terminals (SSBTs), which are experiencing double-digit growth.

SSBTs now offer everything a punter can find online, with the same transactional speed.

“We’re seeing everyone wake up to terminals in betting shops. This has been particularly evident since Covid”, says Lee Drabwell, managing director for Playtech Sports.

The key to retail’s rise in popularity, as Drabwell sees it, is the ability for Playtech Sports to offer speed and convenience, and the ability to place a bet as quickly as online.

“Gone are the days of customers asking for a price at the desk. Everything they want online is now available in a betting shop via terminals. All operators are fully engaged with this and we’re seeing a significant increase in retail traffic as a consequence.”

Drabwell is fully confident that Playtech Sports’ SSBTs have a major role to play in 2024. It is clearly a case of supply meeting demand.

“As long as that investment by operators continues in 2024, we’ll continue to see increased traffic. BoyleSports for example, have expanded into the UK and are doing very well,” Drabwell states confidently.

“JenningsBet is another great example of investment and expansion and we are now seeing nearly 100% of independent operators taking our terminals.”

Retail: A bright future

So how much potential for growth do we see for this in 2024?

“There is plenty of potential for more growth,” Drabwell says with the full confidence of an industry veteran with close to 35 years’ experience.

“There’s clearly market demand for this. The realisation is that if you don’t harness the digital experience and give customers an engaging and seamless experience, then you’ll struggle.

Take in-play betting for example, we now offer a massive range as part of the betting shop experience.”

“We’re now seeing over 40% of football bets taking place through in-play. Of course, the only way you can do that in a betting shop is via a terminal.

In total, about 80% of all in-shop football bets in shops take place via terminals and I am confident that this will grow to nearly 100% in the next two years.

“Our Betbuilder for football is also performing particularly well in shops. This an excellent example of digital demand transferring to shop success.”

The ability to innovate and offer the same as online is what is driving demand. Not only that, but it’s also attracting plenty of new customers.

“This is the great thing about making the betting shop experience digital-first. In effect, we’re taking everything that’s available online and delivering it to the world of retail.”

The pitch is simple, catering to those who like that tangible feeling of the cash-based win twinned with a simple mechanic to bet.

Playtech Sports’ technology and tools also give operators the ability to deliver all customer safeguarding measures in a responsible manner. This makes it a win-win for both market demand and regulation.

“We’re seeing plenty of new sports driving popularity too.” He adds. “Baseball, cricket, American football and basketball are all growing in popularity. These are just a few examples of betting events that are drawing customers into the shop.

“Again, it’s another area where our Betbuilders are performing well, with a full range of betting opportunities for NFL, tennis, basketball – and baseball to follow soon.”

So, which operators will be best placed to lead in 2024? “It’s definitely a case of those who invest the most will have the most success,” highlights Drabwell. In short, bet on any UK operator investing in retail and especially Playtech Sports’ SSBTs.

Investing in brand loyalty will be key

Going above and beyond for the customer will be another key indicator of operator performance in 2024. Star Sports is an excellent example of this. By focusing on the customer experience, they are bullish on their outlook.

“We have made great progress in 2023 with our online product (app), acquired more retail estate and stood at more tracks than ever before,” says Flynn Goward, head of operations at Star Sports.

The company has been quick to capitalise on demand, staking its claim on new pitches on racetracks. The first at the Newbury National Hunt and the second at the Ascot National Hunt.

“We’re now standing for approximately 150 days a year across horse racing and greyhound racing.

Our space in the market currently is to lay some of the largest bets around, while ensuring we give the best service possible for whatever size of punter.”

Where others see crisis, Star Sports sees opportunity. This aggressive approach is paying dividends. “We are trying to be present in as many areas as possible. As other firms are leaving the high street and on-course, we are buying up retail and pitches.”

As Goward has noticed. “Bigger punters are now roaming the betting rings,” he says. “We are seeing larger cash-based bets now on-course compared to previously when affordability checks weren’t being mentioned.

“I’m assuming the on-course bookmakers have been left alone so far, as they only present a limited opportunity to bet (typically six or seven races that day) and possibly the away meetings.”

Indeed, the thought of making affordability checks happen at the likes of Cheltenham in March will be almost insurmountable. “I’m unsure how we would manage this when the punters are climbing over each other to get the price they want in the Champion Hurdle!” Goward adds.

Investing in success

As a customer-focused operator, Goward is very proud of just how much Star Sports has carved out a niche for itself in retail, on-course and online.

“In terms of the online product, I believe we offer the best service around.” He states with pride. The final piece of the puzzle in Goward’s view, is all about having a presence. When asked for his key takeaway, he summarised it shortly.

“Part of our success is by not being faceless. You will often see myself, or Ben Keith (our owner), standing at the big meetings or at the Greyhound Derby,” and it certainly goes a long way.

“We like to think we have a personality, which is backed up by the service we strive to give via our knowledgeable and friendly team at Star.

“We also want to give back to the game. Sponsoring the Brighton Summer Racing Festival (we are Hove-based) as well as sponsoring the Greyhound Derby for years now, which is very close to Ben Keith’s heart.

This rings especially true when it comes to future investment and they have high hopes to continue increasing market share throughout 2024.

“We are always looking to improve our product offering, overall betting experience and reach within the marketing space. This is a huge focus for 2024. Hopefully meaning more customers will find us at Star but more importantly will stay loyal to us as their go to betting firm,” Goward finishes.

Bridging the divide between the GC and the industry

Unfortunately, however, innovation and pro-activity – such as that which Playtech and Star Sports have put on the table – will not be enough to ensure that the UK industry can weather the storm in 2024.

The increasing polarisation between the Commission and the industry needs to be solved. David Brown, with almost 50 years’ service to the industry, is doing his best to offer a solution to bridge this gap.

“There is a perception within many betting operators, especially racecourse bookmakers, that the GC doesn’t quite ‘get’ betting or understand how bettors think and behave. So, it’s a little surprising that of the seven newly appointed commissioners, none of them have any experience of the betting industry.”

So, what steps can we take to ensure this can be done in 2024? For Brown, the first step is to agree what can be agreed on and then focus forensically on where the differences occur and where obstacles lie.

“I have been involved in this industry for nearly five decades and it is resilient. It has emerged from challenging times before and I have little doubt it will do so again. Leaders, please step forward.”

Indeed, this resilience is what will be key. Goward certainly agrees. “At Star we will always be resilient, but it would be naïve of me not to recognise the potential risk to the gambling/racing industry with regulation.

“We all want people to gamble safely and abide by AML regulation, but we need really clear guidance on what this looks like.”

Now, it’s over to the GC for the next move.