Crypto payments in igaming: Can the industry reduce fees and drive adoption?

Cryptocurrency notoriously has its ups and downs, but the past decade on the whole has ushered in a remarkable upward trajectory that saw the value of Bitcoin, the largest cryptocurrency by volume, balloon from under $400 at the end of 2014 to over $100,000 at the end of 2024.

Coinciding with the rise of igaming in regulated markets around the world, cryptocurrencies have also become a very popular way to pay and play in online casinos and sports betting.

A report by Techreport found that the crypto gambling market size was roughly $250 million in 2021, and that interest in Bitcoin casinos quadrupled between 2019 and 2021.

The rapid rise and popularity of cryptocurrency-based prediction market Polymarket – which took in billions of dollars in volume in 2024 – proves there’s large public enthusiasm for wagering with crypto.

All signs point to future growth as crypto sees wider adoption as a payment method. Lifshits, however, goes even further. “Offering crypto deposits is no longer an optional feature for igaming operators – it’s a competitive necessity,” she said.

“Crypto payments [open up access to] high-value players who prefer fast secure transactions, players in regions with limited access to traditional banking, and users who prioritise privacy and want to deposit without sharing sensitive financial information.”

How cryptocurrency deposits work in igaming

While the benefits are clear, few understand how cryptocurrency payments and deposits actually work in practice, holding operators back from adoption.

Cryptocurrencies are digital currencies that combine cryptography with blockchain technology – a type of decentralised database that stores transactions across a network of computers. Cryptocurrencies facilitate peer-to-peer transactions without the need for an intermediary, with transfers verified by the network and publicly stored in the blockchain. The use of anonymous wallet addresses in place of personally identifiable information also hides the identity of the sender.

Their digital nature makes crypto payments instantaneous, and cryptographic algorithms render them secure and reliable despite being peer-to-peer; only the rightful owner can authorise transactions with a private key. Once recorded on the blockchain, transactions are immutable and cannot be altered.

Lifshits described how this functions in the context of deposits in igaming. She said the payment process is structured into three main stages, each comprising specific steps.

The first is dynamic address generation. A transaction is initiated when a customer opts to deposit with cryptocurrency. NOWPayments will generate a unique deposit address for the specific transaction for tracking and security purposes. The system will then provide the customer with the unique address and payment details to proceed with the transaction.

Next, the payment will actually be processed. The customer will transfer the specified cryptocurrency amount to the unique address provided. NOWPayments then monitors the blockchain network for the incoming transaction to that unique address. Upon detection, the system waits for a predefined number of confirmations in order to validate the transaction’s authenticity and prevent double-spending.

The final step is settlement to the merchant. After sufficient confirmations, the received funds are processed by NOWPayments. If the operator has opted for auto-conversion, the cryptocurrency is converted into their preferred currency at this stage (such as into fiat currencies or stablecoins). The final amount is then transferred to the operator’s designated wallet or bank account.

What’s stopping crypto payment adoption in igaming?

Cryptocurrencies’ unique characteristics are all major pros when it comes to igaming deposits, where speed, privacy and reliability are paramount.

“Cryptocurrency has evolved from a niche digital asset into a global financial instrument, with growing adoption across industries, including igaming,” Lifshits said.

“Igaming operators have been early adopters of crypto payments due to their borderless nature, security, and ability to provide fast payouts. In 2025, we are seeing an increased number of igaming platforms integrating cryptocurrencies as they look to tap into a global audience that values privacy, instant transactions and financial autonomy.”

There is, however, one problem with using cryptocurrencies for payments: fees. Cryptocurrency fees represent one of the biggest challenges businesses in igaming and elsewhere face in offering cryptocurrencies as a payment method – turning what would be a no-brainer into a burden that can affect margins.

During cryptocurrency boom cycles, bitcoin was notorious for its exorbitant transaction fees during times of heavy congestion. A single transfer of bitcoin from one wallet to another cost as much $60 in 2017 – a fixed fee no matter how much value was being transferred. While fees are much more modest in times of low congestion – currently averaging roughly $1 at the time of writing – this still represents an obstacle for players looking to deposit small amounts to play with in igaming casinos.

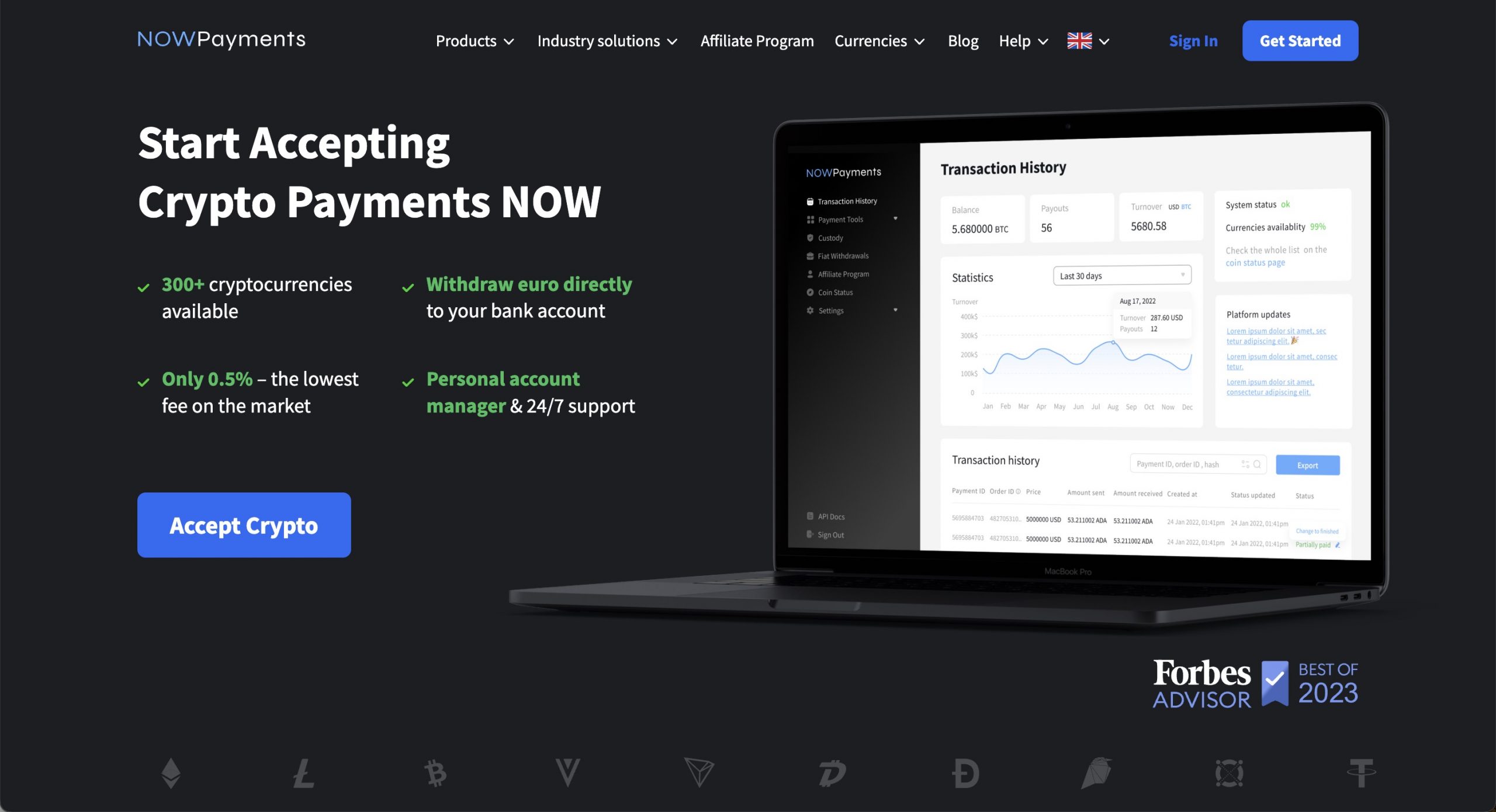

NOWPayments has ways of mitigating high transaction fees, however, in order to make crypto deposits affordable and scalable even for small transactions. These mitigation tactics mean that NOWPayments is able to offer market leading fees of just 0.5% for facilitating crypto payments.

Lifshits said the company works around this challenge through facilitating so-called ‘Layer-2’ solutions – such as the Lighting Network, which processes bitcoin transactions off-chain before batching payments together for settlement on the main blockchain.

In addition, she added, autoconversion means operators can choose to receive payments in stablecoins or lower-fee cryptocurrencies, minimising costs.

“Funds received in crypto are aggregated and routed to liquidity partners (e.g., Binance, Kraken) via APIs for market-rate conversion. With a 0.5% service fee, NOWPayments ensures that both players and operators benefit from cost-effective, seamless transactions without worrying about excessive blockchain fees.”

How NOWPayments solves igaming’s crypto challenges

According to NOWPayments, implementing an option for customers to pay via cryptocurrency is easier than it may sound. Little to no technical work is needed on the part of operators; setup involves integrating a crypto ‘gateway’ via an API, a website plugin, or a simple payment widget, Lifshits said.

“The setup is minimal, requiring only an account, a payout wallet, and an API key activation. NOWPayments supports 300+ cryptocurrencies, including BTC, ETH, USDT, and other high-liquidity assets. Operators can also choose to auto-convert volatile assets into stablecoins, reducing exposure to market fluctuations while still benefiting from crypto adoption.”

Customisation has emerged as a key igaming trend in the past few years as operators attempt to stand out and differentiate their offerings in a highly competitive industry. According to Lifshits, this informed NOWPayments’ decision to put customisation front and centre.

Key customisation options include a highly flexible auto-conversion feature, mass payouts (automated withdrawals to multiple winners or affiliates in one batch), and casino-specific enhancements.

“NOWPayments is recognised as one of the fastest and most secure crypto payment gateways on the market. However, unlike many competitors, NOWPayments is fully customisable to meet the specific needs of operators.

“Recently, one of our partners approached us with a request to accelerate deposit processing for their players. In response, we increased transaction speed by 80%, achieving an average deposit processing time of just ~30 seconds.”

Navigating regulatory concerns

With low-fee crypto payment options bringing the benefits of crypto payments to igaming sites without the barriers, what’s stopping wider adoption in the industry?

Lack of education on the available options plays a big part, Lifshits said, hence NOWPayments’ focus on educating the industry.

Another major concern is regulation. The somewhat murky reputation of cryptocurrency and disparate worldwide approaches to regulating it creates uncertainty for operators.

Regulations in the US differ from state to state, while crypto payments aren’t legal in Brazil, meaning tailored regional approaches are paramount. However, regulation around cryptocurrency is becoming clearer. The European Union, for example, implemented the Markets in Crypto-Assets (MiCA) regulation in 2024 to standardise the bloc’s regulatory approach to cryptocurrency.

The Gambling Commission in the UK has released specific guidance for operators on dealing with cryptocurrency, which states that operators must pay particular attention to anti-money laundering regulation and ensuring that the source of funds is clear if choosing to accept cryptocurrency payments.

With ambiguous regulations around the world, maintaining transparency and documentation and adhering to licensing rules is vital. Lifshits said NOWPayments helps operators stay compliant by offering transaction monitoring, anti-money-laundering (AML) compliant tools, and fiat conversion features where needed.

As cryptocurrency continues to cement itself as a legitimate, safe and realistic payment method, the growth of gaming with crypto is inevitable.

As a result, the value for operators who do choose to allow cryptocurrency payments for their igaming sites is evident – and, when done right, highly lucrative.