Has US GGR growth run out of gas?

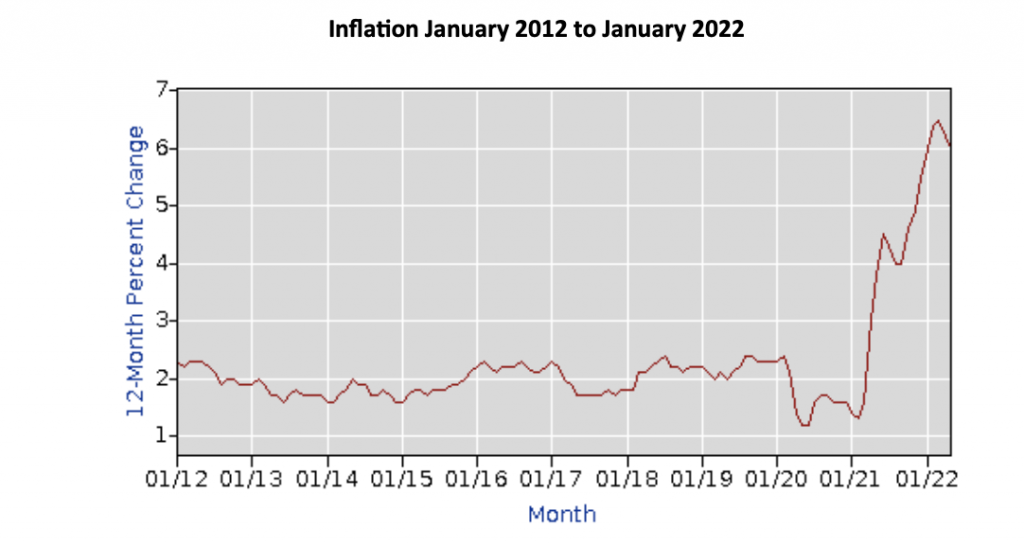

Looking at the data more closely over the last 10 years we can see the magnitude of the change clearly.

Between 2012 and 2021 inflation has hovered around 2%. By January 2022, it was over 6% and by May had increased to 8.6%.

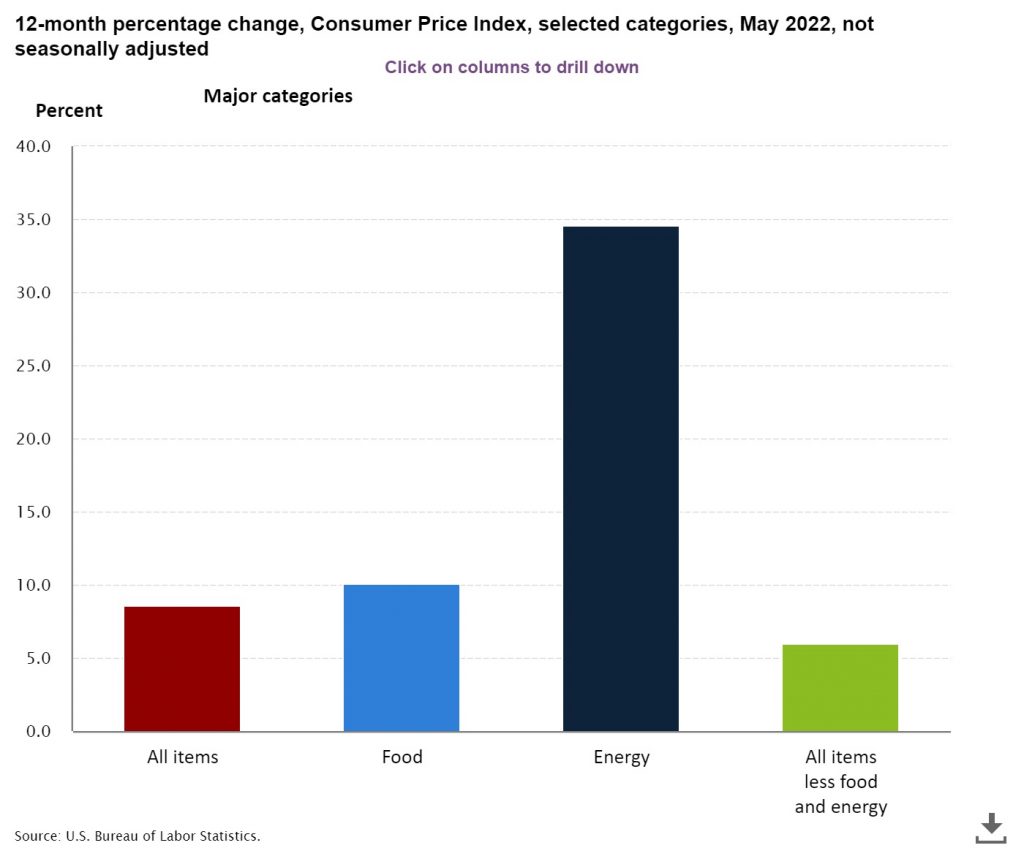

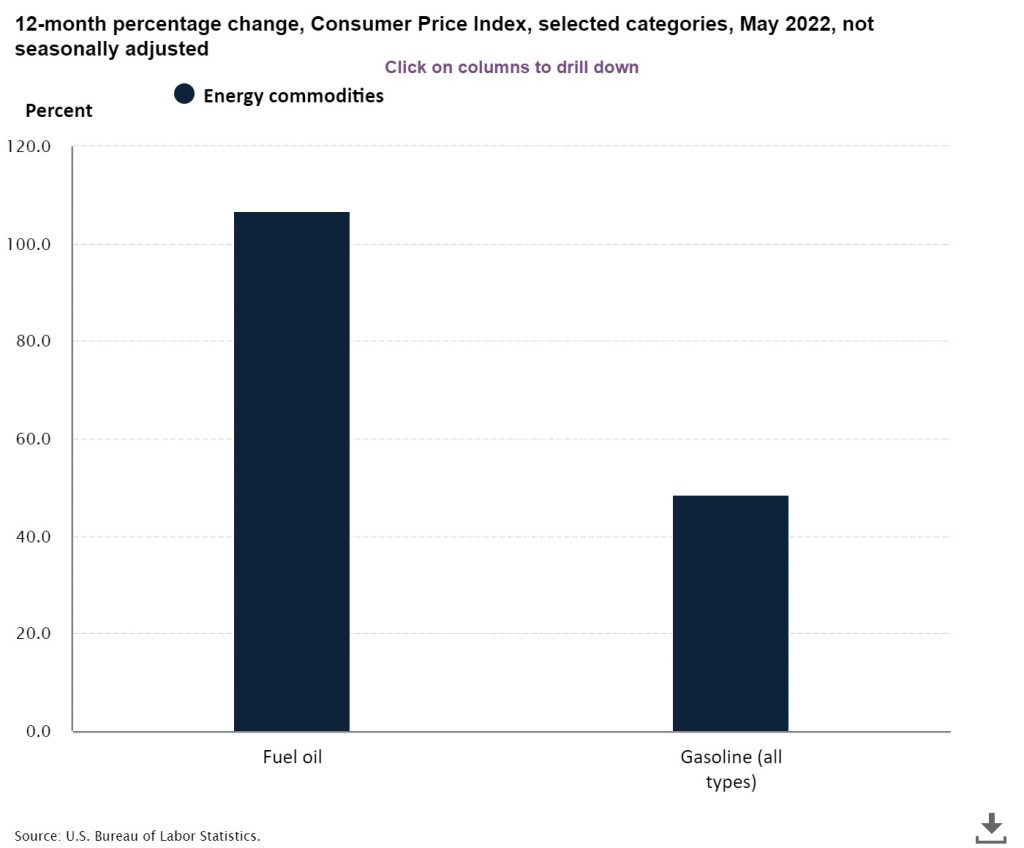

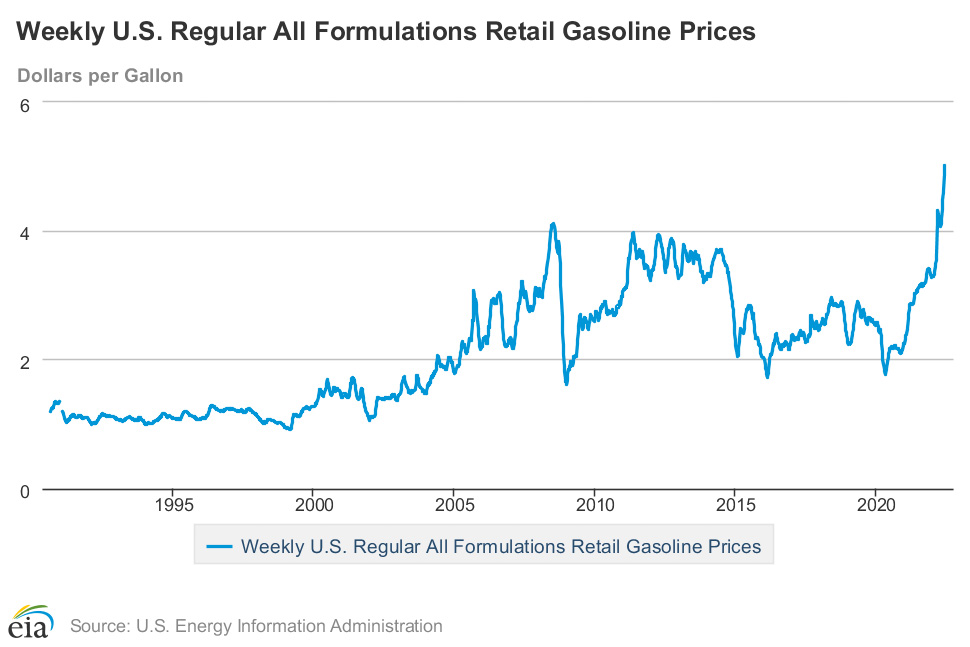

This has been driven not only by supply chain disruptions resulting from the Covid pandemic but also from the brutal Russian invasion of Ukraine and the resultant price disruptions in energy markets. The impact that this has had on consumer energy prices is palpable.

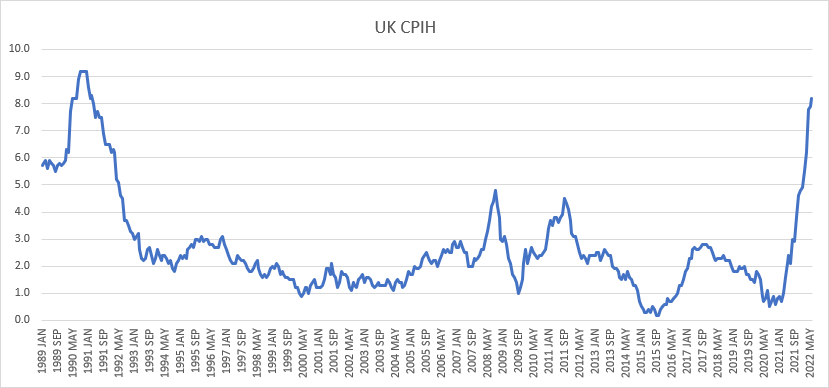

The story is no different in the UK.

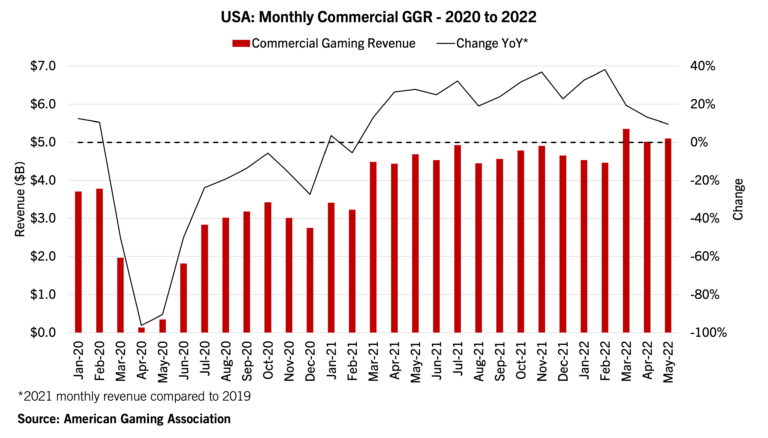

After the worst of the Covid-19 pandemic casinos reopened across the US and impressive gains in GGR were realised, in many cases, with GGR eventually exceeding pre-pandemic numbers. In general, a sense of optimism prevailed.

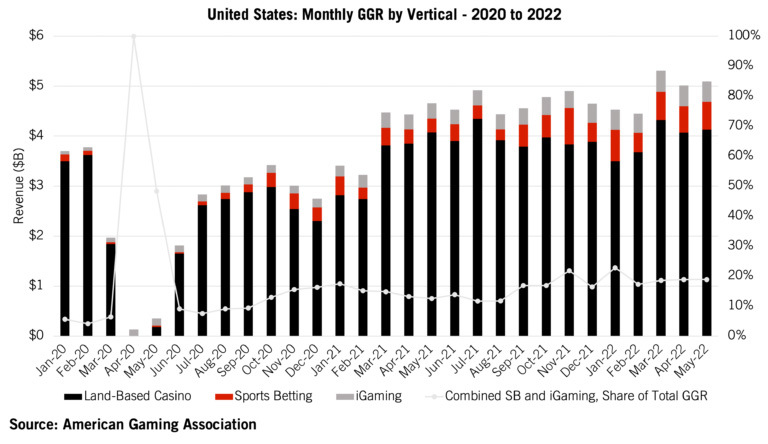

The progress of sports betting expansion continued unabated. Gaming stocks largely rebounded from the pandemic on the back of both impressive GGR recovery and margin improvements. These improvements were generated by FTE reductions and the elimination or curtailment of lower margin amenities which were perhaps not so critical to driving GGR as was once thought.

At least, that was the case in the early post-pandemic world. All this occurred despite supply chain disruptions, labour shortages and a modest uptick in inflation. However, the Russian invasion of Ukraine has upended this comforting pattern. Inflation is now rampant as oil prices skyrocket, with the concomitant sharp gasoline price increases across the US.

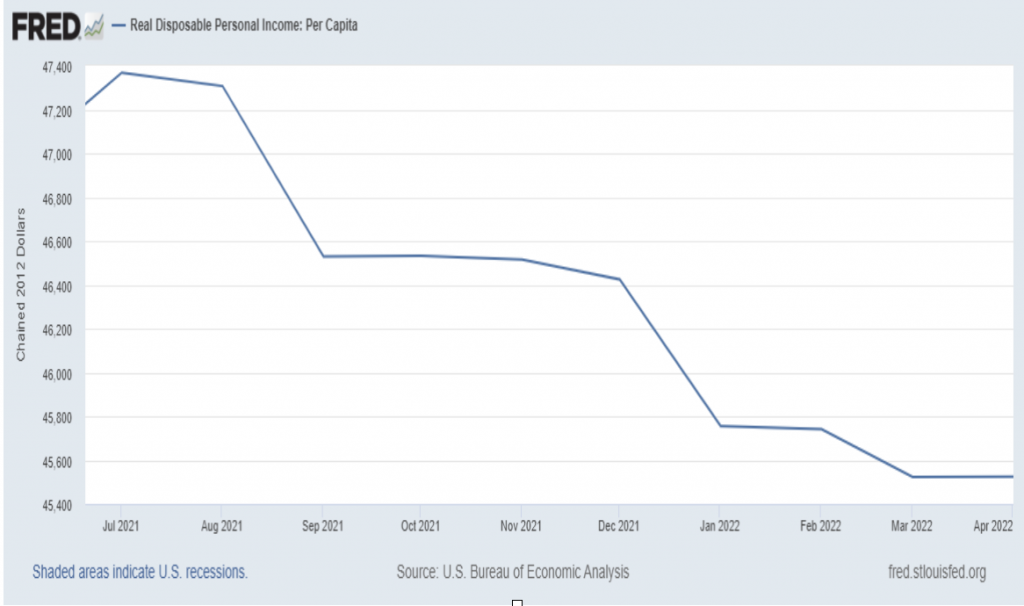

For land-based gaming the news could not be more disturbing. With increasing inflation, disposable income has declined.

Disposable income consistently increased over the last few decades before declining between July 2021 and April 2022, and projections suggest a continuation of this trend. This represents the first sustained decline in disposable income since 2013.

The implication is that GGR growth for both land-based and online betting and gaming will be attenuated in the months to come, but for land-based gaming the news is particularly bleak.

America’s regional casinos draw from very wide geographic areas in comparison to the UK. Many gaming markets draw from a catchment area of two hours’ drive time or more. With the doubling of gasoline prices, more and more US casino visitors will chose not to make the trip.

For those casinos located in major population centres from which they draw most of their clientele the effect may be small. For others located further from their core markets, the impact could be significant. Combined with the overall increase in inflation and the reduction of disposable income, land-based GGR growth, something that has continued unabated and seemed immutable over the last 20 years, may now be moving towards an absolute decline.

We are already starting to see the early warning signs of this. Derek Stevens, owner of three downtown Las Vegas properties, noted in a recent CNBC article that the amount of cash being withdrawn from casino ATMs has been on the decline. Downtown Las Vegas, unlike the Strip properties, relies more heavily on the drive-in California market that would be directly impacted by increasing gasoline prices. For regional casinos which rely more heavily on daytripping drive-in customers the impacts are likely to be even greater.

The warning signs are already showing up in May GGR results. Of 18 commercial gaming states, May GGR increased in eight and declined in 10 versus the prior year.

The most significant of these were Connecticut (-11%), Indiana (-11%), Louisiana (-9%), Mississippi (-8%), New Mexico (-5%) and Iowa (-5%). Connecticut, where the two tribal casinos rely to a significant extent on the drive-in market from New York City (over 100 miles away) and Boston (75 miles away), has seen a decline in GGR of 11% year over year for the month of May.

These properties may be the canary in the coal mine. Early numbers from June suggest that declines are continuing and perhaps even broadening and accelerating.

The American Gaming Association reported a record three months of revenue ending in May of 2022.

However, warning signs are flashing: “Slot GGR fell by 0.1% year-over-year to $2.94bn. Table game GGR rose by 11% to reach $873.9m. Sports betting GGR climbed 78% year-over-year and reached $487.5m, and igaming GGR increased by 31% to $406.4m,” stated the AGA in its June revenue update.

Slots, which account for 77% of total land-based casino GGR, declined slightly between April and May. The increase in table games notwithstanding, overall land-based GGR grew a meagre 1.5% from the previous month.

Despite all the attention garnered by sports betting and igaming, land-based GGR accounts for over 70% of total US gaming revenue.

Igaming, it should be noted, contracted by 2.4% in May, while sports betting grew 5.1%. Drawing conclusions from the growth in sports betting nationwide in any given month is spurious given the variable sports calendar, the advent and maturation of new markets and the unique position sports betting has in the US psyche. It must also be recognised that sports betting accounts for only 7-8% of total US GGR.

The old adage that the US casino market is recession-proof has long been debunked. Consequently, rampant inflation exacerbated by skyrocketing gasoline prices will likely result in stock price declines for commercial operators, as punters fear the likely impacts of inflationary pressures.

Some of this has already dramatically manifested; Caesars Entertainment’s stock has fallen 57% between 3 January and 24 June this year, for example. Over this same period, Bally’s has dropped 46%, while Penn National Gaming and MGM Resorts shares have declined by 44%.

Meanwhile the S&P 500 is only down 20% over the same period. For tribal casinos these threats to GGR represent more than just a decline in value but an existential threat to the tribe’s wellbeing and a direct impact on tribal services that will be felt personally by individual tribal members.

For igaming a rise in gas prices and a reduction in land-based gaming travel could theoretically be considered a boon, as gamers turn to their computers rather than their cars to access gaming options. However, with broad declines in disposable income and inflation on a wide variety of necessities that sector will also see increasing pressure on GGR.

Could we already be seeing the impacts on igaming revenue? It is still early to assess the impact with a high degree of confidence but early numbers from the four big igaming states suggest we are.

Declines in igaming revenue for Michigan, Pennsylvania, New Jersey and Connecticut from December 2021 through June 2022 are outlined in the chart below.

Change in igaming revenue: March to June 2022

| March-June 2022 | |

| Pennsylvania | -12.9% |

| Michigan | -7.7% |

| New Jersey | -5.3% |

| Connecticut | -11.4% |

| Total | -8.6% |

Between March and June 2022, igaming revenue in each state has declined. Pennsylvania leads the pack with a decline in this period of 12.9%, followed closely by Connecticut registering an 11.4% decline.

Totals across these four states shows igaming revenue down by 8.6% between March and June.

Again, while it is too early to be definitive, this decline should be considered against a backdrop of consistent month-over-month revenue growth in prior periods.

Some of this variation could be associated with a maturing igaming market and seasonality, nevertheless this weakness could serve as an early warning sign. The next quarter of revenue data will be definitive.

Should these declines persist month over month then a consistent pattern will have been established.

Paul Girvan is chief executive of PKC Gaming & Leisure Consultancy. He has been involved in the US gaming industry since its development beyond Atlantic City and Las Vegas, conducting project-specific and statewide analyses for governments, tribes and commercial casino operators. Girvan has conducted numerous nationwide and state level analyses on igaming and its legislative development. He is also the author of the annual ICE 365 Tribal Gaming Report.