MGM to acquire LeoVegas next week as shareholders accept offer

The public tender, which sees MGM pay SEK61.00 in cash per share, was unanimously backed by the LeoVegas board after it was submitted in May 2022. The figure is a premium of 44% compared to LeoVegas’ closing share price just ahead of the deal’s announcement on 29 April.

MGM said it is expected that settlement of the shares will be initiated by 7 September, with all necessary regulatory and governmental approvals having already been secured.

“The completion of this transaction represents a major milestone for MGM Resorts as we continue to pursue our strategy of growing our online gaming footprint worldwide,” said Bill Hornbuckle, MGM Resorts’ chief executive and president.

“We look forward to welcoming the LeoVegas team and are excited to begin working with them to grow our global digital gaming business and maximise the full potential of our omnichannel strategy.”

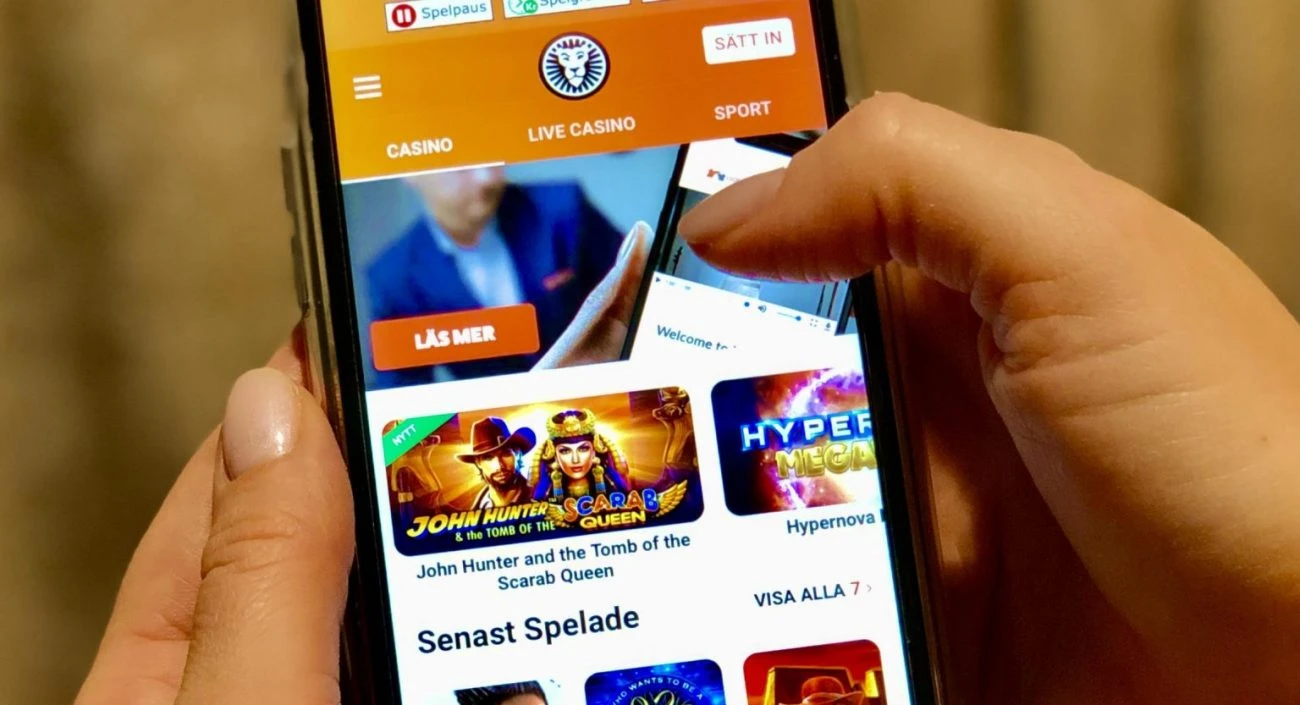

In outlining the rationale for the deal, MGM said the acquisition of Nasdaq Stockholm-listed LeoVegas will provide a “unique opportunity” for the group to create a scaled global online gaming business. It said the deal will offer strategic opportunities to accelerate growth and product offerings and a commitment to continued profitable growth.

“From 2017 to 2021, LeoVegas’ revenues compounded annual growth rate was 16%, while maintaining strong profitability,” said MGM. “MGM Resorts’ scale, brands and expertise will allow the combined businesses to expand within existing gaming segments and provide incremental opportunities to enter new areas.”

Today (1 September) LeoVegas announced that it would apply for a de-listing of its shares from the Nasdaq stock exchange in preparation for the acquisition. In a statement on its website, LeoVegas said that its last day of trading on the exchange will be announced soon.

Last month, MGM reported a 54.3% year-on-year rise in revenue for the first half of its 2022 financial year. LeoVegas generated €394m in revenue and €46m in adjusted EBITDA during the 12 months ended 30 June 2022.

“Joining forces with MGM Resorts is a major win for LeoVegas and we’re excited to begin working with our new teammates to build upon the work we’ve done over the last 10 years,” said Gustaf Hagman, LeoVegas’ group chief executive.

“MGM Resorts is a premier gaming entertainment company and we look forward to leveraging their expertise to further our long-term strategic goals.”