Oddin.gg report: Betting volume doubles as esports continues to grow

It looked like business as usual for esports in 2024. Desks lined with gaming computers, headsets and keyboards pulsed with characteristic mosaics of RGB lighting in stadiums across the globe as fans flocked to major esports events, both in-person and online, building on growing mainstream interest in competitive video games.

But while viewership of esports competitions grew modestly, a different sector of esports was surging in bedrooms, living rooms and gaming cafes the world over. 2024, it turns out, was a hallmark year for betting on esports. That’s according to a new report by esports betting ecosystem provider Oddin.gg, which found that betting volume had more than doubled year-on-year (YoY) in 2024.

The remarkable growth of esports betting isn’t just propelled by dedicated fans betting in bigger volumes. Oddin.gg’s data offers vital clues as to what drove 2024 to be such a big year for esports betting and the trends that are changing the vertical – forming key takeaways for operators that want to get more out of their esports betting offering.

Esports betting in 2024

In many ways, growth in esports betting is unsurprising. Interest in esports has been rising for years, boosted particularly by the Covid-19 pandemic. Online livestream views have doubled since 2019, with 2.89 billion hours of esports competitions watched in 2024, according to a Stream Hatchet report.

Now, as more of its predominantly Gen Z audience reaches legal betting age, and as operators’ marketing campaigns mature, the vertical is poised for further growth.

The ways in which that growth is playing out is laid out in detail in Oddin.gg’s Esports 2024: A Review of Betting Growth and Milestones report, which is based on first-party data from operators that Oddin.gg supplies with its esports betting iFrame and other products.

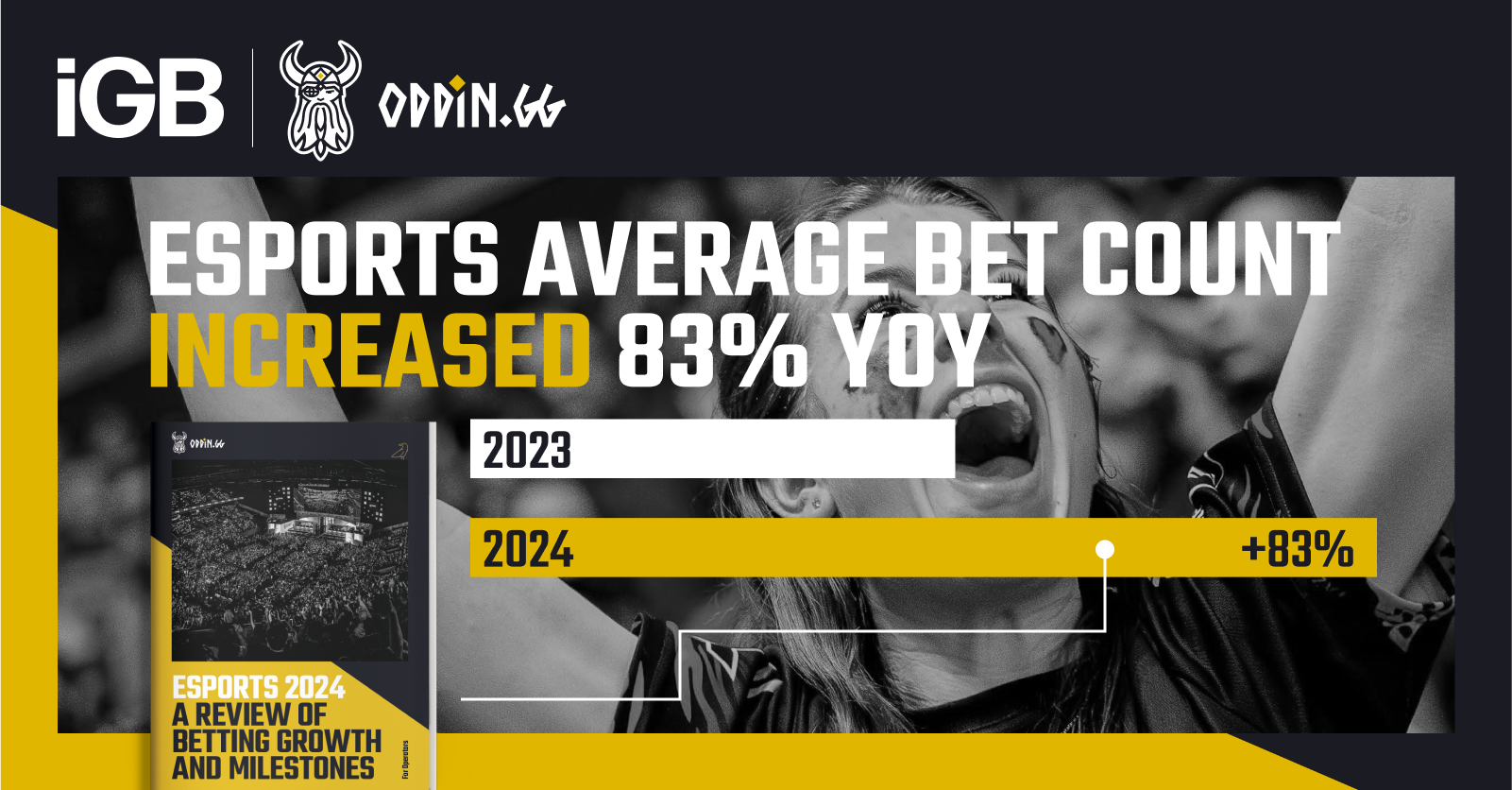

Overall, Oddin.gg found that betting volume was up 106% YoY, a remarkable rate that reflects the growing opportunity in the vertical. Average bet count increased 83% YoY, while the average bet was €29 (£24), dwarfing football’s €5. The LPL Spring 2024 in League of Legends set a record high for a tournament’s average stake, at €70 (£59).

“[Esports betting’s] growth in 2024 came from bettors becoming more invested in esports, both as fans and as participants in the betting experience,” Suchar says. “Across all key metrics, esports betting experienced remarkable growth.

“Total wagered amounts, bet counts and average stakes climbed across major tournaments compared to 2023 – stream viewership also saw notable increases.”

Key esports betting trends

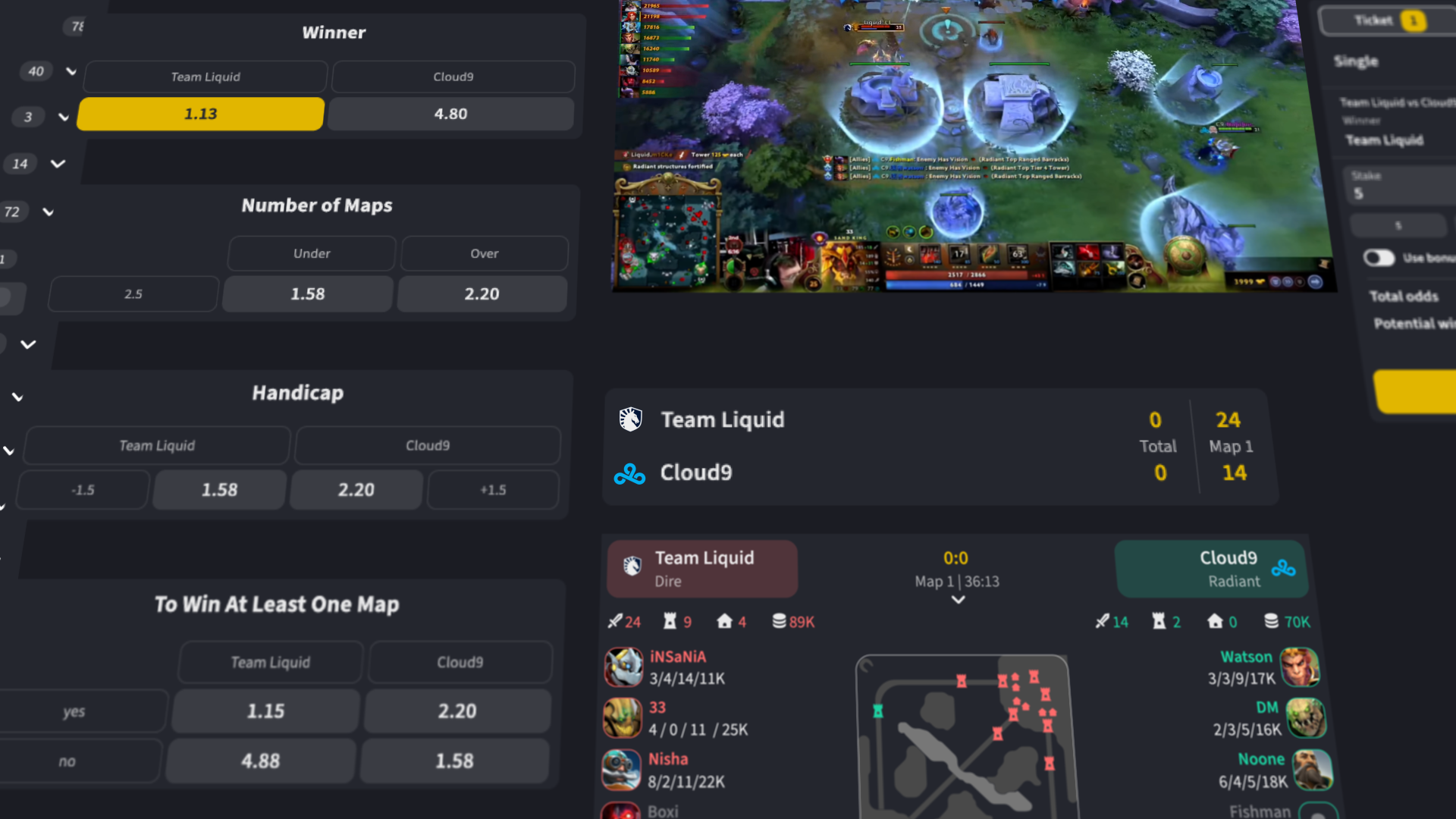

Esports betting volume has long been driven by a few standout esports titles, the most popular competitive games globally: League of Legends, Counter-Strike 2, Dota 2 and to a lesser extent Valorant.

The betting growth identified by Oddin.gg in its report was driven by across-the-board jumps in all four, signalling healthy growth in the highest volume titles. Counter-Strike 2 saw a 99% YoY hike, Dota 2 a 90% jump, League of Legends a 61% uplift – and Valorant had a standout 175% increase in volume over 2023.

Bet count also shot upward. Counter-Strike 2’s bet count grew by 80% YoY, Dota 2’s by 56%, League of Legends’ by 65% and Valorant by 131%.

Suchar chalks this growth up to the fact each title had something compelling to offer in 2024. “Counter-Strike 2 brought a fresh wave of interest with its [update], League of Legends revamped its regional structures to drive local rivalries, Dota 2 expanded with third-party tournaments after the Dota Pro Circuit ended, and Valorant took major steps forward with its regional leagues and platform expansion.

“On top of that, the betting experience itself improved across the board. More live markets, better risk management and features like player prop bets made wagering on these titles more engaging. It wasn’t just about watching a favourite team anymore – bettors had more ways to get involved.”

Explore the full findings of Oddin.gg’s esports betting report here.

Valorant becoming a betting favourite

Valorant led the pack with standout growth figures in 2024. Part of its monumental growth is likely a result of the game’s relative youth compared to the other big titles, having only been released in 2020, meaning more room for maturity.

But Valorant’s betting traction wasn’t just down to its age. Game developer Riot Games has ushered in a major expansion to the esports’ regional leagues in the past year, in turn creating higher-stakes games with more local rivalries.

Valorant Champions 2024, the game’s biggest esports event, recorded 9.1 million peak concurrent viewers for its final, according to Riot Games, surpassing the previous year’s record five-fold. More eyeballs on the sport is creating more bettors.

Riot Games has also moved to loosen its restrictions on gambling sponsorships for esports teams in its leagues. The game developer, which runs most of Valorant’s esports events, previously barred teams from promoting betting sponsors but is relaxing those rules this year, opening up a new way for operators to target Valorant fans.

Suchar adds that innovations in Valorant-specific betting offerings also had a big impact. “Esports betting offerings are constantly improving, with growing emphasis on live betting and tailored experiences for fans.

“According to our data for 2024, live betting volumes on Valorant alone grew by 368% year-on-year. That tells us that fans aren’t just watching; they’re actively engaging with the action in real time.”

Player-focused betting takes off

One of the most interesting trends identified in the report – and arguably one with the biggest takeaways for operators – is the rise of player-based markets, particularly in Counter-Strike 2.

Perhaps a result of the relative novelty of esports betting, simple pre-match ‘map winner’ or ‘game winner’ markets have long driven the highest volume. But that’s beginning to change, Oddin.gg’s data shows.

As professional gamers take on celebrity-like status within their game communities, interest is growing in betting on individuals’ performances – long a feature in established sports like football. Standout star performances from the likes of Counter-Strike professionals Danil ‘donk’ Kryshkovets and Mathieu ‘ZywOo’ Herbaut in 2024 have ignited major interest in player-specific wagers.

“Personalities like donk or ZywOo attract massive attention, and we’re seeing that reflected in betting behaviour,” Suchar says. “Bettors want more ways to engage with their favourite players, not just teams or match outcomes.

“The rise in player-focused markets has been driven by two things: better data and growing demand for more personalised betting experiences. Until recently, it was difficult to offer reliable, real-time markets centred on individual performances. But that’s starting to change.

“Our always-improving models and trading allows us to expand into deeper player prop markets. And this trend towards more personalised, granular betting experiences is only going to accelerate. As esports continues to evolve into a major entertainment vertical, we expect these kinds of markets to become standard – giving bettors more control and more ways to connect with the action.”

How operators can leverage esports betting growth

Esports forms an ever-more important vertical for igaming operators. Its growth last year reinforces the narrative that it isn’t a niche anymore and shouldn’t be treated as such, Suchar says. We’re past the early-adopter stage and entering territory where it is becoming a core entertainment and betting product.

“Triple-digit increases tell us there’s still plenty of room to grow, particularly as technology and betting options evolve,” Suchar argues. “And with more regulation and operator investment, the sector is stabilising in ways that weren’t possible just a few years ago.

“Growth at this rate won’t last forever, but we don’t see a slowdown yet. The fundamentals are strong – the audience is growing, engagement is deepening and product offerings are getting better.”

So far in 2025, viewership and betting figures show esports is maintaining the levels of engagement seen in 2024. The real test will come later in the year, when most of esports’ major tournaments take place.

However, the growth of esports betting underscores the importance for operators of properly and purposefully catering to fans. Esports fans’ demographic differences from traditional sports fans and bettors offers a lucrative opportunity, but those same differences make it vital to cater to the audience’s unique demands and preferences.

Without tailored products that speak directly to esports’ unique audience, the momentum currently being enjoyed may be missed.

“Operators need to act now to capture this opportunity,” Suchar warns. “But esports bettors aren’t interested in a copy-paste of traditional sports betting – they want fast, mobile-first personalised experiences.

“Operators who treat esports as a core vertical, and invest in products that reflect what this audience wants, will be in the best position long-term. Those who hesitate, though, risk losing an audience that’s already making clear demands about what they expect.”

Want to explore the full findings in more detail? Download the complete Oddin.gg report here.