Playtech sells German B2C business HappyBet

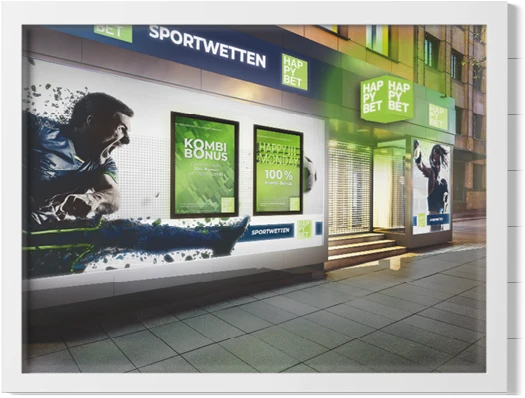

Playtech has continued its shift away from B2C operations with a deal to sell its German gambling brand HappyBet to Pferdewetten AG subsidiary NetX Betting announced Wednesday.

The agreement comes two months after Playtech began the process of selling the HappyBet business.

“The agreement significantly strengthens the market position of Pferdewetten in the stationary sports betting business and marks another milestone on the company’s growth path,” Pferdewetten said in a statement.

In the financial year 2024, Playtech reported an adjusted EBITDA loss of €11.8 million for the HappyBet business. This came about due to increased costs, with revenue up 4% to €18.9 million.

During 2024, the FTSE 250-listed group closed HappyBet’s operations in Austria and said it would close its German operation if a buyer could not be found.

HappyBet franchise partners

The buyer is being given the opportunity to contract with franchise partners for the HappyBet shops. These would then operate under Pferdewetten’s Sportwetten.de brand.

The acquisition includes approximately 600 hardware units, including betting terminals and POS systems, according to Frankfurt-listed Pferdewetten. No financial details were released.

A transition period allows Pferdewetten to negotiate with franchise partners and secure regulatory approvals from German state authorities. Any remaining HappyBet assets not transferred to Pferdewetten will cease operations and ultimately be wound up.

“We expect a mid-double-digit number of shops to be integrated into our network in the next three months. This corresponds to an expected additional annual turnover […] of around €7 million and a positive EBITDA contribution of over €1 million,” said Pierre Hofer, chief executive of Pferdewetten.

Playtech’s switch away from B2C

Playtech’s divestment of its HappyBet business is the latest step in its “renewed focus” on becoming a pure-play B2B operator.

Last year, it struck a deal to sell its Snaitech business in Italy to Flutter Entertainment for a total enterprise value of €2.30bn (£1.94bn/$2.56bn).

This “simplified” business model and focused B2B strategy will allow Playtech to improve its technology, grow its customer base and expand its share of wallet with existing customers.

The Snaitech sale was a “large value creation event” for shareholders, Playtech said. It will pay a special dividend of between £1.7bn and £1.8bn to shareholders, equating to £4.56-£4.83 per share.

Snaitech was an important part of the group’s growth in recent years, Chief Executive Mor Weizer explained. However, the transaction represented a “compelling opportunity” to maximise value for shareholders.

HappyBet was folded into Snaitech in 2021. It secured one of the first federal sports betting licences in Germany, in October 2020.

Shares in Playtech were trading down 0.93% at 319.50 pence per share in London Wednesday morning. Shares in Pferdewetten AG, meanwhile, were up 6.83% at €2.97 per share in Frankfurt.