Optimove iGaming Pulse – September 2020

As September is the month following the final rounds of the UEFA Europa League and Champions League, we can see an overall decrease in all monetary key performance indicators, such as average deposit amounts and revenue per player.

Sports KPIs

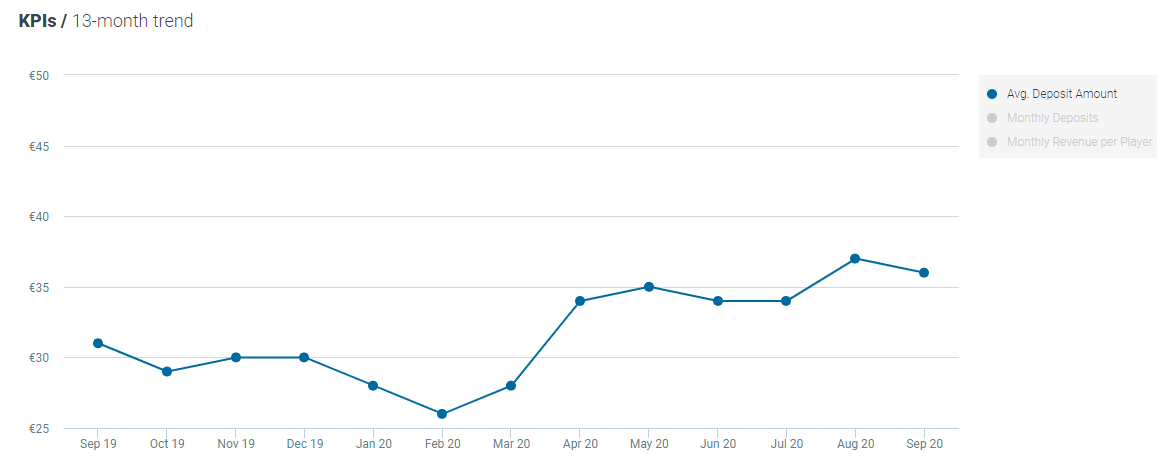

Average deposit amount The average deposit amount for sports betting was down 3% month-on-month, though up 16% year-on-year, standing at €36 per player in September. However, at this point in 2019, most leagues were in their off-season, whereas the English Premier League returned on 12 September, contributing to the year-on-year rise.

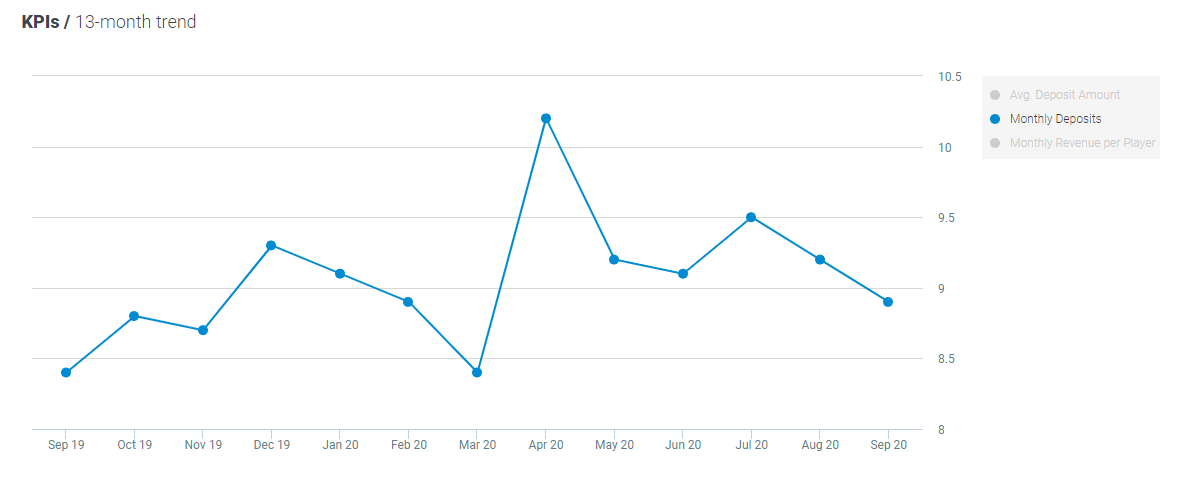

Monthly deposits The average number of monthly deposits for sports bettors decreased by 3% compared to August, but and increased by 6% from September 2019.

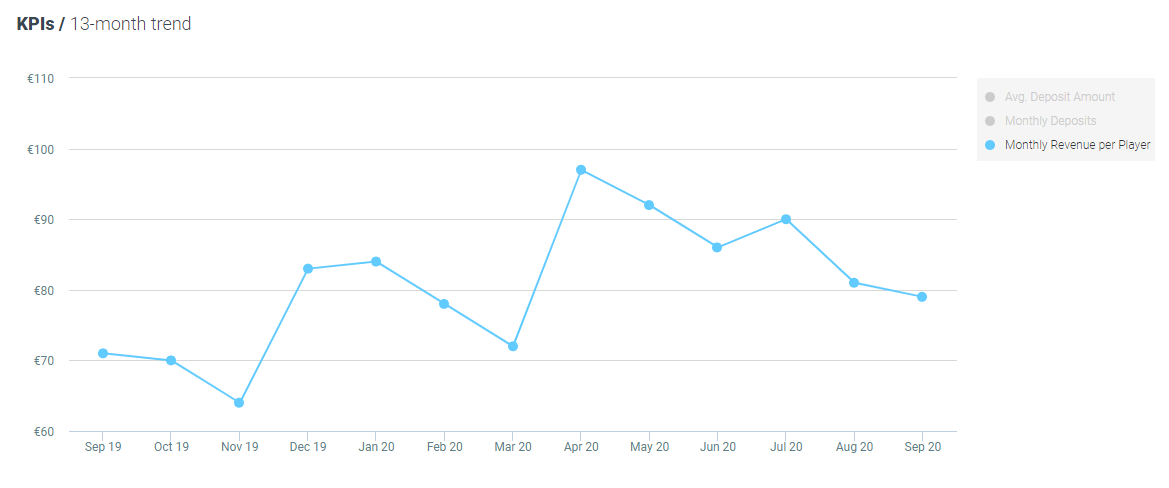

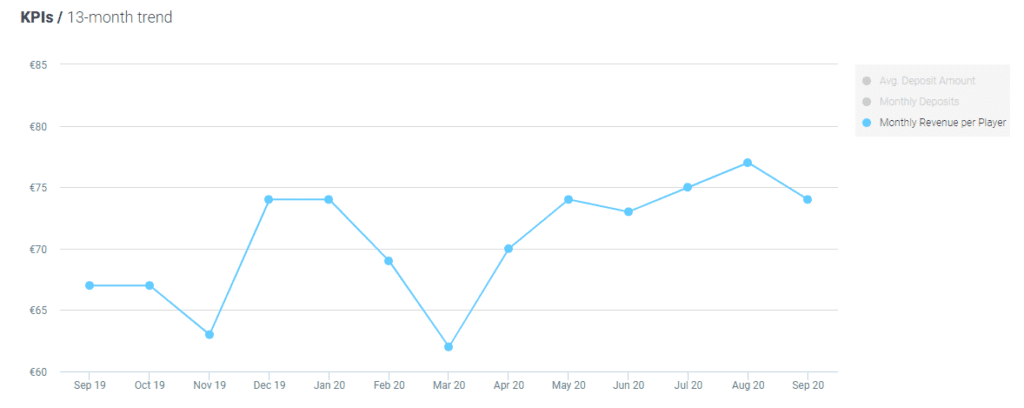

Net gaming revenue per player There has been a slight decrease in average revenue per active player during September, falling 2% compared to August. However, it was again up year-on-year, by 11% to €79 per player.

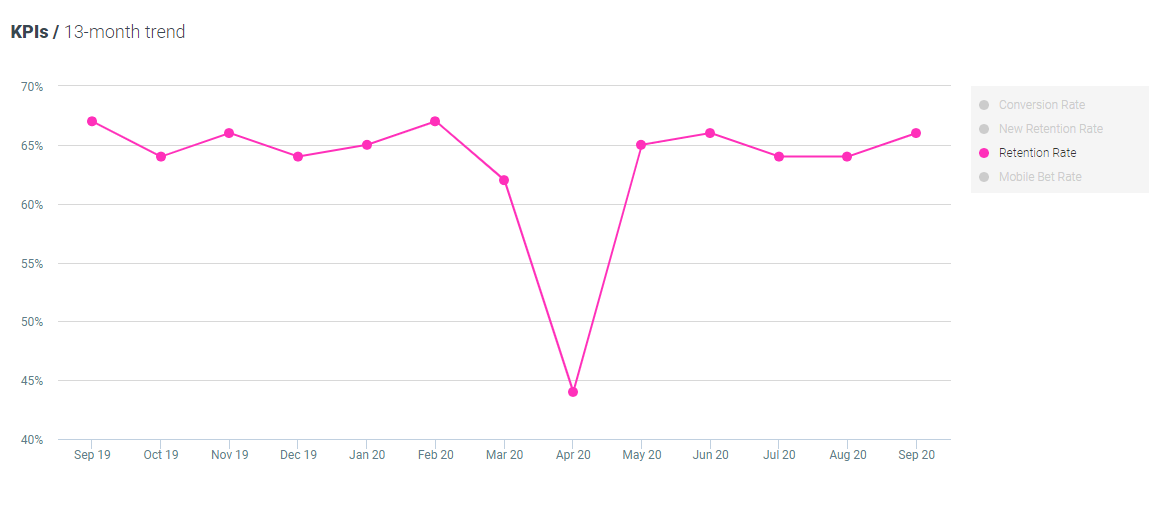

Retention rates Retention rates for sports bettors have slightly increased, by 3% month-over-month. And almost without change, retention rates decreased marginally, by 1% year-on-year.

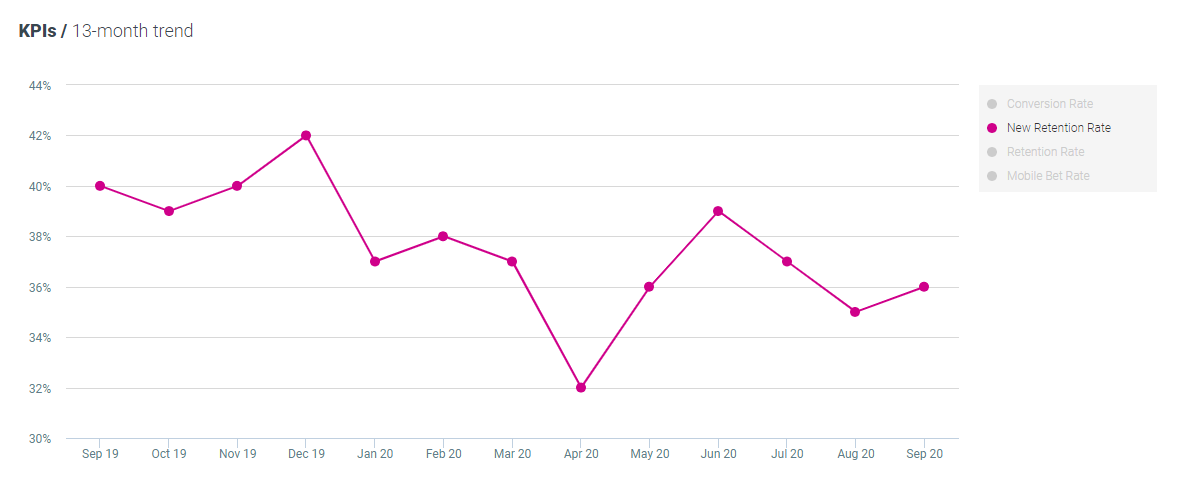

New retention rates Explained as the number of players who made their first deposit last month (in August) and remained active this month (in September).

New retention rates increased by 3% sequentially, but fell 10% compared to the prior year.

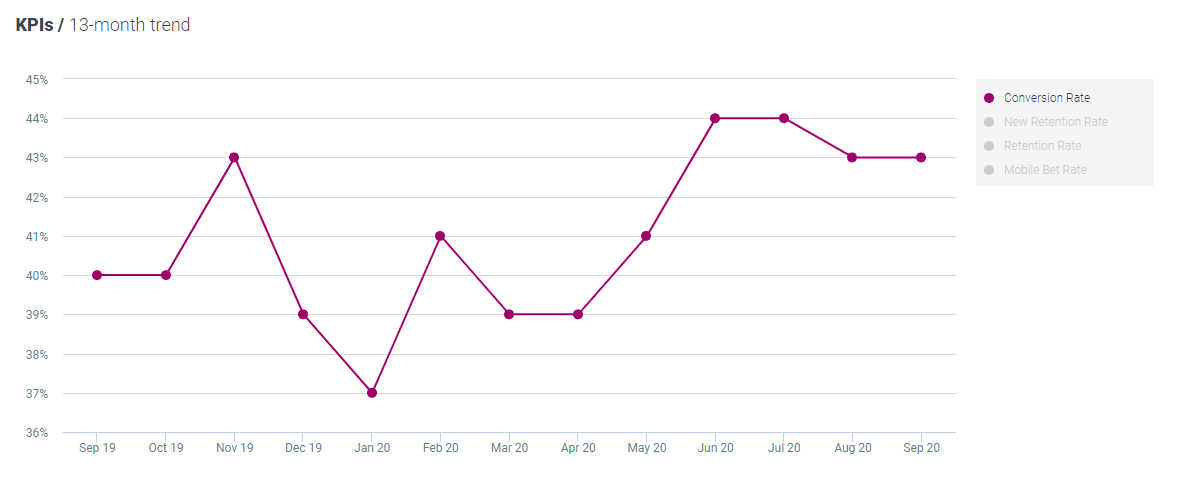

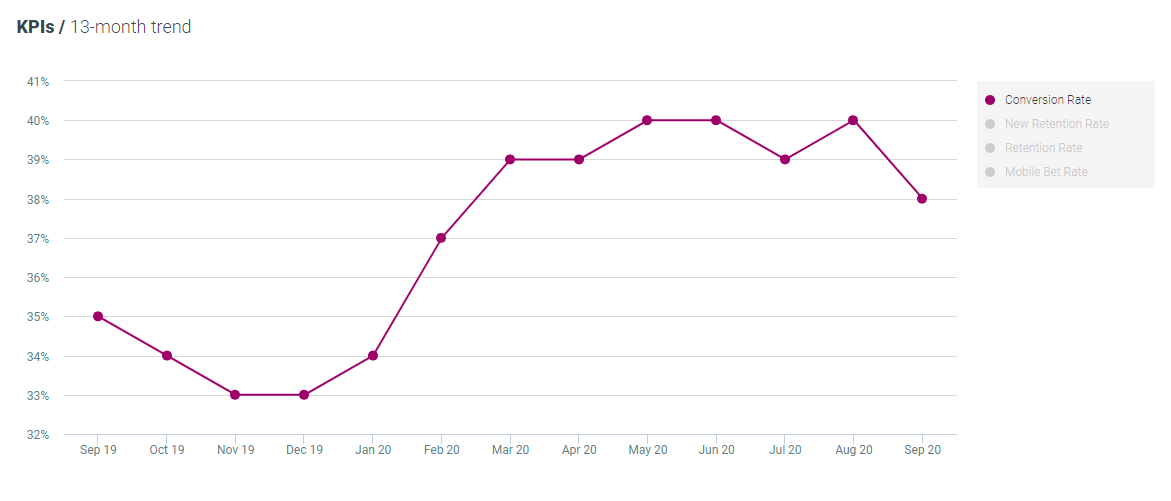

Conversion rates Conversion rates remained the same with no change month-over-month. However, there is an evident increase of 8% year-on-year, to 43%.

Casino KPIs

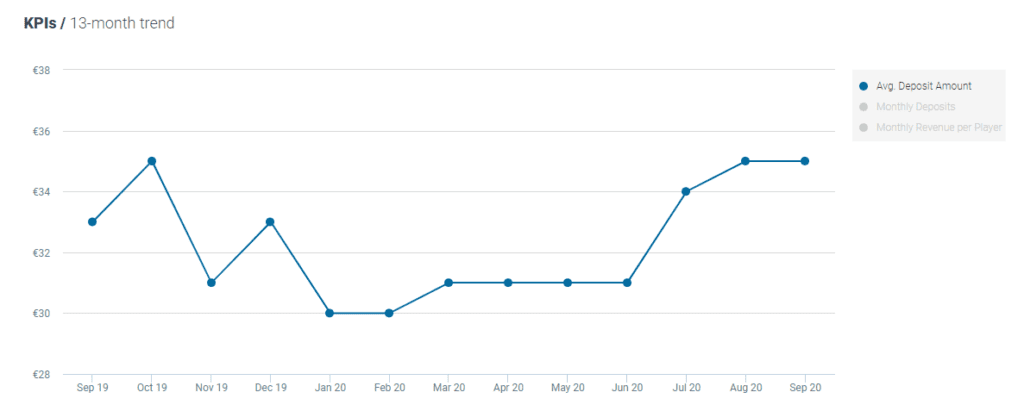

Average deposit amount The average deposit amount for casino players remained the same month-on-month, and increased by 6% year-on-year, to €35.

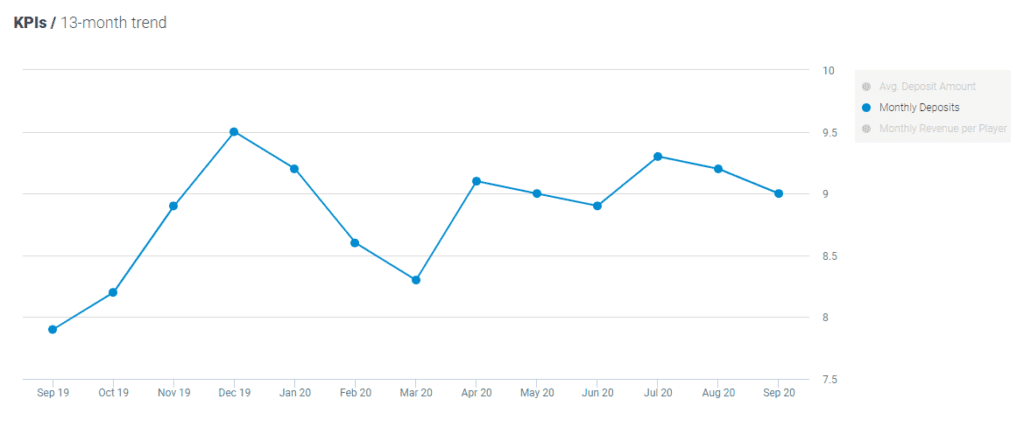

Monthly deposit per player The average number of monthly deposits per player in September slightly decreased by 2% month-over-month (as in, almost no change) and increased by 14% from September 2019 now standing at nine deposits per player.

This could (once again) be explained by the fact that people are still home more due to the pandemic, playing casino games online.

Monthly revenue The average net gaming revenue per active player in September, decreased by 4% from August, and increased by 10% from September 2019.

Conversion rates Conversion rates decreased by 5% month-on-month and increased by 9% year-on-year.

KPI in focus:

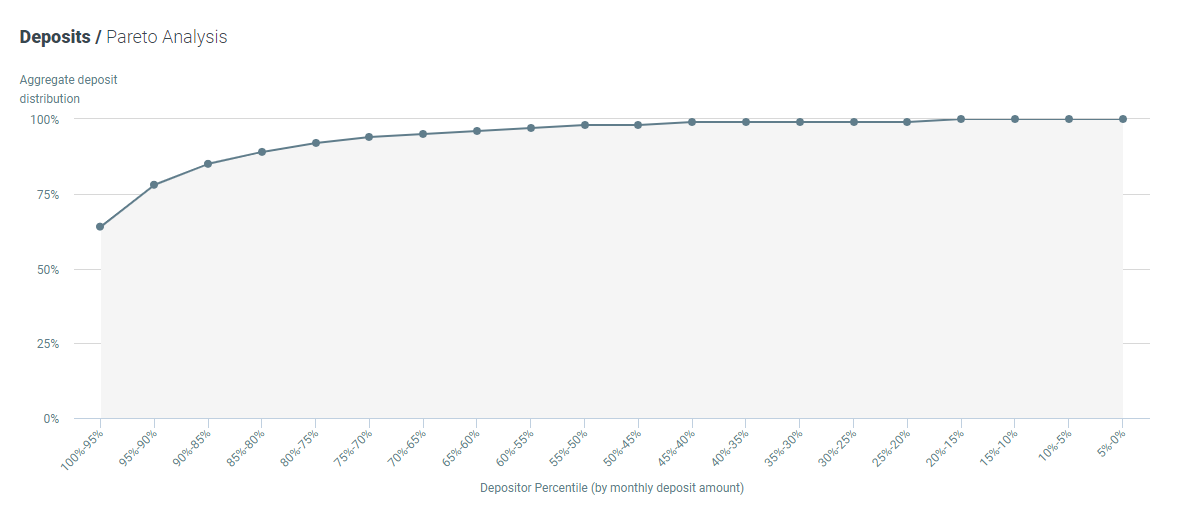

Pareto Principle The Pareto Principle, a concept originally developed by Italian economist and social scientist, Vilfredo Federico Damaso Pareto, is also known as the 80/20 rule. It’s used describe an imbalance in input and outcome in which 20% of the customers create 80% of the profits.

Though the ratio doesn’t have to be exactly 80/20, the discrepancy between resources invested and results generated is used as a KPI in gaming to illustrate what percentage of players generate most of the revenue.

This month, looking at the deposit amount Pareto analysis, 89% of the deposit amounts come from the top 20% of customers. Meaning that these 20% are the top players – those who are really strong VIP customers, also known as high rollers.

Stay tuned for Optimove’s next iGaming Pulse report, due out early November.

About iGaming Pulse: iGaming Pulse is an industry benchmark tool for the gaming sector. iGaming Pulse enables gaming operators to accurately assess their overall performance against industry-wide key performance indicators.

Its figures are updated on a monthly basis. It enables gaming operators to gain a clearer understanding of how their KPIs compare against the rest of the industry, broken down by geography and game type. This type of data, which is made publicly available for the first time, provides operators with the ability to conduct comparative analysis and derive insight into how their performance compares with industry averages.

iGaming Pulse comprises of data collected from over 200 online casinos and sports betting companies, including industry giants and boutique operators, providing an accurate, statistically significant sample of the industry. Access to this information is vital for operators that are limited to only their own data. Optimove’s iGaming Pulse is now fully accessible, ensuring operators will have a clearer overview of how they compare to the industry.